- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- What forms do I need to be mailed to file Virginia State income taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What forms do I need to be mailed to file Virginia State income taxes?

TurboTax was not very helpful in trying to get information together in order to do my Virginia State Income taxes.

First I had to try and break out all of my information from the joint federal tax forms we had completed.

This was done by creating an additional federal tax filing with me choosing Married filing separately.

This was painstakingly ridiculous.

I then had to go and use this Federal Income Tax file to go through my Virginia State Income tax questions.

When it was all said and done I wanted to print out the Virginia tax form as Turbo Tax stated I had to mail the Virginia State Tax forms in.

When I clicked on print my forms, The printout included the fake or mock federal return which TurboTax explicitly stated to not file.

So, my question is, What forms are needed to file Virginia State Taxes??????

Why doesn't TurboTax print out the forms I needed and not all the confusion, on top of the confusion in putting together the fake federal return that TT instructed me to do so that I can separate out any and all documents that are erroneous?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What forms do I need to be mailed to file Virginia State income taxes?

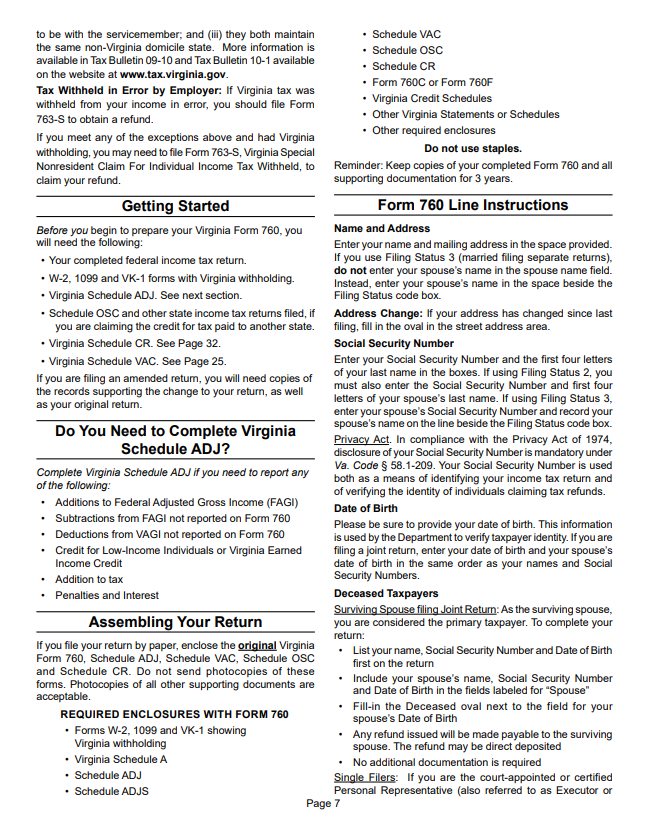

Please see the excerpt from the instructions below for details on what needs to be sent with your Virginia income tax return.

VA instructions - page 7 for attachments

As far as filing separately, I recommend purchasing the software CD in the future as it has more features to make this process a bit easier. You will be able to prepare the returns within the same file instead of having to create mock returns to prepare the state returns.

Filing separately for state guide

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

VAer

Level 4

dpa500

Level 2

dpa500

Level 2

tandonusatax

Returning Member

jamie2082

New Member