- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- SC State Taxes - Part Time Resident

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SC State Taxes - Part Time Resident

After submitting my taxes, the State of SC changed it and considered me as full-time resident so instead of having a refund they're charging me almost $1,000.

My taxes show clearly that I've lived in SC for only a month.

How do I fix this?

Turbotax gets all my income from my federal taxes and transfers it over to my state taxes.

Anyone here knows how to fix it and amend my return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SC State Taxes - Part Time Resident

If you moved to South Carolina during the year, you are considered a part-year resident. As a

part-year resident, you may file as a full-year resident or a non-resident.

If you file as a part-year resident, you will claim all of your income as though you were a

resident for the entire year and take credit for any taxes paid in another state.

As a non-resident, you will report only income earned in South Carolina. Your deductions and

exemptions will be prorated by the same percentage as your South Carolina income compared

to your total income. You may choose the method which benefits you best.

Which did you use?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SC State Taxes - Part Time Resident

@Alex562745 Turbo Tax would have recommended which of the two options to choose from (see @SweetieJean's post) and would have used its recommendation unless you overrode it.

But those two choices relate to part year residency. But from your post the State isn't bying either of those options because they think you were a full year resident....

So I think the conversation is with the State - not with Turbo Tax - and there are some facts missing here.

What state did you live in the other 11 months?

What state did you work in the other 11 months?

Did you file taxes in that other state?

What date did you tell Turbo Tax you moved to SC?

let's start there.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SC State Taxes - Part Time Resident

I've lived in TN almost the full year and did my taxes there as well (got a refund).

I told turbotax I moved to SC in 12/2020 and my W2 is proof of it.

The problem is when I did my SC state taxes it transferred all my federal income as my year income to add to my state income, then it gave a totally different result from that point on.

Not sure if it's a bug in the software or some kind of tax mandate, other states don't do that, so I feel cheated on by the state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SC State Taxes - Part Time Resident

@Alex562745 - what year are we talking about??????

are you complaining about your 2021 income tax return?

If moved to SC from TN in 12/20, and that is the date you entered into Turbo Tax, then you did live in SC for the entire year of 2021.

please confirm what year the SC tax return is incorrect for? 2020 or 2021???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SC State Taxes - Part Time Resident

I'm complaining about my 2020 taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SC State Taxes - Part Time Resident

From what you stated, Turbo Turbo Tax calculated your return as a part year resident.

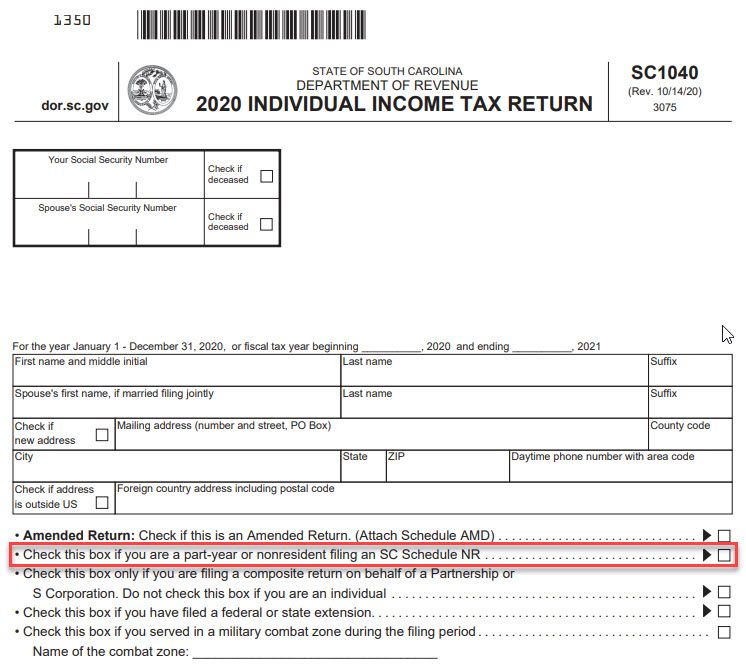

There is a question about 1/4 of the way down on the SC tax form ("check this box if you are a part-year or non-resident")... is that box checked? That will tell me which method Turbo Tax used to calculate your tax.

Your best bet is to call the State of SC and ask WHY they changed your tax return from part year resident to full year resident, but I'd like to know about that check box first.

Because, if Turbo Tax calculated your tax as a part time resident, then the State did something; it wasn't Turbo Tax that did something you weren't expecting.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SC State Taxes - Part Time Resident

It’s the same box for part time and full time residents, that’s the one I checked.

Tubotax got it right and according to it I’d have a return but some auditor changed it and now I owe almost $1,000

Have no idea how to fix it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SC State Taxes - Part Time Resident

@Alex562745 - you can only fix it by explaining to the State that they did it wrong.... or get them to explain their justification on why they changed it

From everything you wrote, you did it correctly and Turbo Tax reflected your actions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SC State Taxes - Part Time Resident

Yeah, according to the person I've talked over the phone I need to amend my return to make sure they see me as part time resident and not the opposite.

It's sad that there's nothing I can do through turbotax but I'll have to hire an accountant, expend a money I don't have (much more than I'll receive as return) and do that on paper.

It looks like the only way to go.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SC State Taxes - Part Time Resident

@Alex562745 - I guess what I don't understand - without seeing the return itself - is what is wrong with what you submitted originally.

From your description all you are going to do is re-present the same tax return that Turbo Tax created in the first place. Won't the State deny that again??????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SC State Taxes - Part Time Resident

According to the person that I talked on the phone they have me as a full time resident and I need to fix it.

Not sure how it happened but the truth is the truth, and I wasn't a full time resident, and I have all documents to proof it.

Not going to bow my head just because one auditor decided to change my taxes and classify me as a full time resident, it has to be fixed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SC State Taxes - Part Time Resident

@Alex562745 It sounds like South Carolina changed you from part-year resident filing as a nonresident to part-year resident filing as a resident.

As @SweetieJean said, SC has two part-year resident options—filing as a resident or non-resident. Check your originally filed return.

SC1040 should have the part-year/nonresident return box checked and you should have included Schedule NR. It’s possible your return was changed because you did not do one of those two things.

TurboTax can prepare the correct amended return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SC State Taxes - Part Time Resident

@SundayInSalem - here is what I don't understand.....TT would have automated all that. There is no reason for the user to have to decide which option to choose (most users wouldn't know which to choose and that is the benefit of a software like TT which is going to determine the best option "behind the scenes" and go with it...... and if it was efiled, then the correct data would have been in the efile.

i have the SC version (desktop) and verified that it does indeed automatically choose the option that maximizes the benefit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SC State Taxes - Part Time Resident

@NCpersonKudos for checking TurboTax CD/Download. TurboTax Online does give you a choice of filing, though the default is part-year resident filing as a nonresident.

That said, I know of at least one instance where the original return was filed as part-year filing as a nonresident and South Carolina changed the filing status to part-year filing as a resident after making an unrelated adjustment. I don't know whether this is their policy or an oversight made by their auditor.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tdobbs37

New Member

slamny

Level 3

itzty33

New Member

ava-nasseri

New Member

mrsscamp316

New Member