- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- The NC retired benefit worksheet

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The NC retired benefit worksheet

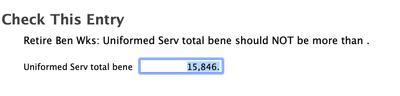

The NC "retired benefit" worksheet is creating an unspecified error. See screenshot, below.

Should not be more than WHAT?

Thanks for any help you can offer. I am unable to file the NC taxes without the error.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The NC retired benefit worksheet

That error shows up for me, if I attempt to claim a Military Pension distribution as being Baily Settlement eligible where I entered the 1099-R form in the Federal section....

BUT

...Then, during the NC section of the software interview, I also claimed the same $$ amount as being eligible for the Uniformed Services retirement deduction.

You cannot claim it in both places...

__________________

If you blank-out that 15,846, and continue thru the next pages (another error my show up on the next page....just ignore it, continue out to the main menu) and then run the error check a second time.

________________________

But, if it was a Military 1099-R, you should also go back and check whether you claimed those same 1099-R $$ as being Bailey Settlement eligible when you stepped thru it's entry in the Federal section.

Like I said. you can take Bailey Settlement (if it was eligible for that) OR Uniformed Services ..,not both.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

debrajmoss

New Member

50safe69

New Member

jdc_carroll

Level 1

user17708421015

New Member

Paulse3

Level 2