- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Pa state return -- military -can't get it to reconize that the military pay is non taxable

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pa state return -- military -can't get it to reconize that the military pay is non taxable

can't get the pa state return to recognize active duty pay is non taxable

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pa state return -- military -can't get it to reconize that the military pay is non taxable

You will need to review your input in a couple of areas to ensure your military pay is treated as nontaxable if you are active duty.

First review your input in the My info section of the program.

- Select Edit to the right of you name under the Personal Info summary page

- Under Occupation, there is a line that says I am a member of the U.S. Armed Forces. Be sure to answer Yes here.

- Next, go to the Income & Expenses section.

- Select edit to the right of Job (W-2).

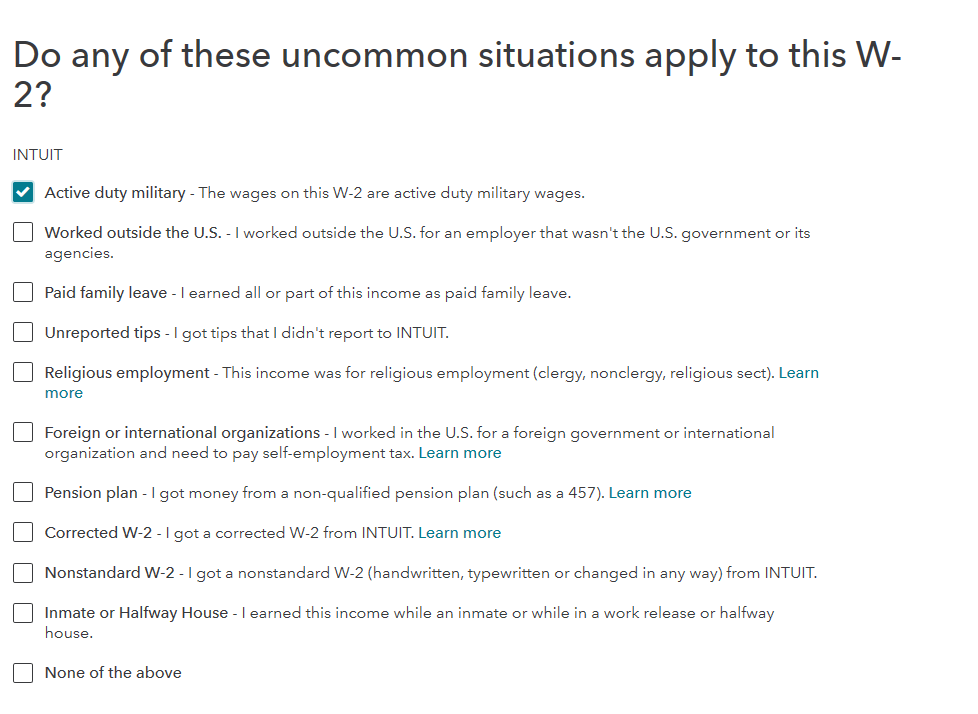

- Scroll through the input screens until you see the following screen:

Be sure to select that you are Active Duty Military.

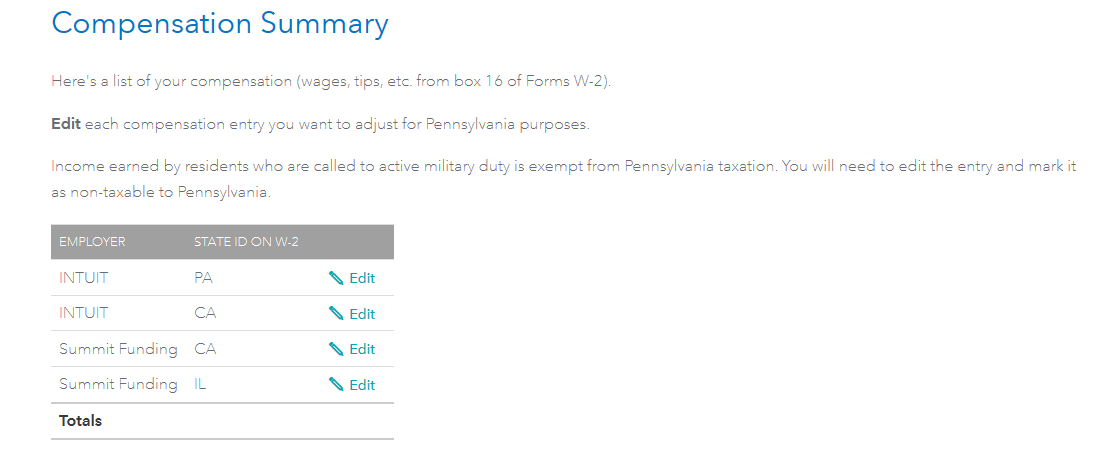

Now, go to your state interview section for PA. Under the Income and adjustments section, you will see a screen asking about your wage income as follows:

Select Edit to the right of the applicable W-2 as it would pertain to you.

The next screen will show you which if the income has been treated as taxable or not. Your active duty pay should show up!

If it does not, please comment again so we can help you determine why the income is being treated as taxable.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

demarius1211

New Member

user17525940873

New Member

drildrill23

Returning Member

smfwalker

Level 2

cpo695

Returning Member