- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Tax obligation for remote internship

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax obligation for remote internship

I have a question about my state tax return. I am a student in Virginia and had a remote internship during summer 2024. However, I was physically located in Utah while working. My company withheld taxes for Virginia, as shown on my W-2 form.

Could you clarify whether I need to pay state taxes to Utah and advise me on how to proceed?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax obligation for remote internship

If you worked for more than 20 days in Utah, you would be required to file a non-resident tax return there if you were required to file a federal tax return. If you end up owing taxes to Utah, you can apply for a credit for taxes paid to another state on your Virginia return to get a credit for those taxes so you don't end up being double taxed.

Assuming you need to file the Utah return, you should complete a non-resident Utah return in TurboTax before you complete your Virginia return, as you will need the tax paid to Utah for the credit on your Virginia return. When you work on your Virginia return, look for the credit for taxes paid to another state in the deductions and credits section on the Virginia return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax obligation for remote internship

Hi I just wanted to reclarify. The Utah state income website states that a non resident needs to file return if income is from Utah sources. My income was not from Utah sources, instead it was from Virginia source (as shown on my W-2). I just went to Utah to visit friend during summer. Do I still need to pay Utah State Tax?

https://incometax.utah.gov/instructions/who-must-file#nonresidents-working

You must file a TC-40 return if you:

- are a Utah resident or part-year resident who must file a federal return,

- are a nonresident or part-year resident with income from Utah sources who must file a federal return, or

- want a refund of any income tax overpaid.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax obligation for remote internship

That would be a grey area. If you are performing services in Utah but being paid by a company located in Virginia, then it would be Utah sourced income. Similar to professional athletes who play a game in city away from their home city. They get taxed by the state where the game is played on the money they earn while there, even though they are being paid by the owner in their home state.

If you were there simply telecommuting which had nothing to do with being in Utah, then you could make an argument that the work does not have a nexus to Utah. You may need to contact the Utah Department of Revenue for clarification at 1-800-662-4335.

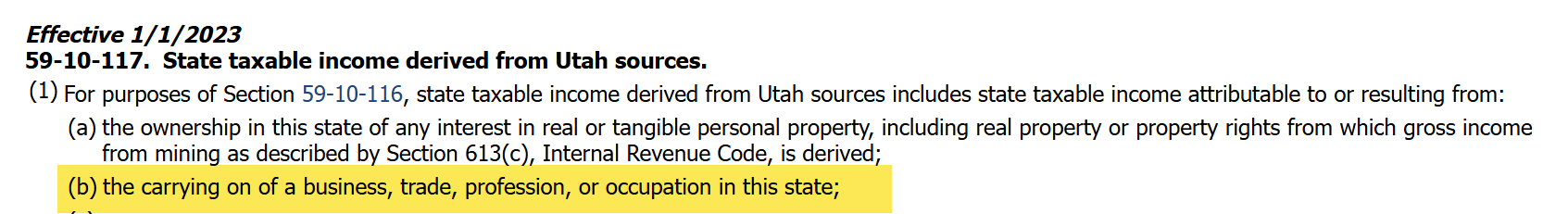

Here is an excerpt from the Utah State Legislature mentioning that the carrying on of a profession in the state is Utah sourced income, so some interpretation is required:

[Edited 1/28/25 at 2:58 PM PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kiritoaxer

New Member

LAH_2025

Level 1

awburrell

Level 2

rset

Level 2

in Education

crabbygirl02

Level 1