- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- State tax issue

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax issue

I live in Kentucky and worked remotely in Ky. However my work was in Virginia. I am doing a nonresidential state tax form for Va. I am confused on how to get past the issues it’s saying I have. It wants me to leave two places on the Virginia state tax form blank. However, when I do this it won’t allow me to go farther. I don’t know what to do. Please help. Thx

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax issue

You are filing a Kentucky resident state tax return and a Virginia nonresident state tax return.

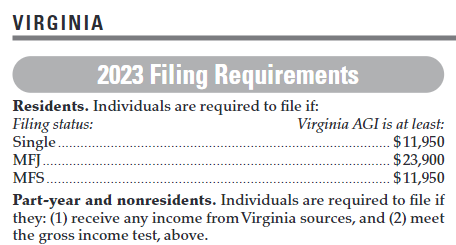

Virginia nonresidents are required to file if they receive income from a Virginia source and meet the gross income test listed below.

If your income is not from a Virginia source, you need to file to receive a refund of the Virginia income taxes withheld. See that @TomD8 explains that 'work carried out in a location in Kentucky is Kentucky-sourced income'.

Virginia and Kentucky do not have a reciprocal agreement.

In the Virginia state tax return, what two places are you being asked to leave blank? Or what error messages are you seeing?

Please clarify and someone here may be able to help you.

[Edited 2/5/24 | 8:22 am PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax issue

Was your work carried out 100% from a Kentucky location?

If you never physically worked within Virginia, then your income from that work is not subject to Virginia income tax. Non-residents of Virginia are subject to Virginia income tax only on Virginia-source income

"Net income, gain, loss and deductions from Virginia sources" means that attributable to property within Virginia, or to the conduct of a trade, business, occupation or profession within Virginia."

https://law.lis.virginia.gov/admincode/title23/agency10/chapter110/section180/

Work carried out from a location in Kentucky is Kentucky-source income, regardless of the employer's location.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Sarmis

New Member

abuzooz-zee87

New Member

cobralady

New Member

mjbrown37

New Member

4md

New Member