- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Moving from CA to WA and working remotely - tax implications

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moving from CA to WA and working remotely - tax implications

I currently live and work in CA but because of Covid, I can work remotely from a different state until next Summer(My employer mentioned they will still keep the permanent work location as CA because benefits are located to primary work location). So, I'm planning to move to WA for a year to be close to family.

So, if I move to WA and work remotely from there do I need to pay CA taxes for rest of the year even though I did not live in CA or do I need to pay taxes only for the time I lived and worked in CA?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moving from CA to WA and working remotely - tax implications

First, you want to establish what your domicile is. Your domicile is the place of your permanent residence, that is, the place you will return to when your sojourn to another state or country is finished. Domicile is more than just where you are sleeping.

Once you establish your domicile, it does not change unless you take positive steps to move your domicile elsewhere.

In your case, it seems that you are a California resident who is temporarily working out of state. That is, some or all of the following is true: your property where you live is in California, your home phone number (if a land line) is in California, your driver's license is in California, your voter's registration is in California, and so on.

And when the Covid-19 situation ends, you intend to return to California all the while working for the same company.

The question of residency is important, because if you are a resident of California, you owe tax on all income earned from any state or country, no matter where you are working or sleeping at the time.

Please see the following on page 4 of CA Pub 1031:

"A resident is any individual who meets any of the following:

- Present in California for other than a temporary or transitory purpose.

- Domiciled in California, but outside California for a temporary or transitory purpose. See Section L, Meaning of Domicile."

Note that CA Pub 1031 does describe on page 4 a "safe harbor" in which employees who are out of state for more than 546 days (about 18 months) can claim to be nonresidents. But it is not clear to me that this would apply to you. In the first case, you don't plan to be out of state for that long, and in the second case, I do not think that your sojourn in Washington is due to a clause in your employment contract (please correct me if I am wrong) but due to the willingness of the company to let you work remotely from out of state (i.e., they did not tell you where to live as a condition of your employment).

Based on what I see so far, you appear to be domiciled in California, have done nothing to change that domicile, and therefore must file as a resident of California, which means that you are taxed "...on ALL income,

including income from sources outside California." (page 6 of CA Pub 1031).

So, to answer your question, based on what I see so far, you will be liable to pay CA tax on all of your CA income, even that earned while out of state, until such point as you take positive steps to change your domicile to another state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moving from CA to WA and working remotely - tax implications

If you literally move to Washington and make it your new main, permanent home (your domicile in tax terminology), then your W-2 income from remote work carried out in Washington is not taxable by California.

Once you become a non-resident of CA, CA can tax you only on CA-source income. Remote work carried out outside CA is not CA-source income. Work is sourced where the work is actually performed.

You can find CA's detailed rules for determining your residency status in this web reference:

https://www.ftb.ca.gov/forms/2019/2019-1031-publication.pdf

But if you work as an independent contractor (your income is reported on a 1099-MISC instead of a W-2), and you provide contract services to a business located in CA, that income would be considered taxable by CA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moving from CA to WA and working remotely - tax implications

Thanks a ton for the detailed response.

If I move to WA, get new license, apartment etc in WA with no apartment/house/drivers license etc in CA wouldn't I be considered to be domiciled in WA? and I would have no presence in CA other than that my employer has CA as my primary work location even though I am working remotely.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moving from CA to WA and working remotely - tax implications

If you move to WA, "abandon" your home in CA, and establish your new permanent home in WA, then yes, your domicile would become WA.

Your domicile would change to WA on the day you begin living in your new permanent home in WA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moving from CA to WA and working remotely - tax implications

"If I move to WA, get new license, apartment etc in WA with no apartment/house/drivers license etc in CA wouldn't I be considered to be domiciled in WA?"

Tom is of course correct that a change of domicile would make you a nonresident of California. Note, however, that unless you move at midnight between December 31st and January 1st, you would need to file a part-year return for California for that part of the year in which you were living there.

Tom is also correct about this unique feature of California law that if you are a business (like a sole proprietorship, which a contractor is), then income generated from California clients is California source income and therefore taxable to California, even if you did the work elsewhere. This is different from most states who tax you where you work, not where your clients are.

