in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: If I itemize deductions on Federal tax returns, is it possible to use standard deduction on m...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I itemize deductions on Federal tax returns, is it possible to use standard deduction on my state tax returns ? Married filing separate from Maryland.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I itemize deductions on Federal tax returns, is it possible to use standard deduction on my state tax returns ? Married filing separate from Maryland.

Yes, you can choose to use the Standard Deduction in Maryland even if you itemized on the federal return.

See

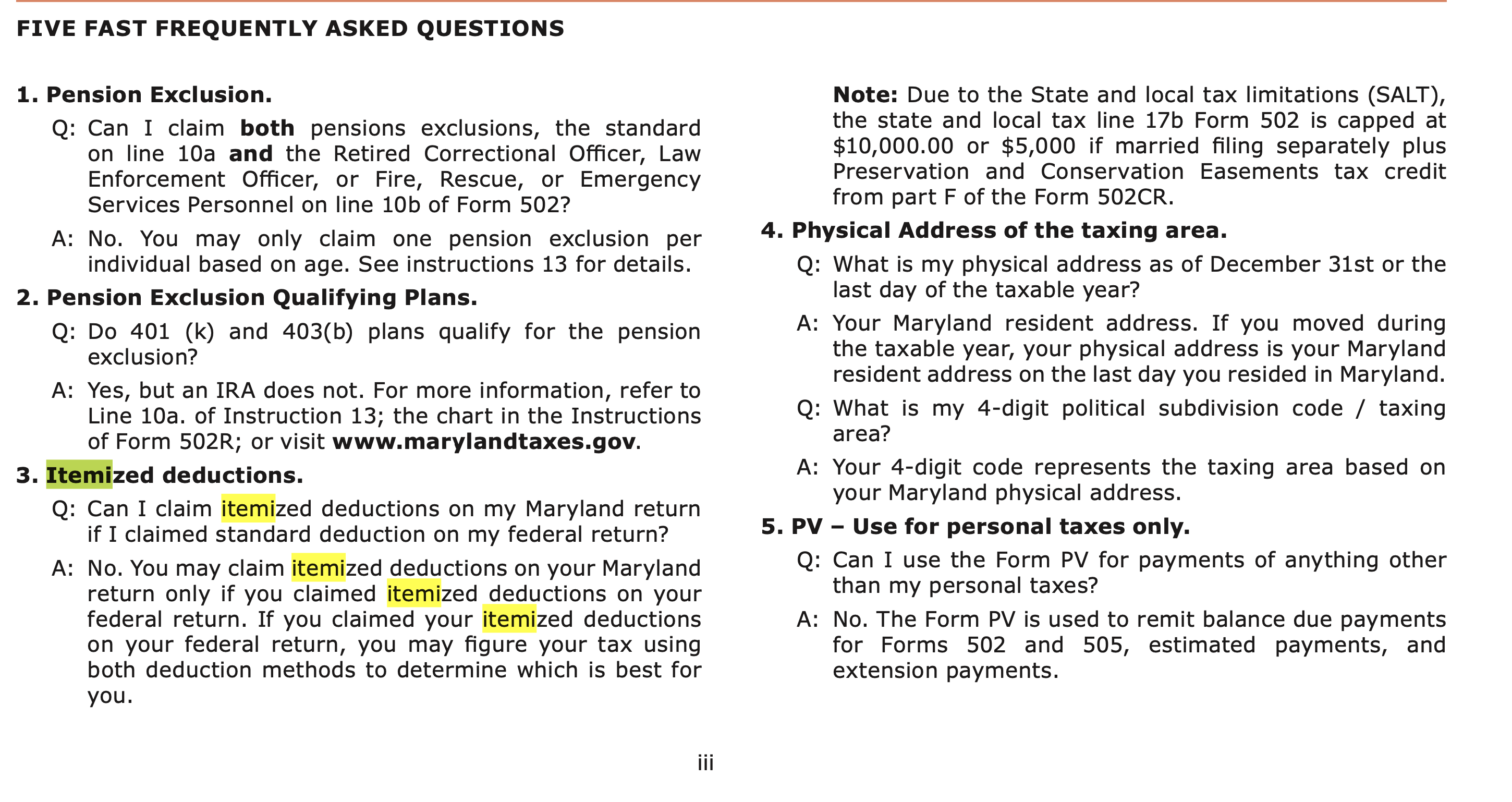

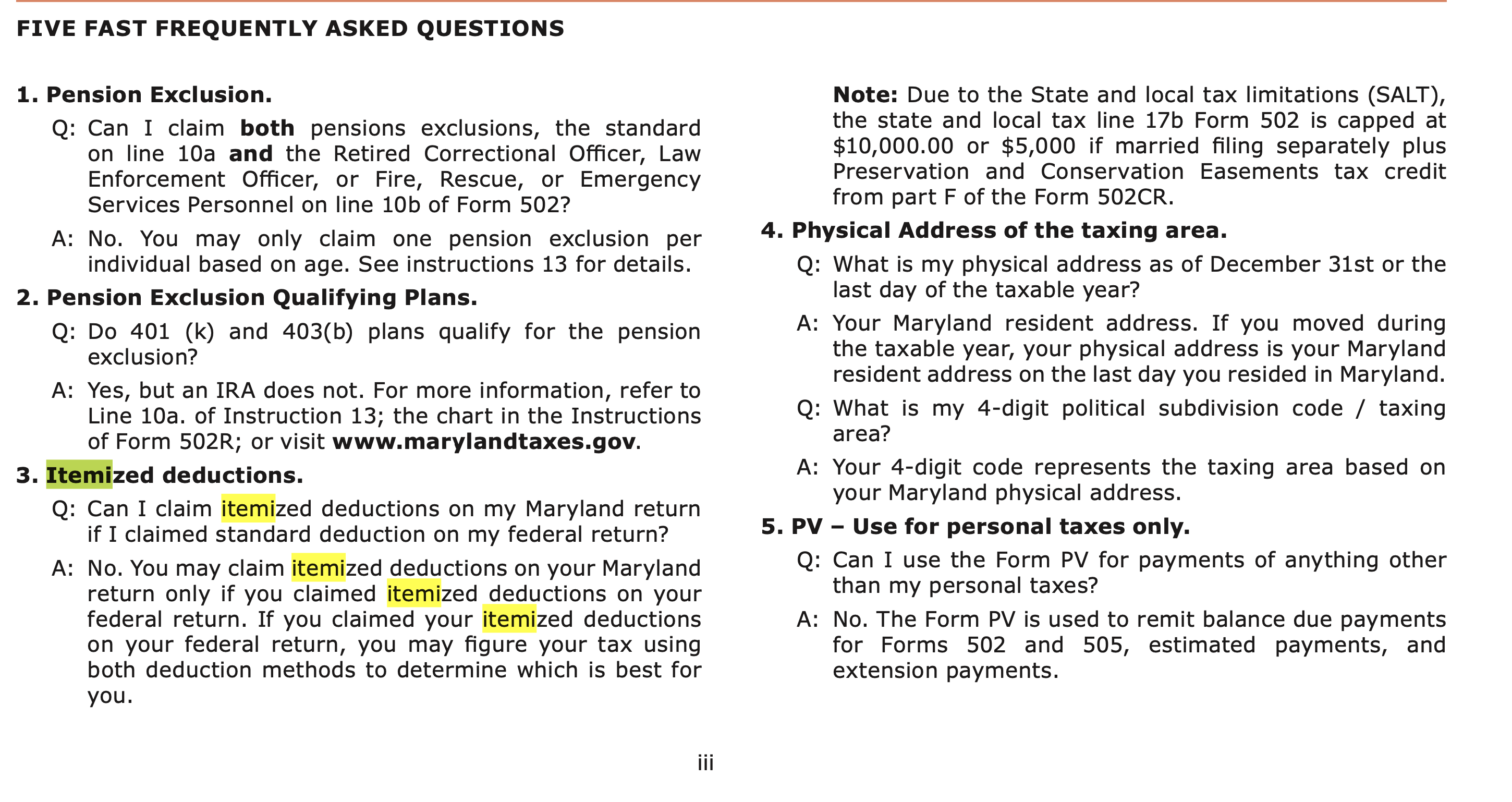

"2. Itemized deductions.

Q: Can I claim itemized deductions on my Maryland return if I claimed standard deduction on my federal return?

A: No. You may claim itemized deductions on your Maryland return only if you claimed itemized deductions on your federal return. If you claimed your itemized deductions on your federal return, you may figure your tax using both deductions methods to determine which is best for you."

See page iii in Maryland 2019 Tax Booklet.

But you must read "8 SPECIAL INSTRUCTIONS FOR MARRIED PERSONS FILING SEPARATELY" on page 4 of the same link, because this describes special rules for taxpayers filing married separate.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I itemize deductions on Federal tax returns, is it possible to use standard deduction on my state tax returns ? Married filing separate from Maryland.

