- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

That would be a grey area. If you are performing services in Utah but being paid by a company located in Virginia, then it would be Utah sourced income. Similar to professional athletes who play a game in city away from their home city. They get taxed by the state where the game is played on the money they earn while there, even though they are being paid by the owner in their home state.

If you were there simply telecommuting which had nothing to do with being in Utah, then you could make an argument that the work does not have a nexus to Utah. You may need to contact the Utah Department of Revenue for clarification at 1-800-662-4335.

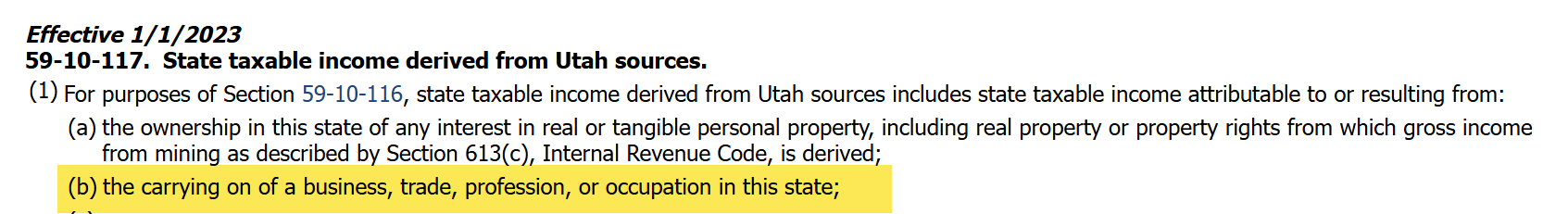

Here is an excerpt from the Utah State Legislature mentioning that the carrying on of a profession in the state is Utah sourced income, so some interpretation is required:

[Edited 1/28/25 at 2:58 PM PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"