- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

Hello TomD8 (or anyone else who wants to weigh in),

I'm kind of in a similar situation where I abandoned my domicile in CA and established a new domicile in AZ while working remotely for the CA employer for one month, but my employer continued to withhold taxes only for CA and not for AZ, and also refused to correct the W2.

It seems clear based on my own research and what you've said that the last month's taxes are due to AZ and not due to CA, but I'm curious mechanically what the form 4852 (substitute for W2) should look like when I submit my tax returns because my experience has mostly been auditing.

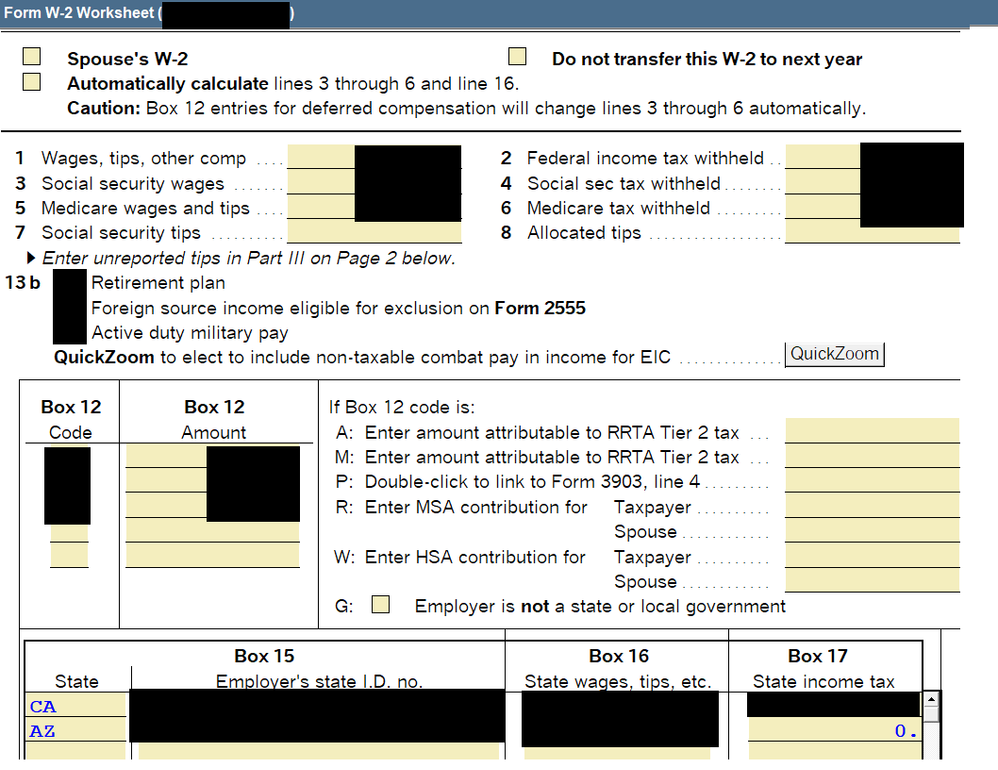

I'm using Intuit Pro Series and input the form W-2 indicating what my AZ and CA wages should have been (but weren't correctly allocated by my employer on the actual W-2) as seen below (redacting my personal information):

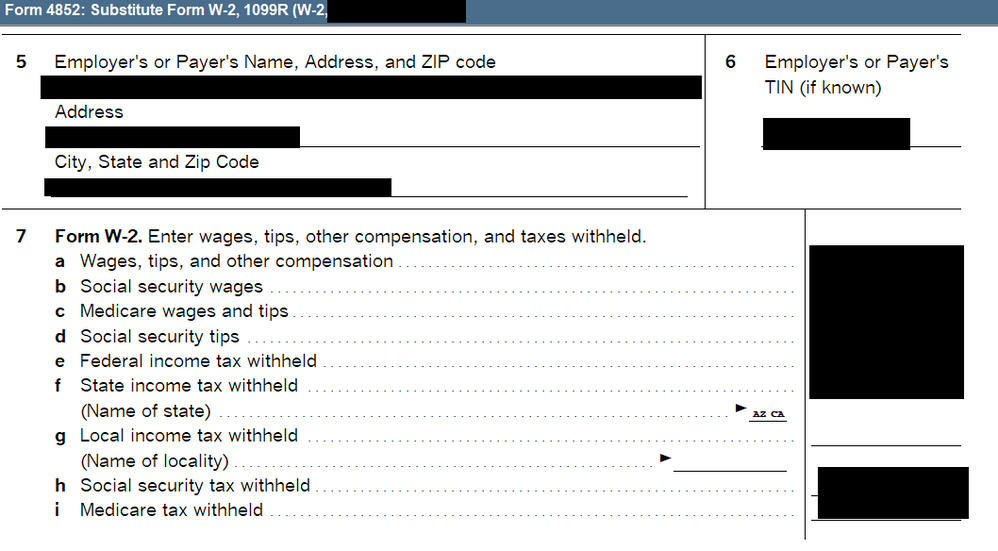

Pro series generated the form 4852 with identical numbers to the W2 but only put in AZ CA for the name of the state under state income tax withheld (which is identical in amount to the uncorrected W2).

Is this the appropriate way to fill out a form 4852 in this situation?

Thank you.