- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: NY State taxes my Social Security, military retirement and investment income, all earned whil...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State taxes my Social Security, military retirement and investment income, all earned while a permanent resident in FL

I am a permanent resident in FL since December 2017. I own no property in NY, and have not maintained a residence in NY since 2018. I have not been in NY since 2018 except for 3 days in Feb 2019. I work remotely in NY (W-2 income) from my home in FL. In TurboTax, my NY return includes Social Security income for my wife and me, my military retirement income and our investment income, all earned exclusively in FL. The NY return calculates a "New York adjusted gross income" equal to about 3 times my total W-2 income in NY, adjusts out a standard deduction and declares that I have "New York taxable income" almost 3 times my total W-2 income in NY. The return calculates the fraction of my W-2 income divided by this phony "New York taxable income" and applies that fraction to a "base tax" taken from a table based on my "New York adjusted gross income." Am I doing something wrong? As a full-time non-resident, do I really have to pay NY income tax on income earned entirely outside of NY? Please help. Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State taxes my Social Security, military retirement and investment income, all earned while a permanent resident in FL

New York includes your total income to calculate your tax rate as awesome Tax Expert @MaryK1101 said.

You are then taxed on the New York income percentage of the total tax that a full-year resident would pay. That is shown on lines 44 to 46 of your New York tax return.

The larger question is why are still paying New York tax? If you are working fully remote from Florida, and have never been to NY since 2019, then your employer should not be withholding NY tax because you only have a “minimal connection” to New York.

Read the discussion by @kristinelbly, a former NY state auditor, in I work for a NY company, remotely from NC. I spent 1 day in 2017 on site, but my W-2 has full salary...

You can report $0 New York income and get your entire withholding back as a refund. New York may challenge your position. The decision is up to you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State taxes my Social Security, military retirement and investment income, all earned while a permanent resident in FL

@gseglinton NY doesn't tax that income,exactly, but you are seeing the refund drop as a result of the way in which NY apportions and calculates tax. New York uses all of your income when determning the rate of your tax. This means the more income you have, the higher tax rate you will pay on the portion of income that NY does tax. They also don't really apportion your income but, rather, they apportion the tax. They use all of your income to calculate tax, then they determine that, say, 10% of it is from NY sources and leave you responsible for that amount of the total tax.

Rather than re-allocating the income as "this is NY, this is no", they just charge you 10% of what the tax would be should the entire amount of your income be considered NY source. (This, of course, works instead at whatever percentage of income ends up being identified as NY income.)

When you are done, view the NY PDF forms and you'll be able to follow it a bit better.

Don't be afraid of NY, though. Pay what you're supposed, not more or less, keep good records and you'll be fine.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State taxes my Social Security, military retirement and investment income, all earned while a permanent resident in FL

As a nonresident, you only pay tax on New York source income, which includes earnings from work performed in New York State, and income from real property located in the state. To determine how much tax you owe, TurboTax computes a base tax as if you were a full-year resident, then determine the percentage of your income that is subject to New York State tax and the amount of tax apportioned to New York State.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State taxes my Social Security, military retirement and investment income, all earned while a permanent resident in FL

Thank you for your help. I must be doing something wrong. While awaiting brokerage 1099s, I completed everything else in TT Premium for federal and NY. My NY return showed a refund of about $450 due. When I entered my brokerage info, I could see the NY refund declining and tax due climbing. When I finished, NY had gone from about $450 refund due to now I owe NY another $310. I think my entry of brokerage info should not increase my NY state income tax. I have looked through the questions and answers and traced through all of the forms. I see no way to exclude my investment income from taxation by NY. I have been a legal resident of FL since 2017. I have not lived in NY since 2017. I work only remotely in NY with only W-2 income from NY sources and I have appropriate NY income tax withholding. My investment brokerage income has nothing to do with NY and should not be taxed in NY. Please tell me what I am doing wrong. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State taxes my Social Security, military retirement and investment income, all earned while a permanent resident in FL

it depends. First check to see if you are filing as a New York non-resident as some filers may overlook this when filing a return.

