- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Sale of an inherited property/593 CA Tax withholding

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of an inherited property/593 CA Tax withholding

My husband inherited his mother's house in 2017. We never used it as a rental property or lived in it and we finally sold it in 2022 for a profit. My issue is trying to complete our CA State taxes and it keeps asking me for the purchase date and sale date of our former main home which this was not our main home. When I did our Federal taxes, I did not mark this sale as our main home but as an investment (which is what I've read to do). I don't know how to eliminate this on the California Home Sale Worksheet so it will stop asking me for that information.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of an inherited property/593 CA Tax withholding

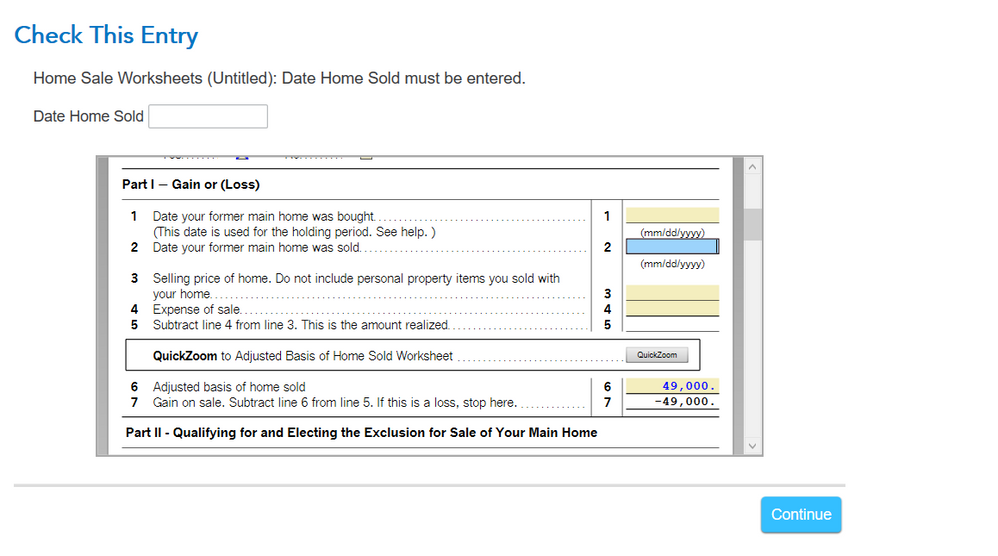

Something is very wrong because you have a basis of $49,000 and a loss of $49,000 which means you literally gave the house away for zero. You need to go back to federal and get rid of what you did. Then follow the steps in Where do I enter the sale of a second home, an inherited home, or land on my 2022 taxes?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of an inherited property/593 CA Tax withholding

Hi Amy,

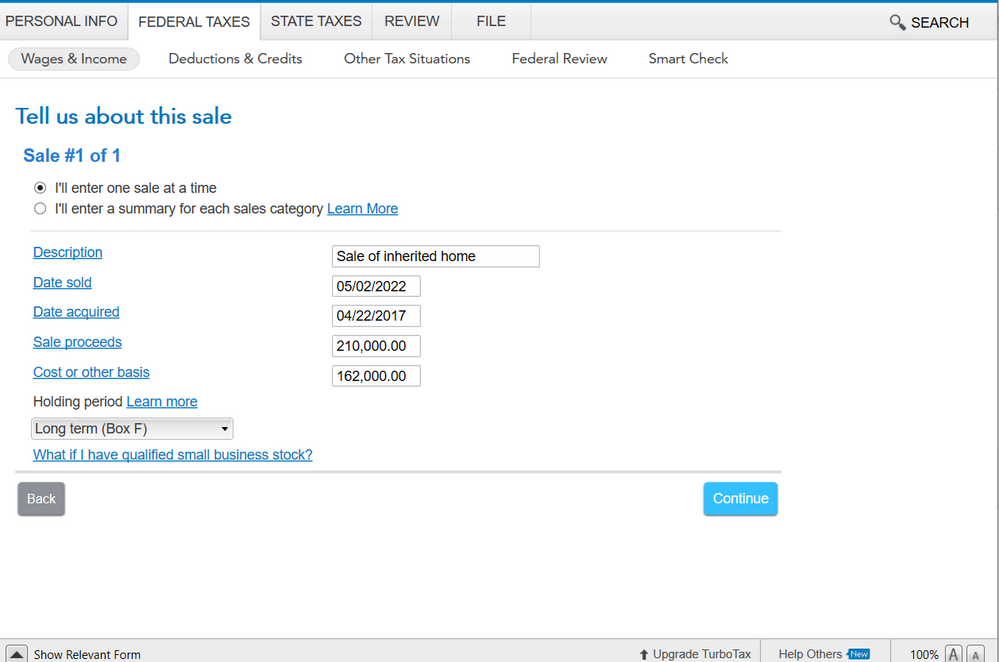

I deleted my original entry for my inherited property sale in Federal and here is what I entered and it is still giving me the same error in my State Taxes.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

akiefer6831

New Member

cnhowardcell

Returning Member

Mysonme63

Level 1

neneestoner25

New Member

jamesstace05

New Member