- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Non-resident of NY with non NY sourced incomes seem to be double taxed with turbotax

I live in PA and work in NY, thus i have wage income that is taxed by NY as it is NY sourced,

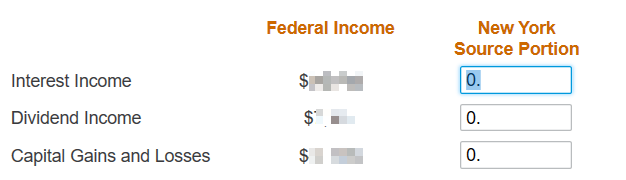

I have other interest and capital gain incomes that is not NY source, so when i file with Turbotax, I input something like below:

If i understand correctly, all these incomes should not be in the NY adjusted gross income (AGI), as i am a nonresident of NY and they are not NY sourced. Assume i have wage income of 100k, and above incomes of 30k, then my federnal AGI should be 130k, and NY AGI should be 100k.

However I found it is not the case for Turbotax, my final IT-203 output from turbotax shows that my NY AGI is equal to federnal AGI, and i am taxed by both NY and PA for my other 30K incomes...

in my IT203,

- line 19, it says my federal amount 130k, ny state amount 100k

- line 31, it also says my federal amount 130k, ny state amount 100k

- line 32, for NY AGI, it ask me to copy federal amount to it (which suprise me the most)

- lint 36, NY taxable income is the federnal amount minus the standard deduction, but not the non-NY sourced incomes...

Is that expected? it has been like this for the past 4 years using turbotax, and i just found that, if this is not expected, then i have loss thousands of dollars....

Need help here 😥