- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why won't the TT MA Part Year Resident state return allow me to allocate excluded US Govt Debt Obligations carried over from my federal return?

I have gone in CIRCLES trying to get an answer from TT on this question and am VERY frustrated. I am using TT Online.

I was a part year resident of MA and NC and received 1099-DIV income mostly from US Debt Obligations so there was significant exempt state income.

I entered the exempt amount in the TT Federal return under "Enter the amount of dividends reported on this 1099-DIV from VANGUARD that represents interest from U.S. Government obligations".

1. There is no choice in the Federal or the MA state return to allocate this amount (Govt. Obligations) so that TT stops reporting that all of it is applied against MA. A portion should be allocated to NC. A Turbo Tax Expert gave me instructions in another post which said to make the allocation in the Federal return but this is not possible, at least for TT Online and is especially confusing because the TT NC interview DID do the allocation (as expected).

** TT will allow me to ADD more "customized" excluded and included income to the MA state return which would result in me paying the correct MA tax, but these entries would be inconsistent when viewed against the Federal and NC returns.

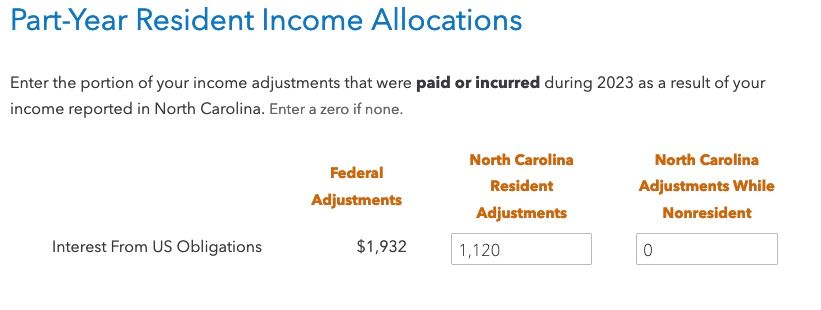

2. The NC Return DOES allow me to allocate the amount as shown in the example below.

The problem is the MA return DOES NOT ALLOW ME TO MAKE THIS ADJUSTMENT

How do I handle this?? Please don't tell me to switch to TT desktop there must be a way!