- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: There's a part where it asks me on this Form TC-40S (1), "Tax paid to other state must be ent...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

There's a part where it asks me on this Form TC-40S (1), "Tax paid to other state must be entered." I have no idea how to find this.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

There's a part where it asks me on this Form TC-40S (1), "Tax paid to other state must be entered." I have no idea how to find this.

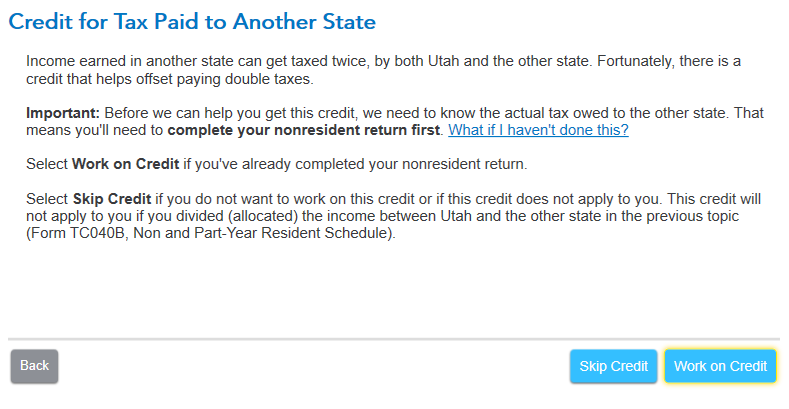

You may find that In TurboTax within the Utah state income tax return. See the screen Credit for Tax Paid to Another State,

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

There's a part where it asks me on this Form TC-40S (1), "Tax paid to other state must be entered." I have no idea how to find this.

Yeah, but how do I find the value to put in there?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

There's a part where it asks me on this Form TC-40S (1), "Tax paid to other state must be entered." I have no idea how to find this.

Review the Missouri income tax return. Missouri MO-1040 line 36 reports the tax.

In TurboTax Online, you may print or view your full tax returns prior to filing after you have paid for the software.

- View the entries down the left side of the screen at Tax Tools.

- Select Print Center.

- Select Print, save or preview this year's return.

In TurboTax Desktop, select FORMS in the upper right hand corner of the screen.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Malmo

New Member

gerald_hwang

New Member

kac42

Level 1

user17550208594

New Member

moranjcfollowers

New Member