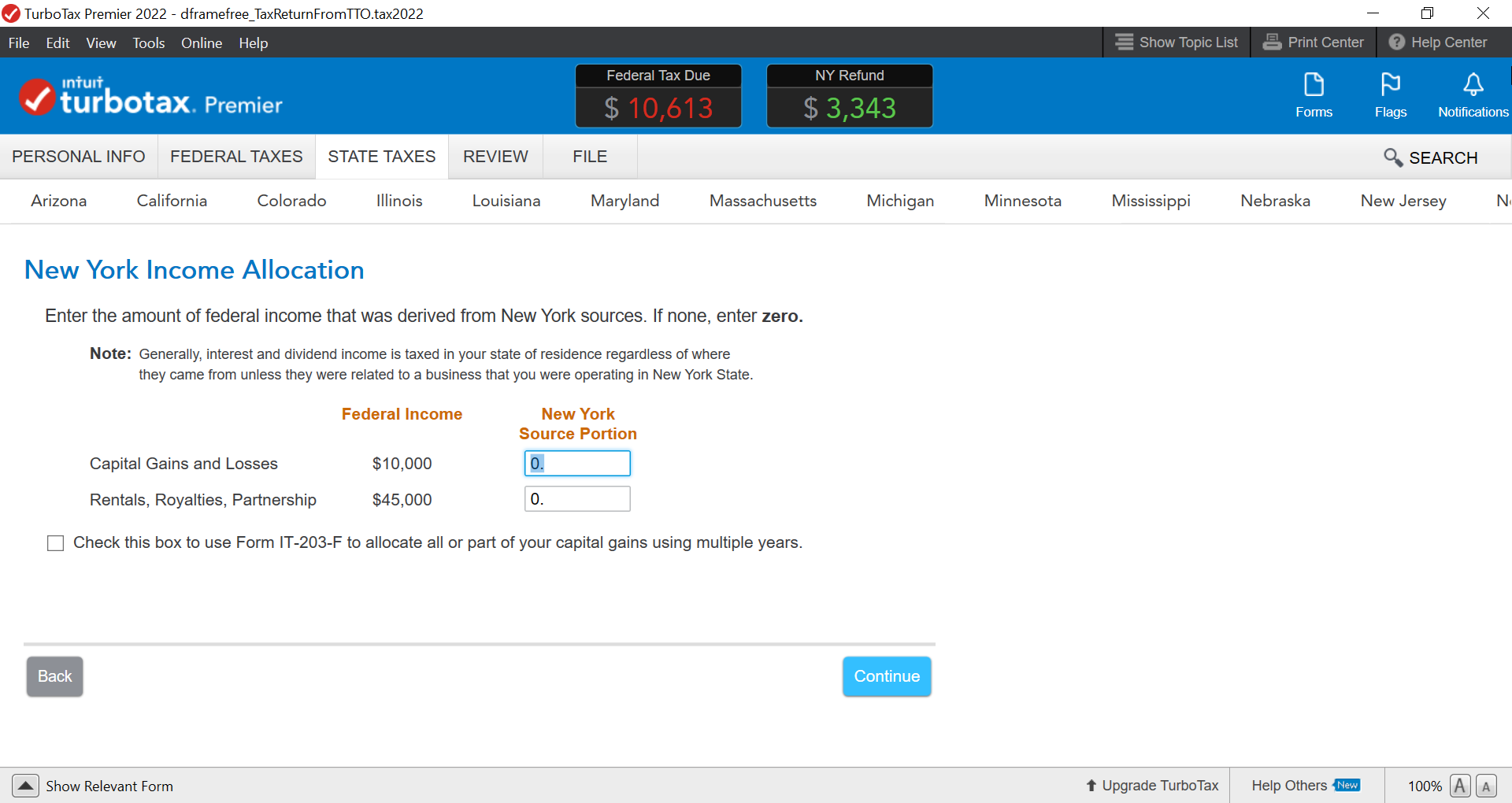

Also you may need to allocate your capital gains to 0 when you prepare your New York non-resident tax return. When you prepare your state tax return, you will need to allocate your income as either New York sourced-income or non-NY sourced income.

Here is an example of a New York income Allocation screen that addresses how to allocate a capital gains distribution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State taxes my Social Security, military retirement and investment income, all earned while a permanent resident in FL

Thank you. Yes, I am filing as non-resident. And yes, I have allocated 0 for interest, cap gains and dividends for NY allocation. Thank you for trying.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State taxes my Social Security, military retirement and investment income, all earned while a permanent resident in FL

New York includes your total income to calculate your tax rate as awesome Tax Expert @MaryK1101 said.

You are then taxed on the New York income percentage of the total tax that a full-year resident would pay. That is shown on lines 44 to 46 of your New York tax return.

The larger question is why are still paying New York tax? If you are working fully remote from Florida, and have never been to NY since 2019, then your employer should not be withholding NY tax because you only have a “minimal connection” to New York.

Read the discussion by @kristinelbly, a former NY state auditor, in I work for a NY company, remotely from NC. I spent 1 day in 2017 on site, but my W-2 has full salary...

You can report $0 New York income and get your entire withholding back as a refund. New York may challenge your position. The decision is up to you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State taxes my Social Security, military retirement and investment income, all earned while a permanent resident in FL

Thank you for your reply. In terms of why do I file in NY, TurboTax says I must. The other expert who used to be an agent for NY provides color for the legitimate concern I have about never provoking NY state taxing authorities. NY has agents tracking and investigating NY residents and former residents in FL. I never want to have NY think there is some reason to investigate me. I will pay more taxes than necessary to avoid provoking NY.

I do not understand how TurboTax is calculating my NY income tax. I decided to start another return and watch carefully at each step what happens to the federal and NY state refund windows at the top of the page. I started with a blank slate and entered only my W-2 income from my two NY employers. I work exclusively remotely from home in FL for two NY employers and have only W-2 income in NY. I started watching both federal and state refunds due.

