- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

That was a very interesting idea you had, to enter a negative number to make the final MA income come out correctly.

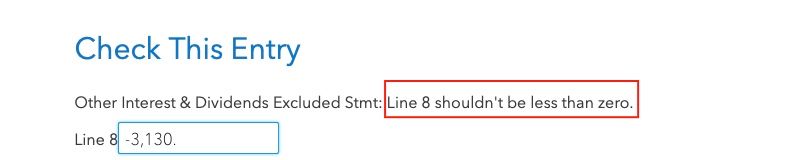

The GOOD news is the numbers added up correctly and I got the proper MA income. See the BAD news below after running error check ☹️

I am convinced the only way around this problem for MA is to enter into the federal return the amount to exclude ONLY FOR MA (Don't enter all excluded income for both states) and generate a MA return from the print center to mail.

Then go back to the federal return and modify so it has the exclusion amount for BOTH NC and MA (as originally intended for any situation). TT correctly prompts me (during the NC interview) for the NC amount to exclude which I enter as a Positve (+) number. TT handles the minus sign internally with no errors. But this requires two separate federal returns, one gets filed and the other was only used to print and mail the MA return.

You are not going to believe this but now the NC return has a problem where it's not properly adding up the "NC only" portion of the Coverdell ESA distribution. It's just flat out ignoring it in the worksheet and even though the entry is showing in the subtotal, its not being added to the final total which then flows incorrectly to the state return. I have a separate post on it. Seems TT is having trouble with part year returns.