- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- 10200 Unemployment Not Being Exempt

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10200 Unemployment Not Being Exempt

Call your representative and demand that they outlaw tax preparation and force the IRS to do our taxes for us. Everything to do with it should be automatic and handled by the IRS. THEY ALREADY HAVE THE DATA! THEY DO NOT NEED US TO PROVIDE THEM WITH ANYTHING. The system as is exists SOLELY for garbage companies like intuit to profit at our expense.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10200 Unemployment Not Being Exempt

It's Saturday March 20th and still no update.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10200 Unemployment Not Being Exempt

It's Saturday, March 20th, 2021, 7:35AM EDT and still no 10,200 UC tax exception code showing

It was supposed to be Thursday, then Friday, and it is now Saturday.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10200 Unemployment Not Being Exempt

@NeuroPsyche wrote:

It's Saturday, March 20th, 2021, 7:35AM EDT and still no 10,200 UC tax exception code showing

It was supposed to be Thursday, then Friday, and it is now Saturday.

The TurboTax online web-based editions have been updated for the UC exclusion. The TurboTax desktop CD/Download editions have not been updated. That should be forthcoming sometime next week.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10200 Unemployment Not Being Exempt

Program updates have always been subject to change and getting new ones completed in less than 2 weeks during an active tax season is amazing. My professional program has the unemployment fix in for the last 5 days however the Premium Tax Credit repayment is still not working and many states have not yet completed the changes ... again patience will be needed by all parties while everyone works hard to integrate the mid season changes CONGRESS put in place ... if you want to be angry at someoe then yell at your congressperson for not handling this earlier.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10200 Unemployment Not Being Exempt

I updated TT today and it has NOT happened. waiting to file my taxes because of unemployment. get it done TT!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10200 Unemployment Not Being Exempt

@pabst wrote:

I updated TT today and it has NOT happened. waiting to file my taxes because of unemployment. get it done TT!

The update for the UC exclusion was made available for the TurboTax online editions. It is not currently available for the TurboTax desktop CD/Download editions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10200 Unemployment Not Being Exempt

My web-based edition has not been updated as of Saturday a.m.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10200 Unemployment Not Being Exempt

@skirch64 wrote:

My web-based edition has not been updated as of Saturday a.m.

Did you enter Unemployment Compensation in the correct section of the program?

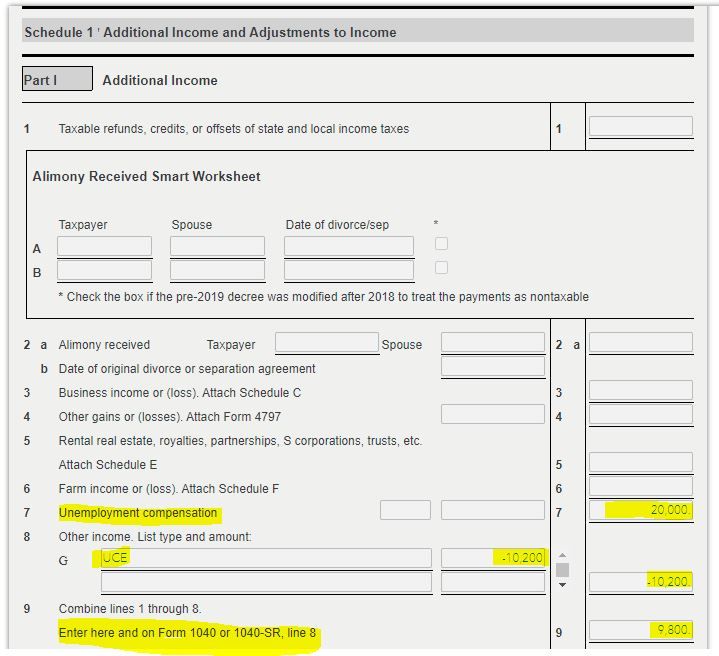

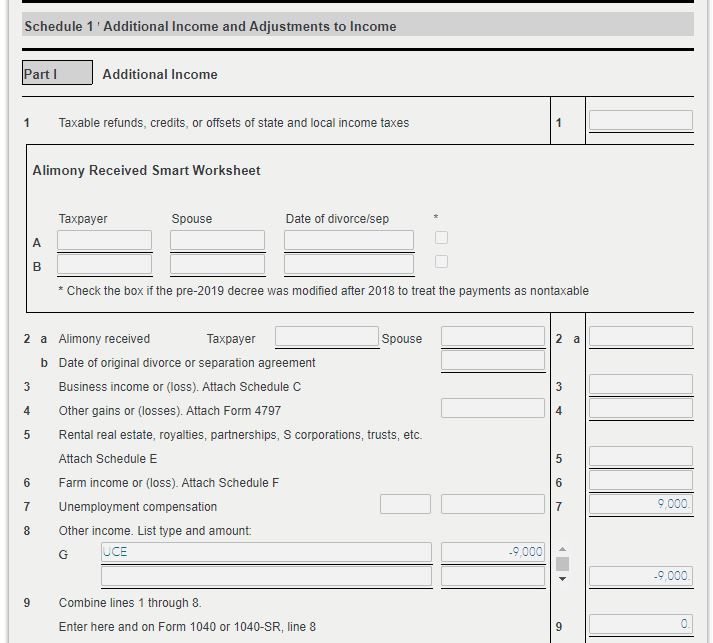

Look your tax return on Schedule 1 Line 7 for the UC that was entered. On Line 8 will be the exclusion amount entered as a negative number.

Click on Tax Tools on the left side of the screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10200 Unemployment Not Being Exempt

Note that if your unemployment payment is LESS than $10,200 then it is simply not included in your taxable income so nothing needs to be subtracted and there will be no Schedule 1.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10200 Unemployment Not Being Exempt

@macuser_22 wrote:

Note that if your unemployment payment is LESS than $10,200 then it is simply not included in your taxable income so nothing needs to be subtracted and there will be no Schedule 1.

Schedule 1 will still be included since there was UC entered, just a 0 will be entered on Form 1040 Line 8 assuming there were no other entries on the Schedule 1 Lines 1 thru 6.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10200 Unemployment Not Being Exempt

You are correct, I should have said that there will be no negative entry on the 1040 line 8.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10200 Unemployment Not Being Exempt

Question for @macuser_22 and @DoninGA

Have you heard how the State returns are doing? ProSeries got the update on Friday, and most state returns are messed up now because of it (states that set their own rules but start off with Federal AGI now are either double-deducting the $10,200 or deducting the $10,200 when it should be taxable).

So I was just wondering if TurboTax is equally as messed up or if Intuit fixed the State returns before they released it for TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10200 Unemployment Not Being Exempt

I also have not seen any change to my refund amount after accessing my return on 3/20. Both my husband and I collected UEI this year so expecting not to pay tax on 20,400 in UI compensation. Has anyone seen if the update has been delayed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10200 Unemployment Not Being Exempt

If you already filed then the IRS will make the adjustment for you. Amending is not necessary. The IRS has not stated any timeline for doing this.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dfletcher61

New Member

taxdean

Level 4

Mohit

Level 3

joemirarchi10

Level 1

gwennypaa

New Member