- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

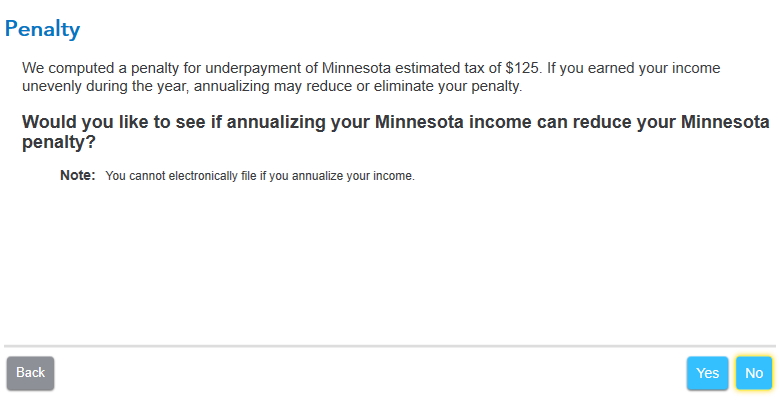

The code for this rejection is for the selection to annualize Minnesota income for purposes of calculating the underpayment penalty. If you select Yes, to use that method, e-filing will not be supported because it uses Annualized Income Installment Worksheet. With this option, printing and mailing the return to the Minnesota Department of Revenue is required.

If you select No, to the question "Would you like to see if annualizing your Minnesota Income can reduce your Minnesota Penalty?" it should it should still be eligible for e-filing with the Minnesota Department of Revenue.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 4, 2023

6:28 PM