- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Please help me understand one option in the Delaware tax retrun

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help me understand one option in the Delaware tax retrun

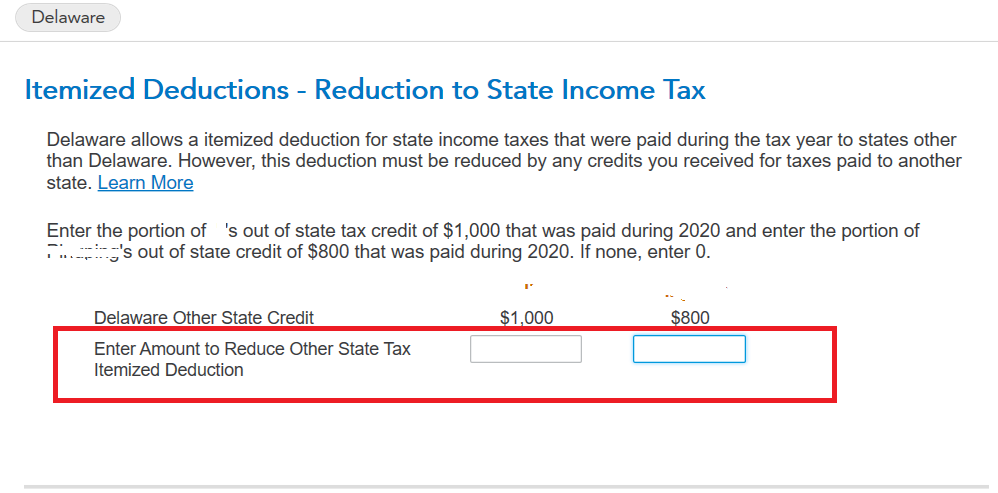

My wife and I live in Delaware and work in Pennsylvania. The PA income taxes that had been withheld by our employers can be used as the credits for Delaware income tax return.

I paid $1,000 PA income tax and my wife paid $800.

Does that mean for 'Enter Amount to Reduce Other State Tax Itemized Deduction', I should enter $1,000 for my self, and $800 for my wife since the paid PA income tax has already been used as the credit for the DE tax deduction on form DE 200-01?

I read the instruction and 'Learn More' but still don't quite understand.

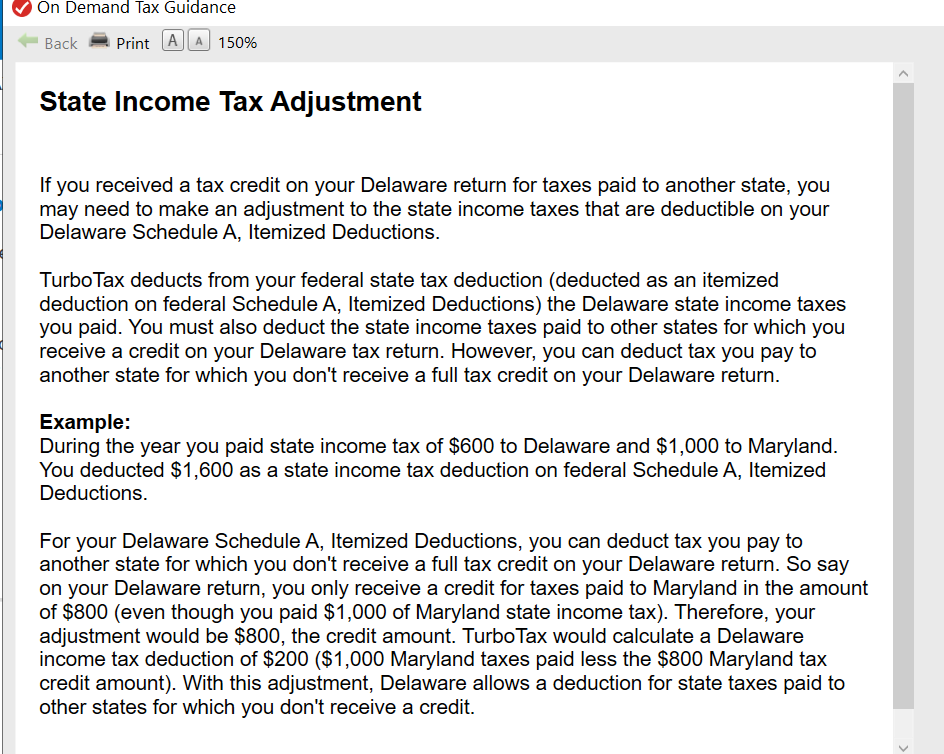

From the "Learn More' link on the above screenshot:

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help me understand one option in the Delaware tax retrun

The way it works is this:

If you have to pay income taxes to a different state and DE is your home state of residence, then you complete the other state tax return and determine the amount of tax liability to the other state as a nonresident on the income earned in the other state and taxed by DE (since you are a DE resident, all income earned everywhere is taxable to a DE resident).

Once you have determined the tax liability due to the other state on the income also taxed by DE, you go to the DE return "other state tax credit worksheet" and enter the other state's tax liability and the other state's income also taxed by DE and you get an other state tax credit to claim on your DE return.

For additional information, please refer to the following link:

DE Instructions for other state tax credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help me understand one option in the Delaware tax retrun

@gloriah5200 Thank you for the explanations. I checked the other state tax credit worksheet and it determined that our PA income tax are used as the tax credit to claim on our tax return. I think my question was once the paid PA income tax is used as the credit, can we still claim it as the deduction on the DE Resident schedule A - Itemerized Deductions form? I believe this was 'Enter Amount to Reduce Other State Tax Itemized Deduction' asked for.

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help me understand one option in the Delaware tax retrun

The amount you use from the PA return is the PA AGI for income taxed in both places.

You have to be sure to use the PA Tax liability (the amount of PA taxes paid in on W2 as well as any additional tax due to PA to cover the PA tax liability) on that amount of PA income.

The thing is that if you are getting a refund of some of the PA taxes paid to PA then that cannot be used as tax credit, only the amount that PA is keeping.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

JazzAlternative

New Member

manbeing

Level 6

RONKELBAUGH

New Member