So you will need to have a discussion with your employer about whether your relocation to Washington can be a permanent thing or not (or get a job in Washington).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moving from CA to WA and working remotely - tax implications

For others reading this, the answer will be the same, no matter which states are involved EXCEPT if you are moving from New York, Pennsylvania, Nebraska, Delaware or New Jersey.

For guidance see: http://www.journalofaccountancy.com/issues/2009/jun/20091371.html

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moving from CA to WA and working remotely - tax implications

May I ask how about from reverse state situation: Work and live in WA for years, just come to CA for Covid and live with relatives while working remotely, will return in less than 5 months. Need to file CA state tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moving from CA to WA and working remotely - tax implications

@mach001 -- Yes, you'll need to file a non-resident CA tax return. Work actually performed in CA (including remote work done for an out-of-state employer) is considered CA-source income, and is subject to taxation by the State of California - regardless of whether or not the taxpayer is a CA resident.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moving from CA to WA and working remotely - tax implications

Great thread! I'm in the same situation as OP, except multiple CPAs have not been as confident that it will be so straightforward for me to reclaim CA state taxes back from the part of the year we moved domicile from CA to WA.

Some background:

- I relocated myself and my family from CA to WA in mid-August 2020.

- My husband and I registered to vote in WA, registered our car in WA, got WA drivers licenses

- We removed the renters from the home I owned all along in WA and we moved into that home.

- We ended our apartment lease in CA. We have no family or property ties to CA.

- My employer is based in CA and continues to take CA taxes out of every paycheck.

- My employer permitted employees to relocate during Covid, but did not permit employees to update their home address in our HR system for taxation purposes, citing that any relocation should be considered temporary.

- However, I'm not expected to go back to the CA office until September 2021, and this can be extended.

- My husband and I never intended to go back to CA, despite what my employer says about relocations being temporary.

Consequently, per the 2020 California FTB 1031 Publication (https://www.ftb.ca.gov/forms/2020/2020-1031-publication.pdf) we appear to meet the CA FTB definition of having changed our domicile due to:

• Abandonment of prior domicile

• Physically moving to and residing in the new locality

• Intent to remain in the new locality permanently or indefinitely as demonstrated by our actions

Per the same publication, it appears we would be a "part-year resident" of CA for 2020 tax purposes (i.e. California residents from January 2020 - first half of August 2020, and nonresidents from second half of August 2020 to December 2020).

The publication mentions that "only income from California sources is taxable by California." It goes on to state:

"Wages and salaries have a source where the services are performed. Neither the location of the employer, where the payment is issued, nor your location when you receive payment affect the source of this income."

From the above information, and the exchange within this thread, it seems clear that we should expect to receive a refund for the taxes we paid to California while living and working from our WA home.

**However, multiple CPAs have noted to us that since my employer has been reporting that I've been paying CA taxes the entire year since my employer claims I am based in CA (even though that's not entirely true since the services I performed were from my home in WA for part of the year - and to this day we are still WFH in WA) - the state of California will be expecting taxes paid commensurate with this income for the full year. So, when we go to claim those taxes back, there's going to be a large discrepancy between what my employer reported and what we claimed.

The CPAs said this would surely trigger interest from the FTB, and we should expect this to drag out in an exchange of letters from the FTB asking for more information, possibly resulting in an audit.

The CPAs said we are within our right to reclaim the portion of CA taxes back since the time we left CA, but they seemed very hesitant to encourage this, and warned that we'd be up against my large and powerful employer here. They said we should get my employer to adjust my W2 to reflect when we moved to WA. My employer has stated in a company-wide FAQ that they will refuse to adjust W2s for any employees due to moves such as ours.

My questions:

1) I get that having my employer adjust my W2 to reflect that I now reside in WA, and convincing my employer to allow me to update my home address in our HR system which is used for taxation purposes would be ideal, however, is this absolutely necessary or is it more of a "nice to have?"

