- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Wisconsin Sch WD (Cap gains/losses)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wisconsin Sch WD (Cap gains/losses)

Does not appear to be correct. Part 1 (short term) is supposed to pull #s from federal schedule D. Wisconsin line 1a = federal line 1a. Line 1b is also supposed to be the same but Turbotax is adding Federal lines 1a & 1b and reporting on Wisconsin line 1b (essentially double counting the federal form 8949 amounts). On that matter, does anybody know why some sales are reported on form 8949 (carries to schedule D line 1b) and some are not and show up on schedule D line 1a? They were all imported from the same brokerage and there is no apparent difference.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wisconsin Sch WD (Cap gains/losses)

Working on my own return now and see the same thing is happening with long term gains. Both Short term and long term are getting partially doubled up on the schedule WD.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wisconsin Sch WD (Cap gains/losses)

First, see if you have any “Items Which Require Adjustment” per the 2019 Wisconsin Schedule WD Instructions. It seems unlikely that this would be the issue based on what you report, but it’s possible.

Then, if you’re unable to correct this data, your best bet may be to clear your state return and start it over.

Please see the TurboTax Help article “How do I delete my state return in TurboTax Online?” or "How do I clear my state return in the TurboTax for Windows software?" as appropriate for guidance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wisconsin Sch WD (Cap gains/losses)

I deleted and started over. Problem persists. I'm convinced it's an error in the program logic. Everything is fine on the federal return and I made no adjustments to the data when completing the Wisconsin return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wisconsin Sch WD (Cap gains/losses)

I did contact customer support today and initiated a remote session so he could see what I was talking about. He did suggest I reinstall a clean Wisconsin version that he arranged a download for on the chance that my version (Amazon) might have missed an update. That didn't work but was worth a shot. I'll see if a fix is coming otherwise I'll use Wisconsin's e-file system.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wisconsin Sch WD (Cap gains/losses)

Suggestion: When a Form 1099-B is entered/imported with greater than 99 detailed transactions (with all Codes A or D and no basis adjustments), it treats this as a summary (consolidating all detailed entries) and reports on Fed Sched D, Lines 1a and 8a, rather than Form 8949. This treatment is allowed and appropriate on the Federal tax return (see Fed Form 8949 Instructions). This seems to be a change from 2018 (the 99 limit).

When WI is calculating the 30% LTCG exclusion on WI Schedule D, the Part I and Part II amounts are being doubled up, because:

- the amounts on WI Schedule WD, Lines 1a/8a are being auto populated from Fed Form 8949 which does not include the 1099-B entries from those 1099B’s with greater than 99 entries (that have gone straight to Fed Sch D, Lines 1a and 8a), and

- The WI Schedule WD, Lines 1b/8b amounts are also being auto populated, but not from Fed Sch D, but rather from the WI Sch WD Wks, which includes all detailed transactions reported on the Federal return, whether or not they were reported on Fed Form 8949 (which occurs if 1099-B has less than 100 transactions) or directly on Fed Sch D (which occurs if Form 1099-B is greater than 99 transactions).

To fix, delete the 1099B with over 99 entries (all coded A and D with no basis adjustments) and manually re-enter as a summary transaction. Now these summary amounts are not included in the WI Sch WD worksheets, and therefore are not doubled up on WI Sch WD (if entered as detailed transactions, then the are included on WI Sch WD WKS regardless of presentation on Federal return – 8949 or Sch D).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wisconsin Sch WD (Cap gains/losses)

I figured that was what was happening. TT has long calculated Wisconsin cap gains/losses from the underlying data rather than relying on federal schedule D which was obvious from the results (Wisconsin dollar rounded each individual transaction whereas federal kept the pennies and only rounded the totals...the differences could be a lot if there were a lot of transactions). This year they seem to be relying on federal schedule D but forgot to scrap the old programming so I'm getting doubled up. Rather than adopt your solution I'm going to use Wisconsin's on-line e-file system and hope TT fixes the error in the future.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wisconsin Sch WD (Cap gains/losses)

