- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- U.S. Obligations free from Maryland (or any state) tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

U.S. Obligations free from Maryland (or any state) tax

How has TurboTax computed the total amount of "Interest/Dividends from U.S. Obligations that are tax free" that are subtracted from our Maryland (or any state) income? We get a different/higher amount when we compute manually.

We thought we were using the amounts that TurboTax should be using from the entries made in the Federal part of TurboTax.

TurboTax shows a number for this total amount, but not how it got that number.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

U.S. Obligations free from Maryland (or any state) tax

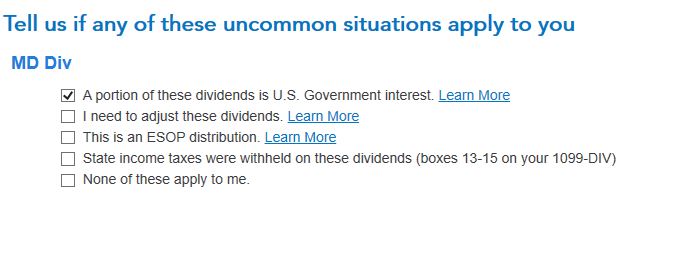

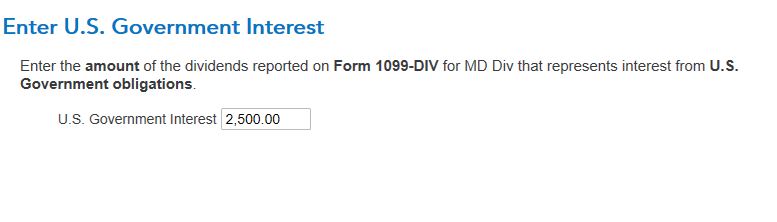

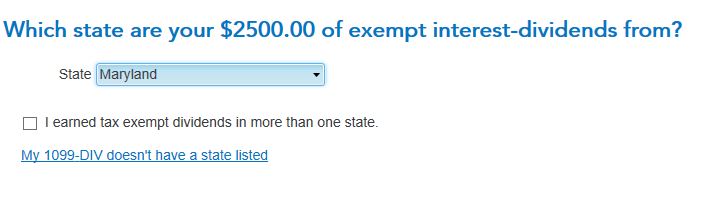

You enter the tax-free interest and dividends in your federal program, when you enter your forms 1099-INT and 1099-DIV. You will be asked if you have income from the US Government and what the amount is and how much belongs in Maryland. Here are the screen shots:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

U.S. Obligations free from Maryland (or any state) tax

We had done everything you suggested. We examined the difference between TurboTax's total for the amount of dividends that represent "interest from U.S. Obligations" and the amount we got when we manually added up the individual amounts. It looks like the first fund that had interest from U.S. obligations (as listed in the Federal form) has been omitted in TurboTax's calculations. The amount of this fund's dividend that "represents interest from U.S. Obligations" and the difference between the total we get and the total TurboTax gets is the same.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

U.S. Obligations free from Maryland (or any state) tax

I see, I would suggest you delete the 1099 form that is not being processed correctly, and re-enter it. It is possible that a change was made to it after it was entered and sometimes that can make things process incorrectly.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

U.S. Obligations free from Maryland (or any state) tax

We tried your suggestion; it did not solve the problem. Curiously, when we added the fund back at the end of the list, TurboTax returned it to its original position. Thus, it was again the first fund to have a "portion of dividends in U.S. Government Interest" that would be subtracted from our state's tax. Of all the funds we have listed, 11 of them have a "portion of dividends in U.S. Government Interest" that would be subtracted from our state's tax. In addition, there are two tax free funds. We have spent many hours reviewing our entries, re-calculating our numbers, repositioning entries, etc. When we add the total of the "portion of dividends in U.S. Government Interest" from these 13 funds that should be subtracted from our state's tax (shown in TurboTax as "automatically subtracted"), our result is consistently higher than TurboTax's amount by the amount in the first fund that has a "portion of dividends in U.S. Government Interest". Since we can't see the 13 amounts that TurboTax is adding to get its result, we do not know what we may be doing incorrectly. Is there something TurboTax does that we don't know about? Is the TurboTax software behaving incorrectly because we may have changed something, somewhere, at some time? If TurboTax is doing this incorrectly, what are our options?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

U.S. Obligations free from Maryland (or any state) tax

Sir,

We are still waiting for a reply to our latest question. If no answer, we will assume it is a bug in the turbotax software and will hope it is corrected in the future.

Thanks.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ningji

Level 2

xsun226001

New Member

RACL2020

Returning Member

theswiezynskis

New Member

cindyjtp

New Member