2) I don't see anything about an employer having any say in this matter with regard to me reclaiming back a portion of my taxes, so I'm not sure what I am missing which makes some CPAs hesitant when I mention reclaiming a portion of the CA taxes paid. Anything I overlooked?

3) What happens from the perspective of my employer? Will they know I filed trying to reclaim some of the CA taxes paid? Does it affect the CA taxes they paid?

Any and all advice is much, much appreciated!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moving from CA to WA and working remotely - tax implications

@mamabear80 You are correct. When you abandoned your domicile in CA and established your new domicile in WA, you became a part-year resident of CA for that year.

As a part-year resident, your income during your period of CA residency is fully taxable by CA. Your W-2 income after you established your domicile in WA is taxable by CA only to the extent that you earned it by physically working in CA. Your W-2 earnings from work physically performed outside CA are not CA-source income and are not taxable by CA.

It is true that there will be a discrepancy between your CA tax return and your W-2, which may cause CA to question your return. Some taxpayers in your position choose to print and mail their state return, attaching a letter of explanation. Or you could just submit your return and wait to see if it's questioned.

Your situation is not all that unusual. Many employers are slow to update their employee's state withholding after a move. I've seen numerous questions like yours on the TurboTax forum. But the W-2 wages of a CA non-resident working entirely outside the state of CA are not subject to CA withholding nor to CA income taxation.

CA Publication 1031, which you cited, is the correct source of CA's rules on your situation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moving from CA to WA and working remotely - tax implications

Thank you Tom, this gives me some peace of mind!

What might make my situation a little unusual is that my employer is refusing to update employees' state withholding to reflect the state those employees moved to outside CA. My employer says that these moves were intended to be temporary, and is likely expecting most employees to return to CA.

There is a chance that I will be allowed to transfer to a WA-based office of my current employer after September 2021, but that's not a guarantee from my employer's perspective.

If my employer insists that the moves are temporary, but my wife and I truly have no intention of going back to CA, whether I stay with this employer or not, does that change anything?

My concern is that when we go to file our 2021 taxes (in 2022) we'll be doing the same thing all over again, attempting to reclaim the portion of CA taxes that are still being taken out of our paychecks to this day.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moving from CA to WA and working remotely - tax implications

"If my employer insists that the moves are temporary, but my wife and I truly have no intention of going back to CA, whether I stay with this employer or not, does that change anything?"

No. Regardless of your employer's stance, CA tax law as described in CA Publication 1031 prevails. Once you have changed your domicile as described on page 10 of Pub 1031, for tax purposes you are no longer a CA resident.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moving from CA to WA and working remotely - tax implications

Thank you Tom, you are extremely helpful! 😊

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moving from CA to WA and working remotely - tax implications

Hello TomD8 (or anyone else who wants to weigh in),

I'm kind of in a similar situation where I abandoned my domicile in CA and established a new domicile in AZ while working remotely for the CA employer for one month, but my employer continued to withhold taxes only for CA and not for AZ, and also refused to correct the W2.

