- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help me understand one option in the Delaware tax retrun

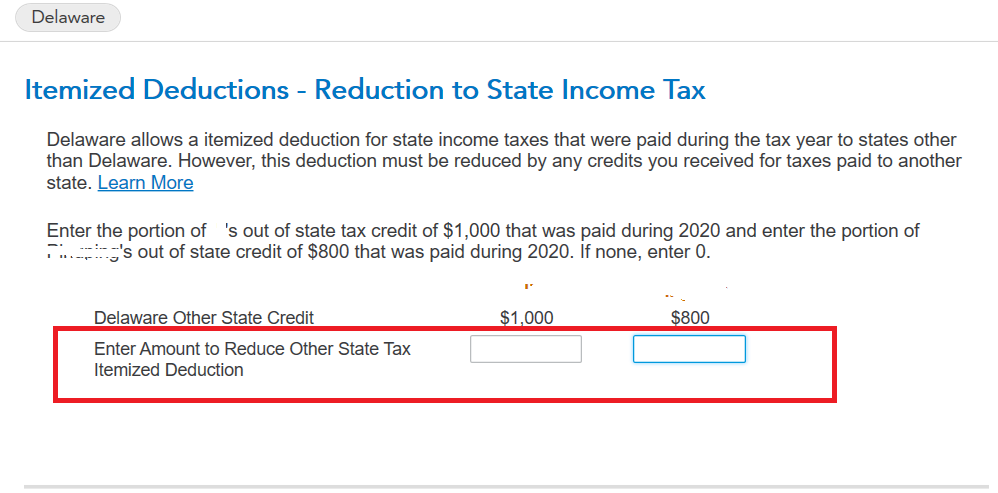

My wife and I live in Delaware and work in Pennsylvania. The PA income taxes that had been withheld by our employers can be used as the credits for Delaware income tax return.

I paid $1,000 PA income tax and my wife paid $800.

Does that mean for 'Enter Amount to Reduce Other State Tax Itemized Deduction', I should enter $1,000 for my self, and $800 for my wife since the paid PA income tax has already been used as the credit for the DE tax deduction on form DE 200-01?

I read the instruction and 'Learn More' but still don't quite understand.

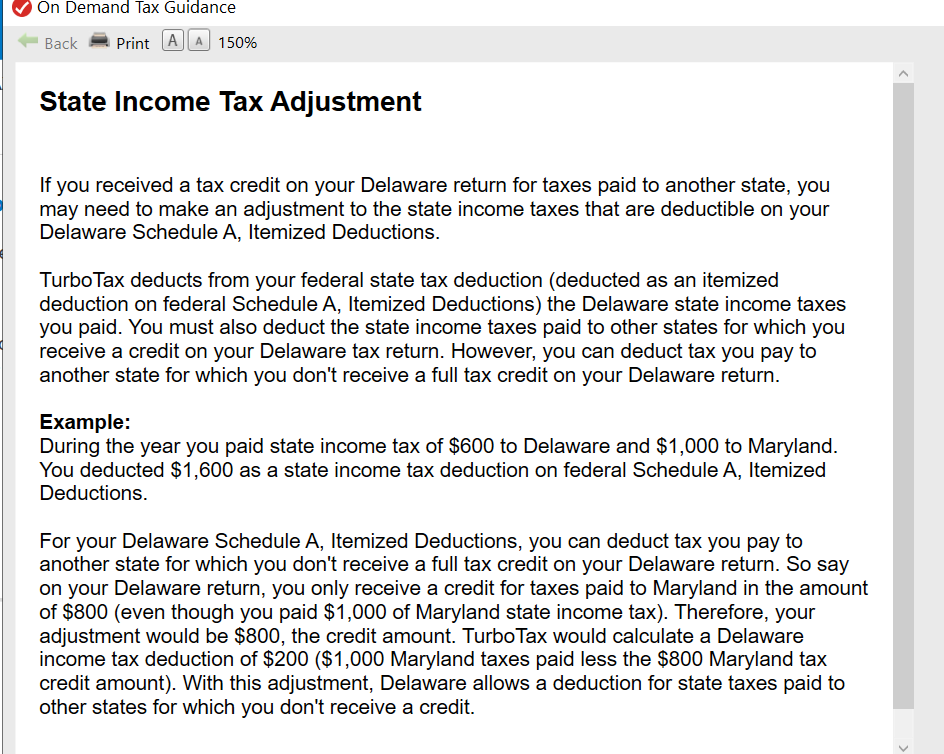

From the "Learn More' link on the above screenshot:

March 7, 2021

4:38 PM