- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Why won't the TT MA Part Year Resident state return allow me to allocate excluded US Govt Debt Obligations carried over from my federal return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why won't the TT MA Part Year Resident state return allow me to allocate excluded US Govt Debt Obligations carried over from my federal return?

I have gone in CIRCLES trying to get an answer from TT on this question and am VERY frustrated. I am using TT Online.

I was a part year resident of MA and NC and received 1099-DIV income mostly from US Debt Obligations so there was significant exempt state income.

I entered the exempt amount in the TT Federal return under "Enter the amount of dividends reported on this 1099-DIV from VANGUARD that represents interest from U.S. Government obligations".

1. There is no choice in the Federal or the MA state return to allocate this amount (Govt. Obligations) so that TT stops reporting that all of it is applied against MA. A portion should be allocated to NC. A Turbo Tax Expert gave me instructions in another post which said to make the allocation in the Federal return but this is not possible, at least for TT Online and is especially confusing because the TT NC interview DID do the allocation (as expected).

** TT will allow me to ADD more "customized" excluded and included income to the MA state return which would result in me paying the correct MA tax, but these entries would be inconsistent when viewed against the Federal and NC returns.

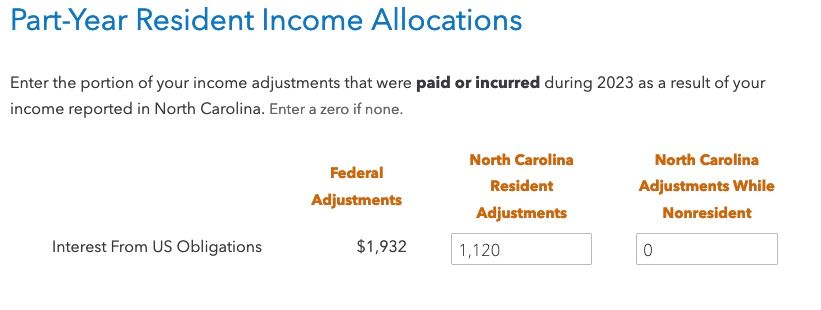

2. The NC Return DOES allow me to allocate the amount as shown in the example below.

The problem is the MA return DOES NOT ALLOW ME TO MAKE THIS ADJUSTMENT

How do I handle this?? Please don't tell me to switch to TT desktop there must be a way!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why won't the TT MA Part Year Resident state return allow me to allocate excluded US Govt Debt Obligations carried over from my federal return?

Follow these steps:

- Open your MA state return

- Go through the MA questions

- Stop when a screen asks about interest and dividends.

- Select yes

- Continue through the screens until you reach Part-year resident and nonresident interest and dividends.

- Enter the MA amount, if any.

- The next screen is Other Interest and Dividends to Exclude, enter the US Obligations along with the non- MA amount of $1120

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why won't the TT MA Part Year Resident state return allow me to allocate excluded US Govt Debt Obligations carried over from my federal return?

The problem is on the MA return, TT excludes ALL of what carried over from the Federal return (20K in your example) PLUS what you showed in the "Other Interest and Dividends to Exclude" snapshot (1120) . There is no way to ALLOCATE the 20K carried over from the federal return. I would end up with $20K + $1120 excluded from the 1099-DIV income on the MA return.

I went over this with a TT expert while he watched my screen and he agreed there is a problem with the TT software for the state of MA. The "workaround" is to enter during the Federal interview for "exlcuded income" only the amount that applies to MA, and generate a printable MA return from the print center which gets mailed, and then go back to the federal return and fix it for North Carolina (enter the full MA+ NC excluded amount), since NC handles allocating excluded income properly.

I am confused why your screen shows NEGATIVE 20,000 excluded. When I get to that screen it shows up as a positive number carried over from the federal return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why won't the TT MA Part Year Resident state return allow me to allocate excluded US Govt Debt Obligations carried over from my federal return?

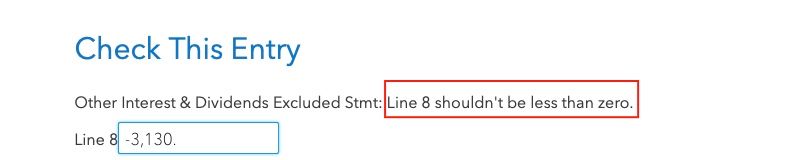

We have multiple returns that we are constantly changing based on customer questions so mine must have been negative from playing around in the program. Great catch on your part! In your case, it would be a positive number. When I went back in to check now, the 20,000 was reduced by the 1120. The program correctly did the math of -20k+1120. Then I went back and changed the sign to -1120 and again the program did the math correctly, adding them together. Then I went back and changed the $20k to a positive number, left the 1120 as a negative, and got a good answer.

Go back through your program and watch the signs for the outcome needed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why won't the TT MA Part Year Resident state return allow me to allocate excluded US Govt Debt Obligations carried over from my federal return?

That was a very interesting idea you had, to enter a negative number to make the final MA income come out correctly.

The GOOD news is the numbers added up correctly and I got the proper MA income. See the BAD news below after running error check ☹️

I am convinced the only way around this problem for MA is to enter into the federal return the amount to exclude ONLY FOR MA (Don't enter all excluded income for both states) and generate a MA return from the print center to mail.

Then go back to the federal return and modify so it has the exclusion amount for BOTH NC and MA (as originally intended for any situation). TT correctly prompts me (during the NC interview) for the NC amount to exclude which I enter as a Positve (+) number. TT handles the minus sign internally with no errors. But this requires two separate federal returns, one gets filed and the other was only used to print and mail the MA return.

You are not going to believe this but now the NC return has a problem where it's not properly adding up the "NC only" portion of the Coverdell ESA distribution. It's just flat out ignoring it in the worksheet and even though the entry is showing in the subtotal, its not being added to the final total which then flows incorrectly to the state return. I have a separate post on it. Seems TT is having trouble with part year returns.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

crash12_mn

Level 3

crash345u

Level 4

crash12_mn

Level 3

crash12_mn

Level 3

crash12_mn

Level 3