- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- WHERE DO I PUT THE RE TAX PAID BY MY NEW MTGE CO-AFTER I REFINANCE? ? YOUR TAX PROGRAM ONLY ASKED IF I PAID RE TAXES ON THE 1ST ORIG MTGE. WHERE DO I ENTER TAX FOR NEW

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

WHERE DO I PUT THE RE TAX PAID BY MY NEW MTGE CO-AFTER I REFINANCE? ? YOUR TAX PROGRAM ONLY ASKED IF I PAID RE TAXES ON THE 1ST ORIG MTGE. WHERE DO I ENTER TAX FOR NEW

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

WHERE DO I PUT THE RE TAX PAID BY MY NEW MTGE CO-AFTER I REFINANCE? ? YOUR TAX PROGRAM ONLY ASKED IF I PAID RE TAXES ON THE 1ST ORIG MTGE. WHERE DO I ENTER TAX FOR NEW

You can enter any additional property taxes in the federal interview section of the program.

- Select Deductions & Credits

- Scroll down to All tax breaks, and select Your Home

- Select Property (Real Estate) Taxes

Also, if you impounded your real estate taxes on your new loan, it may also be entered on your 1098 Form.

If so, you can also enter the amount under the section titled Mortgage Interest and Refinancing (Form 1098).

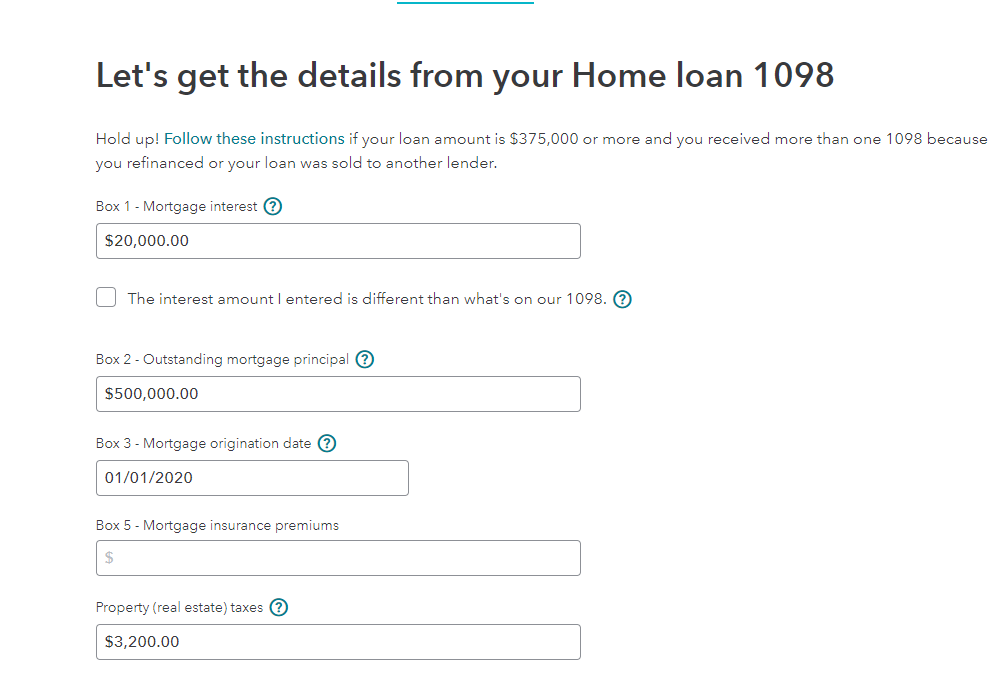

There is an area to enter real estate taxes as shown in the example below. You will find the input on the page titled Let's get the details from your Home loan 1098.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

MarkMConverse

Returning Member

Itty211

New Member

carolynmkendall509

New Member

jtomeldan

Level 1

dgurreri

New Member