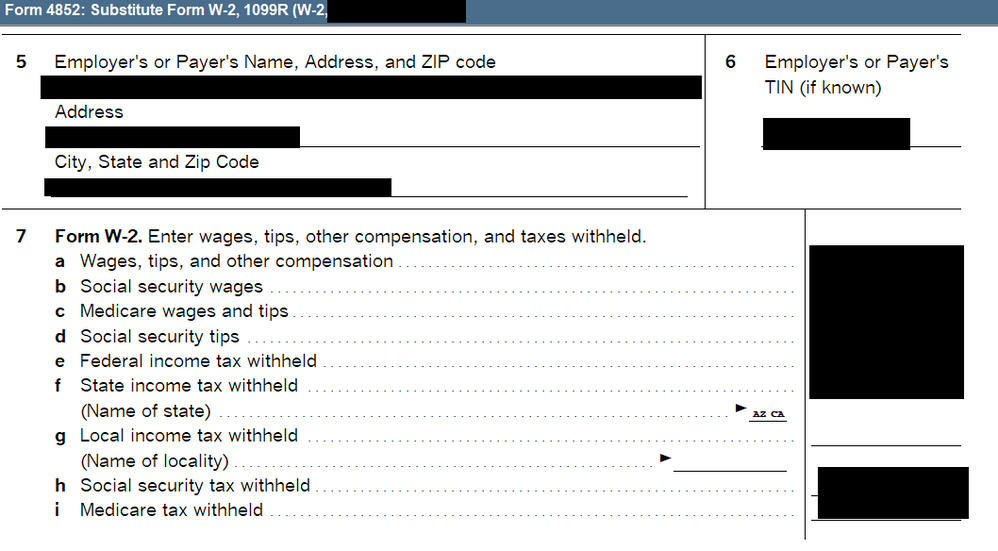

It seems clear based on my own research and what you've said that the last month's taxes are due to AZ and not due to CA, but I'm curious mechanically what the form 4852 (substitute for W2) should look like when I submit my tax returns because my experience has mostly been auditing.

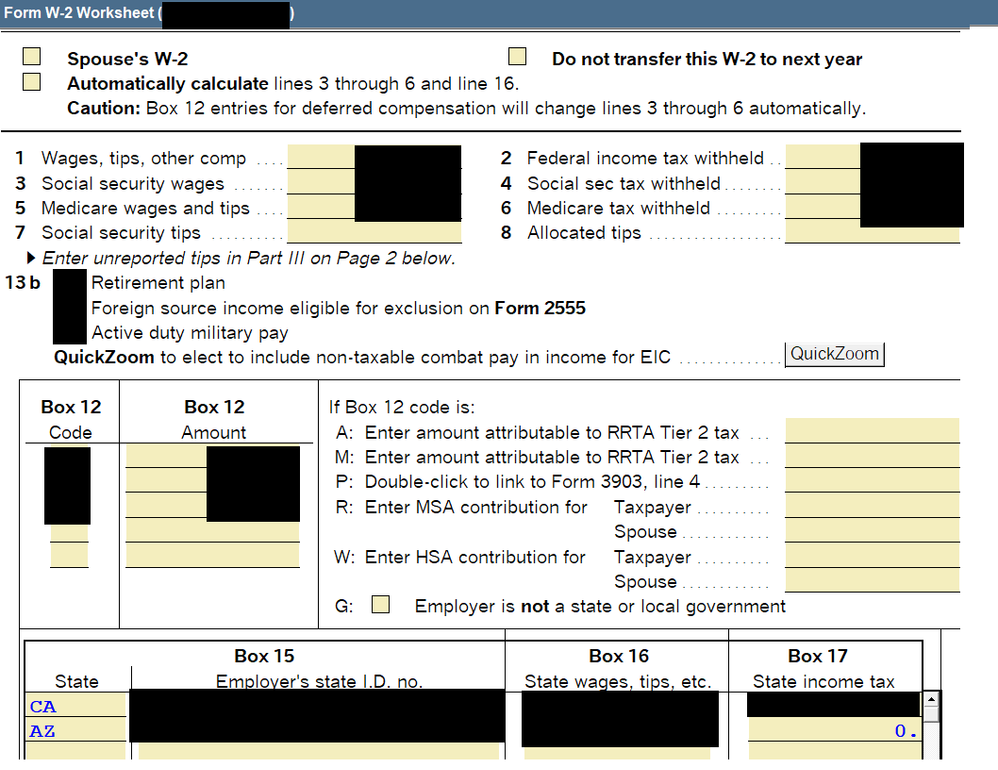

I'm using Intuit Pro Series and input the form W-2 indicating what my AZ and CA wages should have been (but weren't correctly allocated by my employer on the actual W-2) as seen below (redacting my personal information):

Pro series generated the form 4852 with identical numbers to the W2 but only put in AZ CA for the name of the state under state income tax withheld (which is identical in amount to the uncorrected W2).

Is this the appropriate way to fill out a form 4852 in this situation?

Thank you.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

IndependentContractor

New Member

tami_454

New Member

shikhiss13

Level 1

evilnachos123

New Member

Megnrust

New Member