- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Paid Family Leave (PFL) Income in California

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paid Family Leave (PFL) Income in California

Hello,

My wife and I had a baby in 2019. My employer provided paid paternity leave so I was paid normally through my paycheck with NO third party insurance payments as well. When inputting my W2 I checked the box saying part of my income was for PPL.

My wife's employer did not pay for her leave but instead she used sick, PTO, floating holiday and vacation hours to augment insurance benefit. This is because the insurance company paid only a percentage of her normal salary. She has received a W-2 showing the income from the third party insurance company. When inputting this W-2 we also checked the box saying part of this income was for PPL.

We assume we have done everything correct up until this point.

Now what do we input as the amount in the "Paid Family Leave (PFL) Income in California" part in the state return section? Is it just the third party insurance's amount stated on the W2? Does my employer, who paid 100%, have an additional amount I should enter?

Thanks in advance.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paid Family Leave (PFL) Income in California

You would enter the amount listed on your W-2 for PFL on this screen unless you received a separate 1099-G Form.

If you received a 1099-G for your Paid Family Leave, you do not need to change anything on the state input page.

That information would be entered as instructed in the following link and would correctly pull into the state return from your input in the Federal section.

Paid Family Leave income input

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paid Family Leave (PFL) Income in California

You would enter the amount listed on your W-2 for PFL on this screen unless you received a separate 1099-G Form.

If you received a 1099-G for your Paid Family Leave, you do not need to change anything on the state input page.

That information would be entered as instructed in the following link and would correctly pull into the state return from your input in the Federal section.

Paid Family Leave income input

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paid Family Leave (PFL) Income in California

Thanks for that clarification. We will go ahead and input the amount stated on the W2 from her employers third part insurance.

Do we need to take any other steps since she used her PTO/vacation days to help pay a portion of her salary while she was on leave?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paid Family Leave (PFL) Income in California

No, those amounts should be included on her W-2 as wages.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paid Family Leave (PFL) Income in California

I have a follow up question to this. My employer uses a third party to manage my PFL in California. They got the state PFL money and would make up the difference. So, all of my PFL was paid directly by my employer through my regular paystubs. In this case, what is the "PFL Income Received from Insurance Company" that I should be inputting on the state return? I did not and will not be receiving a 1099.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paid Family Leave (PFL) Income in California

You will need to contact your employer to find out what the insurance company's portion of those payments were if they were not disclosed to you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paid Family Leave (PFL) Income in California

I have a follow up question on this.

How do I get to this screen? My box 16 number is different from Box 1 number in W2. It does not explicitly say in W2 is that the difference is due to PFL. But I confirmed with my employer that the difference is due to PFL. I also did not receive any 1099-G. Turbo tax does not adjust state wage based on Box 16 in W2 (Box 12 in form 540). Rather it starts with Federal wage (box 1 of W2). How do I adjust my state wage in Turbo tax if I did not receive 1099-G.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paid Family Leave (PFL) Income in California

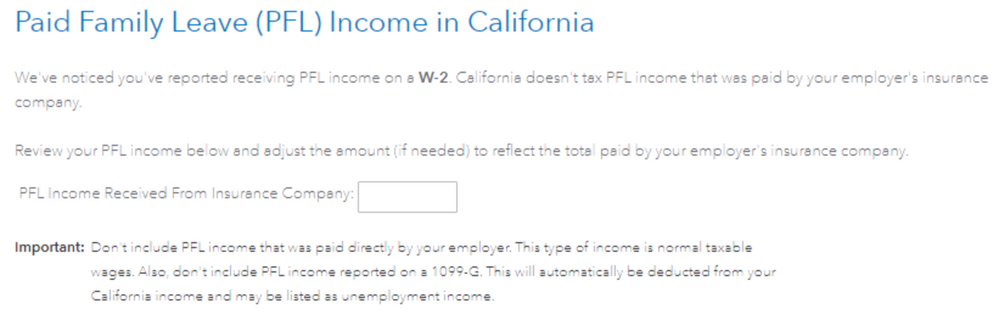

If you have entered your W2, go to the W2 summary screen and select edit.

- Continue past the first screen that displays the W2

- Scroll through the screens until you arrive at a screen that says Do any of these uncommon situations apply to this W-2?

- Here you will select the box that says Paid family leave - I earned all or part of this income as paid family leave.

- Now when you start preparing your California State return and navigate, there will be a question that says Paid Family Leave (PFL) Income in California

- Here is where you will make the adjustment reflecting the difference between your California and federal income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paid Family Leave (PFL) Income in California

I have a follow up question on this. I received a 1099-G form and entered it on my income section. When I got to the state PFL section there was an amount in the box but it is not what I received nor an amount on my 1009-G or my W2. Do I just leave it blank or do I input the amount that is on my 1099-G?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paid Family Leave (PFL) Income in California

On Form 1099-G, Box 1 shows the amount of paid family leave or unemployment compensation, and if there is any amount in other boxes, you should enter the amount reported on the form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paid Family Leave (PFL) Income in California

Similar to @at1421, I also have a 1099-G for PFL and the amount automatically copied over to the state return from federal did not match the amount I entered from the 1099-G. Is that a software glitch/error?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paid Family Leave (PFL) Income in California

@JLP____ the answer I got here wasn’t helpful but I found that where the mixup came was because when I initially was going through the questions and it asks if any other situation applies to you in the beginning, I checked the ‘paid family leave’ box as if the payments I received for PFL was from my employer. I’m not sure if that applies to you or not, but when i unchecked that box because my payments were not from my employer then everything matched up like it was supposed to. I already filed so I don’t have much more specific info than that. I hope it helps!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paid Family Leave (PFL) Income in California

If there was no paid family leave on the W-2 from your employer then the box should not be checked on the screen asking about 'Do any of these uncommon situations apply?'. This can create confusion when it's only the Form 1099-G that reports the paid family leave (PFL).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paid Family Leave (PFL) Income in California

I received a 1099G from the state as well as a W-2 from the employer's insurance provider. Which number should I enter into this field?

- Box 1 from 1099G

OR

- Box 1 from employers insurance provider W2 form???

I am assuming it's the latter but want to make sure.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paid Family Leave (PFL) Income in California

If it is the same payment (voluntary plan), either one will work- but be mindful to check if there was any withholding and make sure you indicate that it was PFL on the W2 so you do not get taxed for California state taxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Irasaco

Level 2

tye4444

New Member

Sea3_G

New Member

cabg

New Member

taxquestion222

Returning Member