- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Taxes Paid to Another State

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes Paid to Another State

I live in Illinois and work in Missouri. My employer withheld state taxes for Illinois and Missouri. I am trying to file my taxes online but its stating that since I have 0 earned income in IL but paid taxes that I can not efile. I have an appointment to go in to speak with someone in a few days but its driving me a little crazy not knowing what I should do?

Do I just go in and file with a company and file for both Illinois and Missouri?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes Paid to Another State

You need to prepare a NON-resident state return for MO first, then prepare a state return for IL, the state you live in.

https://ttlc.intuit.com/questions/2895920-why-would-i-have-to-file-a-nonresident-state-return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes Paid to Another State

Thank you foe your reply! Because I have 0 earned income in IL but paid taxes to them. Will I be able to file electronically? It kept giving me an error stating that my earned income can not be lower than the taxes paid.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes Paid to Another State

You say the employer listed amounts on your W-2 for both states and withheld tax for both states. Or did I misunderstand? What did they put in box 16 for IL?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes Paid to Another State

And.....have you prepared a federal tax return? When you did that, in MY INFO did you say that you live in IL? And then did you say that you earned income in another state? And choose MO from a drop down list? Did you enter everything from the W-2 into the federal return----all the boxes---including the information about both states from boxes 15, 16 and 17?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes Paid to Another State

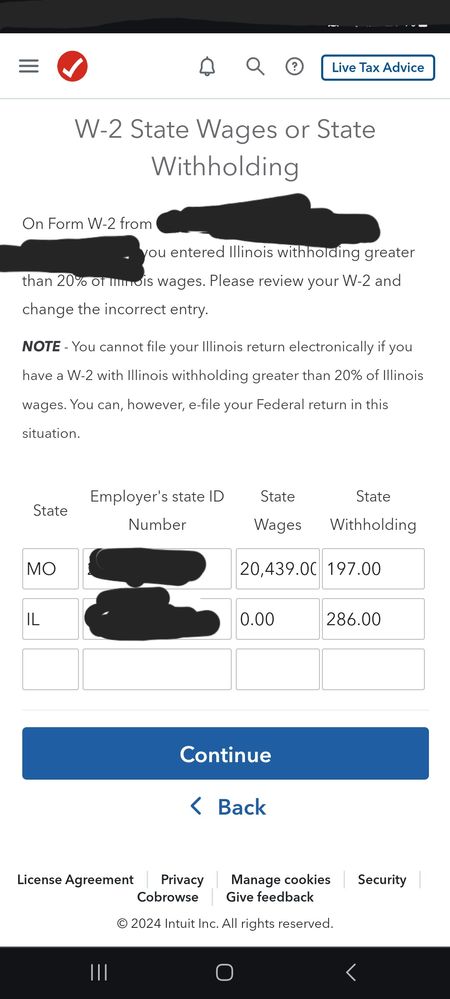

This is what it shows.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes Paid to Another State

Will ask another Champ for some thoughts.

@TomD8 ???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes Paid to Another State

This is what it is telling me when it reviews the info. It says you have one issue to fix and I click it to fit it and it says this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes Paid to Another State

I suspect that the employer made a mistake by not entering that same amount of 20,439 in box 16 for IL. But let's wait for the real state tax guru Champ @TomD8 to weigh in.

And...."worst case" --- you e-file federal and MO, and mail the IL return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes Paid to Another State

"I suspect the employer made a mistake by not entering that same amount of 20,439 in box 16 for IL."

I agree. The error is particularly obvious since the employer entered an Illinois withholding amount in Box 17. I think the taxpayer should enter the $20,439 on the Illinois line in Box 16 when she enters her W-2 into TurboTax.

@LadyKryd -- Be sure to double-check your returns before you submit them to make sure the amounts shown are correct.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

nessa1614

New Member

b4se597025

New Member

weifangwu

New Member

jfernand2107

New Member

-kendunn

New Member