The long-term capital gains tax rate is 0%, 15% or 20% depending on your taxable income and filing status.

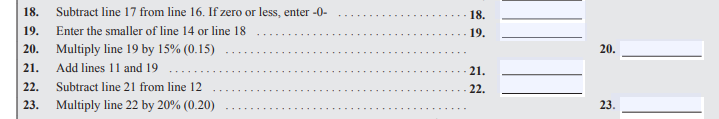

Review you Qualified Dividends and Capital Gain Tax Worksheet on you return. The tax on your qualified dividends and capital gains is calculated on lines 18-23 of the worksheet.

To review the worksheet, you would:

- Select Tax Forms in the Black bar on the left side of the screen.

- Select Tools from the drop down menu.

- On the Tools Center Select Tax Summary

- Select Preview my 1040 in the Black bar on the left side of the screen.

Look for the Worksheet in the documents.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"