- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Underpayment penalty - Minnesota

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Underpayment penalty - Minnesota

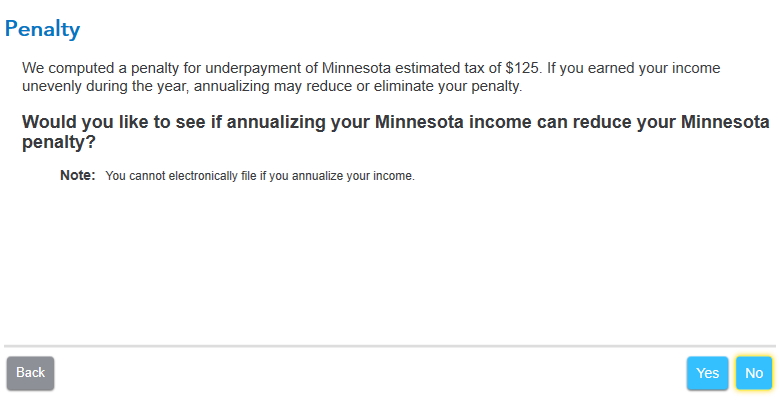

The code for this rejection is for the selection to annualize Minnesota income for purposes of calculating the underpayment penalty. If you select Yes, to use that method, e-filing will not be supported because it uses Annualized Income Installment Worksheet. With this option, printing and mailing the return to the Minnesota Department of Revenue is required.

If you select No, to the question "Would you like to see if annualizing your Minnesota Income can reduce your Minnesota Penalty?" it should it should still be eligible for e-filing with the Minnesota Department of Revenue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Underpayment penalty - Minnesota

TeresaM, thanks for the reply but you are wrong. I answered No to the question "Would you like to see if annualizing your Minnesota Income can reduce your Minnesota Penalty?

Thus, to save time I chose to keep the penalty and e filed my return. However, it was rejected by the state because there is a glitch in Turbo Tax's Schedule M15 creating an error of decimals. The code I got for the rejection said that in schedule 15 Line 22, the result should be equal to the addition of the components of line 21. The result of line 22 should have been $ 5.55 (the penalty). Turbo tax has it in the schedule M15 as $5, thus triggering the rejection of my state return. Again, the reason for the rejection is that $5. and $5.55 do not match. I was on the phone with turbotax for 1 hour and they could not fix this problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Underpayment penalty - Minnesota

I too have the same problem. I overpaid estimated taxes get it computes an underpayment penalty of $2. I'm fine with that as long as it doesn't use the Annualized Income Installment Worksheet.

I checked the M15 form and see that it has the wrong data for Line21 (my first estimated tax payment is not there).

Do you know if M15 can be edited manually? I tried to but was unsuccessful.

I obviously don't have a solution. Hopefully adding more information to your question can help someone troubleshoot this problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Underpayment penalty - Minnesota

FYI -

An update to TurboTax on April 6th fixed the problem for me. I resubmitted it, and it was accepted.

So it was a software problem, not my user error.

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

AJSR111

New Member

freddytax

Level 1

Embers

New Member

Wjm2222

New Member

tf35sc

Level 1