- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

I have a follow up question on this.

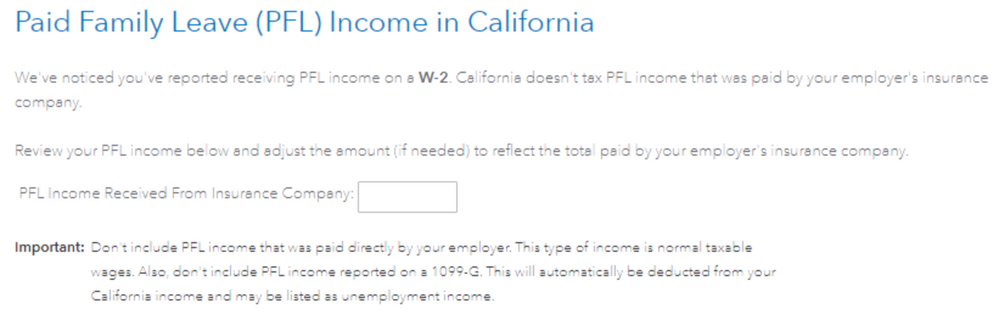

How do I get to this screen? My box 16 number is different from Box 1 number in W2. It does not explicitly say in W2 is that the difference is due to PFL. But I confirmed with my employer that the difference is due to PFL. I also did not receive any 1099-G. Turbo tax does not adjust state wage based on Box 16 in W2 (Box 12 in form 540). Rather it starts with Federal wage (box 1 of W2). How do I adjust my state wage in Turbo tax if I did not receive 1099-G.

April 9, 2020

10:33 AM