- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- What line can I find the "federal income tax after non-refundable credits for 2020?"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line can I find the "federal income tax after non-refundable credits for 2020?"

Trying to file state taxes and need the line from 2020 for federal income tax after nonrefundable credits. All I can find when searching is prior years and the lines from the 1040 don't correspond. Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line can I find the "federal income tax after non-refundable credits for 2020?"

Federal Income Tax after non-refundable credits for 2020 is located on the 1040 Line 24.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line can I find the "federal income tax after non-refundable credits for 2020?"

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line can I find the "federal income tax after non-refundable credits for 2020?"

my 1040 line 24 says estimated tax penalty... is this correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line can I find the "federal income tax after non-refundable credits for 2020?"

No, line 24 of your Form 1040 shows your total tax.

Any estimated tax penalty would be reflected on Line 38 of Form 1040. If you have an amount on this line, it would also be included in Line 24 assuming you opted to have it included in your tax return.

Please see the sample of the second page of Form 1040 below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line can I find the "federal income tax after non-refundable credits for 2020?"

Oh okay, thanks. I was trying to find my 2019 Federal Income Tax after non-refundable credits. I see this one said 2020.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line can I find the "federal income tax after non-refundable credits for 2020?"

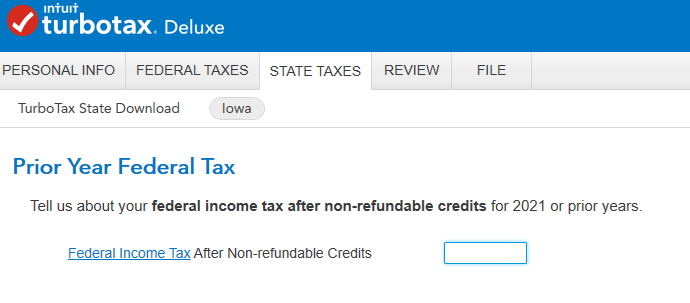

Is that's in this field what we are supposed to put in our state tax filing? Im doing Iowa state taxers and don't know what to put here. Putting what's in this line makes the difference between a small state return and a large one and I don't want to put in the wrong thing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line can I find the "federal income tax after non-refundable credits for 2020?"

@ sbeard99

Please clarify. You’re going in a different direction than where this thread started.

Are you referring to your 2021 Ohio State Income Tax Return? If so, what line?

Otherwise, please provide more information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line can I find the "federal income tax after non-refundable credits for 2020?"

@sbeard99 Did you ever get an answer or figure this out ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line can I find the "federal income tax after non-refundable credits for 2020?"

The amount of federal tax paid is 2021 Form 1040 line 37, however, there may be add-backs.

See Iowa's instructions at Additional Federal Tax Paid in 2022 for 2021 and Prior Years. Also, you would add any back taxes paid that are not on Form 1040, such as taxes paid due to an audit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line can I find the "federal income tax after non-refundable credits for 2020?"

Did you ever find out what to put for this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line can I find the "federal income tax after non-refundable credits for 2020?"

You will need to review your 2021 Tax Return to see the Federal Income Tax after non-refundable credits which is line 31 of your Form 1040.

If you don't have a copy of your return, see the instruction below on how to download it.

You can access your 2021 return by following the steps below:

For TurboTax Online:

- Sign in to your TurboTax account and open your return by selecting Continue or Pick up where you left off

- Select Tax Tools from the left menu, then Print Center (on mobile devices, tap in the upper left corner to expand the menu)

- Select Print, save, or preview this year's return, and follow any additional instructions

- Once your PDF opens in Adobe Acrobat Reader, select the printer icon near the top

- Make any adjustments in the Print window and then select Print at the bottom

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

postman8905

New Member

wallyFLGator

New Member

Etherman

Level 2

dnlprz17

New Member

turner121

Level 2