- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- TT will not e-file my MO return due to payment I made on MO-2NR

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT will not e-file my MO return due to payment I made on MO-2NR

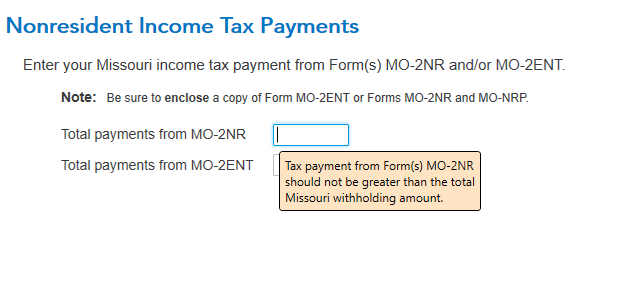

Tax was paid to Missouri on a MO-2NR for income from a partnership there. When I put the amount on my MO personal return in Turbo Tax, it shows as an error on the MO-1040 and will not let me e-file the MO personal return. I show the amount paid which exceeds the tax due on the personal return, which results in a refund. How to fix this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT will not e-file my MO return due to payment I made on MO-2NR

Did you report an amount greater than the total Missouri withholding amount?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT will not e-file my MO return due to payment I made on MO-2NR

As nonresidents, the payment we make on our MO-2NR's is called the withholding amount and is equal to the tax due. We do not have to actually withhold throughout the year as our payment amount is low. Yes, I did fill in the entry box you show. This is very frustrating as it seems TT is looking for an estimated payment or something else to match. Anyway I am out the TT e-file fee as I filed by paper. Also as was noted a copy of the MO-2NR is to be attached, but is not in the MO return information within the program

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cspfire2024

Level 3

gigi0480

New Member

Kathryn1659

New Member

bertkesj

New Member

rltkbirnbaum

New Member