in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- TT Not transferring my federal QBI to my Idaho state return for QBI deduction calculation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Not transferring my federal QBI to my Idaho state return for QBI deduction calculation

Line 2 on the worksheet for Idaho Form 43 does not appear to be pulling in my QBI from my federal return, which results in an incorrect QBI deduction calculation.

Below are relevant screenshots of the

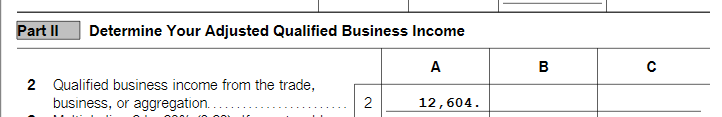

1) federal return showing the total QBI

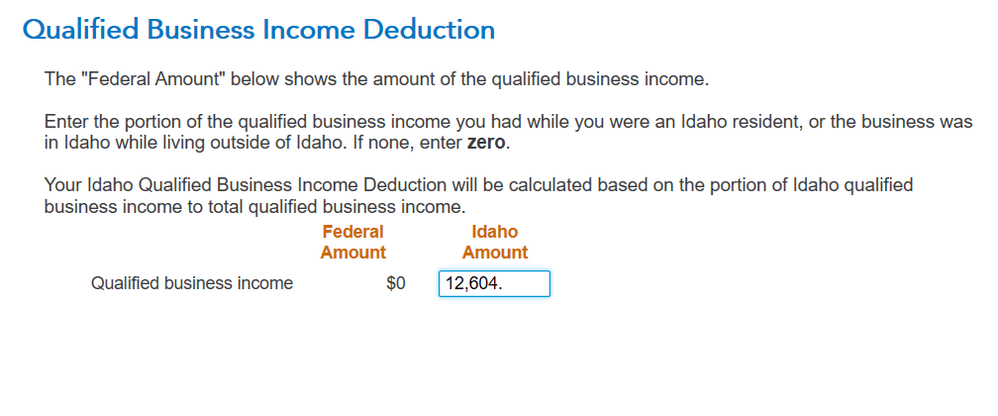

2) the Idaho interview where the federal QBI seems to be incorrectly showing as 0 and

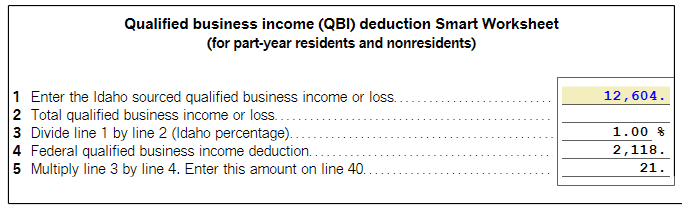

3) the Idaho Form 43 QBI Deduction worksheet where line 2 isn't accurately populated, resulting in an incorrect Idaho QBI Deduction calculation.

1.

2

3.

It seems to be that line 2 on the Form 43 worksheet is not pulling the vale from my federal return. I can't override whats on line 2. The Idaho sourced QBI comprises the entirety of my QBI.

Below is what I think should be reflected in the worksheet:

1. Idaho sourced QBI 12,604

2. Total QBI 12,604

3. Idaho Percentage 100%

4. Federal QBI Deduction 2,118

5. Idaho QBI Deduction 2,118

Anyone have any suggestions or clarifications to my understanding?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Not transferring my federal QBI to my Idaho state return for QBI deduction calculation

Can you clarify if the business QBI is being transferred over from the worksheet to the federal return?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

CRWest-2019

Level 1

AS70

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

dkrawchu1

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

Al2531

Level 2

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

Al2531

Level 2