I allocated capital gains and losses as 0 source for New York. I also entered 0 source allocation to NY every other place I found that option in the software. I chose no, I did not allocate income based on volume of business. Neither of these steps changed the NY refund. Nor did Non resident Business Allocation = “No” change it.

When I entered Ordinary Dividends for a brokerage account, my NY refund was cut in half. Why? That is NOT NY income. That is FL income. And Exempt-interest dividends increased NY tax further, while Specified private activity did not.

Entering my military retirement pay also increased my NY tax dramatically. Why? That is NOT NY income. That is FL income. I have entered 0 allocation to NY income in every question and answer format and in every Forms format where I can find an allocation answer.

On the other hand, entering our non-taxable IRA RMDs dramatically cut my NY income tax. Those are post-tax dollar IRAs with RMDs from post-tax dollars. That is FL income, NOT NY income. How does that decrease my NY tax?

Entering our Social Security income did NOT change NY refund. Entering a small 1099-INT from the IRS for last year’s overpayment DECREASED our NY refund by $2. Why? That is NOT NY income.

Mortgage interest on our FL home INCREASED our NY refund dramatically. Again, why? That has nothing to do with NY income.

Entering 1099-DIV from our other brokerage account DECREASED our NY refund by 1/3. Again, why? That’s FL income, NOT NY income.

Using the question and answer format, I entered our IRA totals from our Forms 5498 many times. Every time I started from the beginning and allowed TurboTax to guide me through all areas, just for review, so I could try to understand what was happening, when I got to the IRA totals, the identifications of the accounts remained, but the totals disappeared and were blank. I kept reentering the totals. When I changed over and started working through all the Forms, looking for gaps, there were the empty fields for our IRA holdings on 12/31/2022 again. Finally, filling the totals on the forms, the totals stuck. Unfortunately, entering our IRA totals wiped out all of our NY refund and increased our NY income taxes by more than $2,000. Why? I entered no income – just the totals in our IRAs. That’s not income. That’s just static amounts in our IRAs. How does TurboTax assign NY State income tax to our IRA total holdings – not our RMDs – just our holdings. That’s not income. Why does TT think our holdings should be taxed as income?

So, I am not getting closer to understanding what TT is doing to me this year. I have used TT Home and Business for years and I have never seen this odd behavior. Because I have no independent contractor income for 2022, as I have had in the past, I used TT Premier this year. Is that the difference? Must I use Home and Business again to have it make sense?

Is there a TT service to have a consultant follow through my returns with me to figure out what I am doing wrong? I used the online version one year and regretted it. In all other years I have used the download version.

Thank you for your replies.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State taxes my Social Security, military retirement and investment income, all earned while a permanent resident in FL

@gseglinton NY doesn't tax that income,exactly, but you are seeing the refund drop as a result of the way in which NY apportions and calculates tax. New York uses all of your income when determning the rate of your tax. This means the more income you have, the higher tax rate you will pay on the portion of income that NY does tax. They also don't really apportion your income but, rather, they apportion the tax. They use all of your income to calculate tax, then they determine that, say, 10% of it is from NY sources and leave you responsible for that amount of the total tax.

Rather than re-allocating the income as "this is NY, this is no", they just charge you 10% of what the tax would be should the entire amount of your income be considered NY source. (This, of course, works instead at whatever percentage of income ends up being identified as NY income.)

When you are done, view the NY PDF forms and you'll be able to follow it a bit better.

Don't be afraid of NY, though. Pay what you're supposed, not more or less, keep good records and you'll be fine.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State taxes my Social Security, military retirement and investment income, all earned while a permanent resident in FL

Thank you and thank you to others who have replied. Nearing the end of the process, my total income in 2022 is similar to the total in 2021. It is apportioned in different categories of income a little differently, but the total is similar, and the tax obligations for federal and NY are similar. Of course NY has a special mechanism to get more out of me and other non-resident NY workers than just taxing our NY sourced income. Someday I will be retired and no longer responsible for NY income taxes. But for now, paying income taxes is better than having no income. Thank you again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State taxes my Social Security, military retirement and investment income, all earned while a permanent resident in FL

This explanantion cannot be correct.

If I earned NY State income of say $10,000 working remotely living in another State. And I win $1,000,000 in a lottery... TT will list $1,010,000 as my total income. It will then calculate the tax from the Total Income at a much higher tax rate and then apportion 1% 10,000/1,010,000.

That would result in a tax bill of about $600 instead of $65 (after Standard Deduction).

This cannot be correct.

There has to be a way to apportion the Federal Income amount to only include actual NY State income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State taxes my Social Security, military retirement and investment income, all earned while a permanent resident in FL

Your example is correct. New York first taxes 100% of your total income. Then, they divide your New York income by your total income to arrive at the percentage of the tax to be allocated to New York. So, in your example your New York state tax on one million dollars would be about $67,000 times 1% which would equal about $667.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

hkim872

New Member

MichaelEgan007

Returning Member

ronequettetax

New Member

BenedictaIris

New Member

MichaelEgan007

Returning Member