Issue has been identified and I believe fix is coming! not sure when though....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wisconsin Sch WD (Cap gains/losses)

I normally use Wisconsin's e-file system anyway. It's free and doesn't take much time other than replicating w-2 & 1099R info. They have it to the point where it does all the math and finds the proper tax. I brought up the issue mostly for TT's other users that may not care about TT's Wisconsin e-file charge.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wisconsin Sch WD (Cap gains/losses)

Program has been fixed! no more doubling up!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wisconsin Sch WD (Cap gains/losses)

Patience does have its virtues.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wisconsin Sch WD (Cap gains/losses)

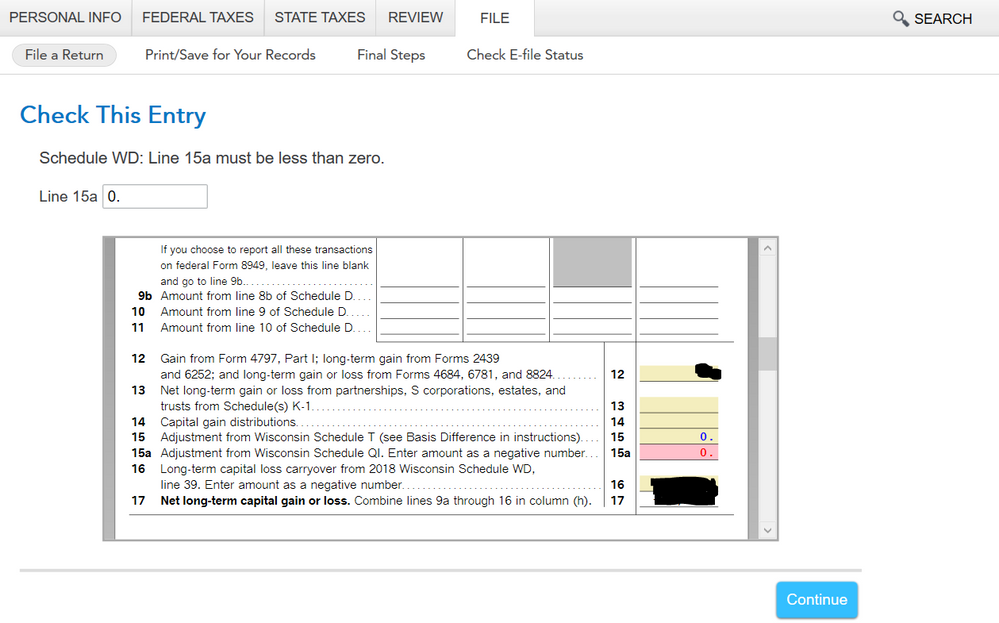

Glad they fixed this doubling problem. This year I entered my capital gains/Losses manually because TurboTax gets Schedule WD wrong and all is well until e-file. I paid the extra money to file Wisconsin with TurboTax, saved to PDF, checked it over, went to e-file and TurboTax does another last second check to find some error with Schedule QI 15a. I don't have any adjustment to make for this form, but TurboTax will not e-file it. For fun, I entered a negative dollar and it did not matter so, I think this is another error. Any way to fix this before I mail it in?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wisconsin Sch WD (Cap gains/losses)

I can't even find schedule QI in the TT forms list! My sch WD leaves the line blank (and it shows no data source) whereas it looks like yours is populating it from somewhere. Did you try to simply delete the zero?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wisconsin Sch WD (Cap gains/losses)

Your a genius by your idea to delete the zero. I like simple when simple works and my WI tax e-filed like one would expect. Thank you very much! 🤔

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wisconsin Sch WD (Cap gains/losses)

Glad it worked. Did you consider using Wisconsin's E-file system? Unless you have a lot of w-2s and/or 1099Rs it doesn't take long to complete and it's FREE.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

skenyonjr

New Member

StPaulResident

Returning Member

BME

Level 3

Boyan

Level 4

Talhakhan104

Returning Member