- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- TurboTax Online - Virginia Individual Return with PTET Credit not available for E-File

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Online - Virginia Individual Return with PTET Credit not available for E-File

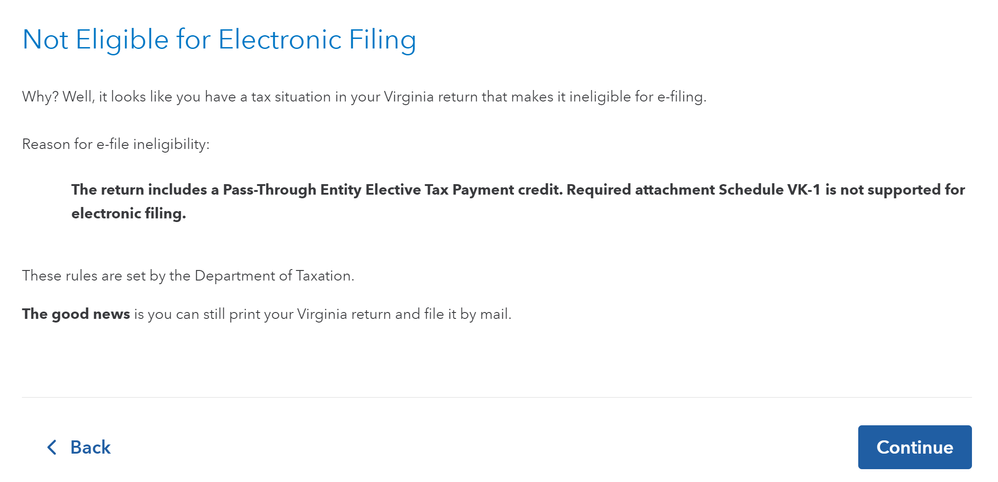

TurboTax Online is telling me that my individual Virginia tax return is not available for e-file due to the fact that I have a Pass Through Entity Tax (PTET) credit. The error message states, "The return includes a Pass-Through Entity Elective Tax Payment credit. Required attachment Schedule VK-1 is not supported for electronic filing." See screenshot below:

The error message appears to be correct about the fact that the VK-1 form is required to be attached to the return when claiming a PTET credit, per Virginia's Schedule CR instructions:

"Pass-Through Entity Elective Tax Payment Credit: Enclose Form 502 Schedule VK-1."

https://www.tax.virginia.gov/sites/default/files/taxforms/individual-income-tax/2023/schedule-cr-202...

However, I couldn't find any documentation on Virginia's website stating that a VK-1 form can't be attached to a return when e-filing.

Is there really no way for me to just upload my VK-1 to TurboTax and have TurboTax include it as an attachment to the e-filing? If not, can this functionality be added? I'd really like to avoid having to print out and physically mail my return in because I'm sure I'll mess something up. One of the reasons I paid for the Premium edition of TurboTax Online is to make filing convenient and somewhat idiot proof. This scenario seems like something that should be supported.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Online - Virginia Individual Return with PTET Credit not available for E-File

I'm surprised no one answered the question. I file VA and also MD. I learned the hard way that TurboTax does not send the K-1 attachments. For MD, I have to always file by paper and attach the K-1. Now you and I both have to do the same for VA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Online - Virginia Individual Return with PTET Credit not available for E-File

Has anyone helped you with this error yet? I have used TT for over 15 years and never had a problem until this PTET VA problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Online - Virginia Individual Return with PTET Credit not available for E-File

No, I reached out to TurboTax support and they confirmed that electronic filing for the Virginia PTET tax is not currently supported because there's currently no mechanism in TurboTax Online to upload the individual's VK-1 form. I asked for them to open a feature request to implement support for electronic filing for the Virginia PTET tax credit, but I did not get any confirmation from TurboTax support about if or when this functionality will be supported.

I ended up having to file my Virginia return by mail and manually included my VK-1 in the packet. Fingers crossed that it doesn't get rejected.

I would imagine that there are hundreds, if not thousands, of other Virginia small business owners who use TurboTax and are encountering this issue with claiming the PTET credit. Hopefully TurboTax adds support for it soon.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Online - Virginia Individual Return with PTET Credit not available for E-File

You get what you pay for

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Online - Virginia Individual Return with PTET Credit not available for E-File

Update: TurboTax allowed me to file my return electronically this year for some reason.

Virginia's requirement to submit a VK-1 form when claiming the PTET tax payment credit did not change. The 2024 Virginia Schedule CR form explicitly states that the VK-1 form is required.

"Pass-Through Entity Elective Tax Payment Credit: Enclose Form 502 Schedule VK-1."

https://www.tax.virginia.gov/sites/default/files/taxforms/individual-income-tax/2024/schedule-cr-202...

However, TurboTax now appears to be ignoring this requirement and allowing individuals to file electronically without it. Not sure if that's a good thing or a bad thing. It definitely made filing easier, but I will be pissed if Virginia disallows the credit because there was no supporting VK-1 attached.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Online - Virginia Individual Return with PTET Credit not available for E-File

Are you sure TT is ignoring it? The VK-1 didn't go through with the return? You should check the file. If indeed it did not go through, VA will not process the return without it. You could send it to them separately, and then cross your fingers that someone in VA tax dept will match it with your return. Or wait until they reject the return, and then send it. I have not filed yet so cannot answer definitively based on my filing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Online - Virginia Individual Return with PTET Credit not available for E-File

Schedule VK-1 is available for E-Filing with TurboTax Online and Desktop versions. You can check the form availability through the link below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Online - Virginia Individual Return with PTET Credit not available for E-File

It might be technically available, but I just filed my VA return through TurboTax online and it didn't appear to attach the form, but should have. Is there some other way TurboTax is reporting this information?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Online - Virginia Individual Return with PTET Credit not available for E-File

Update on this: I went back into TurboTax online where the PTET credit is claimed and there is the following message:

Note: If you're filing by mail, be sure to attach Schedule(s) VK-1 to your tax return showing your share of the PTET credit. If you're planning on e-filing your Virginia return, mail in your documentation only after Virginia has issued you a "Missing Documentation Letter".

So there you have it. No need to send in your VK-1 if you're filing electronically until/unless the Virginia Department of Taxation asks you for it.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

VAer

Level 4

andreagarrett08

New Member

kmarteny

New Member

turbosapper

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

linaw314

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill