- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Part NY and Part NJ taxes with same NY Employer

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part NY and Part NJ taxes with same NY Employer

Hello,

I lived in NY for 10 months during the tax year and then moved to NJ for the remainder of the 2 months while working for the same employer in NYC. I am filing information first for part-year resident NY and then part-year resident NJ taxes. I have a few questions regarding my state filing:

1. While entering my NY resident income do I use the amount in Box 18 of my W2 or manually calculate it based on the # of days/months I lived in NYS? (The difference is about $500, not sure which amount to input there)

2. Do I need to claim credit for taxes paid to another state, in this case claim a credit on my NJ return for tax paid in NYS?

3. While entering income earned while 'living or working' in NJ, am I inputting the same amount I put in my NYS return under the 'non-resident' section?

4. Where do I get the Dividend Income information from? Does that come from my 1099-DIVs? How does that get divided per state?

5. In the section for Double Taxed Income while resident of NJ - which amount am I entering? For 'Tax paid to New York City' I believe I would enter the amount from 'Box 19 - Local Income Tax'?

Tax season is stressful and any help would be much appreciated.

Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part NY and Part NJ taxes with same NY Employer

I think @DanielV01 's answer to this previous Q&A should help you (ignore the paragraph on NYC.):

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part NY and Part NJ taxes with same NY Employer

Thank you. I think it helped me divide the salaried income based on how long i lived in NYS and NJ, for Part Resident NY tax.

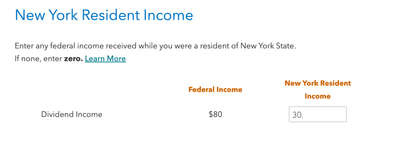

I did come across this for my dividend income - is this also split the same way I split my salaried income?

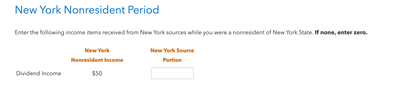

What does 'NY Source Portion' mean?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part NY and Part NJ taxes with same NY Employer

As to your first question, you can take your "Total Unearned Dividend Income", divide by 12 and multiply by the months lived as a NY resident income.

As to your second question, the definition of "NY Source Portion" would include all of the following, see HERE under Subcaption

"Nonresident individuals, estates, and trusts."

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

MarkMConverse

New Member

alex_garzab

New Member

rbessey2

Level 2

kemp5774

New Member

Itty211

New Member