- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Non-resident of NY with non NY sourced incomes seem to be double taxed with turbotax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Non-resident of NY with non NY sourced incomes seem to be double taxed with turbotax

I live in PA and work in NY, thus i have wage income that is taxed by NY as it is NY sourced,

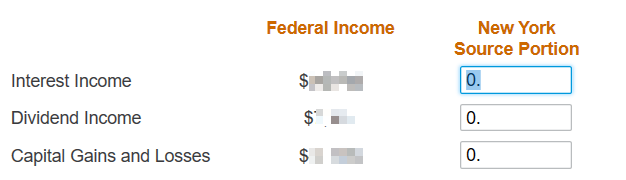

I have other interest and capital gain incomes that is not NY source, so when i file with Turbotax, I input something like below:

If i understand correctly, all these incomes should not be in the NY adjusted gross income (AGI), as i am a nonresident of NY and they are not NY sourced. Assume i have wage income of 100k, and above incomes of 30k, then my federnal AGI should be 130k, and NY AGI should be 100k.

However I found it is not the case for Turbotax, my final IT-203 output from turbotax shows that my NY AGI is equal to federnal AGI, and i am taxed by both NY and PA for my other 30K incomes...

in my IT203,

- line 19, it says my federal amount 130k, ny state amount 100k

- line 31, it also says my federal amount 130k, ny state amount 100k

- line 32, for NY AGI, it ask me to copy federal amount to it (which suprise me the most)

- lint 36, NY taxable income is the federnal amount minus the standard deduction, but not the non-NY sourced incomes...

Is that expected? it has been like this for the past 4 years using turbotax, and i just found that, if this is not expected, then i have loss thousands of dollars....

Need help here 😥

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Non-resident of NY with non NY sourced incomes seem to be double taxed with turbotax

You are not being double taxed. TurboTax is doing the calculations as required by the New York forms and instructions. You didn't look far enough down on Form IT-203.

The way New York calculates the tax is complicated, confusing, and hard to follow. It first calculates tax on your entire federal income (after New York adjustments). But then it applies an "income percentage" that is your New York income as a percentage of your total income. That's how it adjusts the tax based on how much of your income is taxable by New York.

In spite of the wording, the "New York taxable income" on line 36 and 37 of Form IT-203 is not the amount of income that you are actually paying New York tax on.

Lines 38 through 44 calculate what the tax would be if you paid tax on the full "New York taxable income." Line 45 uses the federal and New York amounts from line 31 to calculate your New York income as a percentage of your federal income, called the "income percentage." The hypothetical tax on line 44 (the form calls it "base tax") is then multiplied by that percentage to determine the actual "allocated" tax on line 46.

Again, TurboTax is not choosing to calculate the New York tax this way. This is how New York requires it to be done. All tax software has to do it the same way.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

josht777

New Member

jangsarah11

New Member

Micky2025

New Member

sonia-yu

New Member

thisblows

Returning Member