- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- TT will not e-file my MO return due to payment I made on MO-2NR

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT will not e-file my MO return due to payment I made on MO-2NR

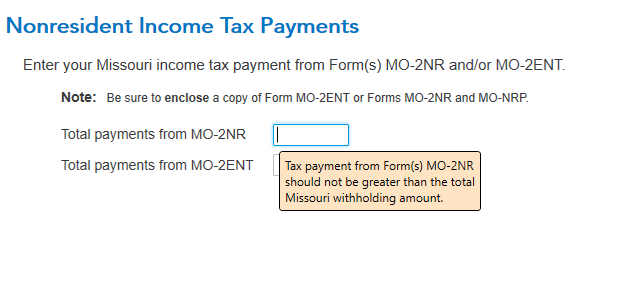

Tax was paid to Missouri on a MO-2NR for income from a partnership there. When I put the amount on my MO personal return in Turbo Tax, it shows as an error on the MO-1040 and will not let me e-file the MO personal return. I show the amount paid which exceeds the tax due on the personal return, which results in a refund. How to fix this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT will not e-file my MO return due to payment I made on MO-2NR

Did you report an amount greater than the total Missouri withholding amount?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT will not e-file my MO return due to payment I made on MO-2NR

As nonresidents, the payment we make on our MO-2NR's is called the withholding amount and is equal to the tax due. We do not have to actually withhold throughout the year as our payment amount is low. Yes, I did fill in the entry box you show. This is very frustrating as it seems TT is looking for an estimated payment or something else to match. Anyway I am out the TT e-file fee as I filed by paper. Also as was noted a copy of the MO-2NR is to be attached, but is not in the MO return information within the program

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

teamely5

New Member

borenbears

New Member

mulleryi

Level 2

mulleryi

Level 2

matto1

Level 2