Maryland requires taxpayers to use the same method of calculating deductions on their state returns as they do on their federal returns - standard deduction or itemized deductions (see Item 3 on the screen shot below)

TurboTax will allow you to file a federal return (using standard deduction) and a state return (using itemized deductions). It requires a desk version (CD/Download) of the TurboTax program. You have to prepare two returns with the same income information but with different deduction options.

From the Maryland 2020 State and Local Tax Forms and Instructions:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I itemize deductions on Federal tax returns, is it possible to use standard deduction on my state tax returns ? Married filing separate from Maryland.

Yes, you can choose to use the Standard Deduction in Maryland even if you itemized on the federal return.

See

"2. Itemized deductions.

Q: Can I claim itemized deductions on my Maryland return if I claimed standard deduction on my federal return?

A: No. You may claim itemized deductions on your Maryland return only if you claimed itemized deductions on your federal return. If you claimed your itemized deductions on your federal return, you may figure your tax using both deductions methods to determine which is best for you."

See page iii in Maryland 2019 Tax Booklet.

But you must read "8 SPECIAL INSTRUCTIONS FOR MARRIED PERSONS FILING SEPARATELY" on page 4 of the same link, because this describes special rules for taxpayers filing married separate.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I itemize deductions on Federal tax returns, is it possible to use standard deduction on my state tax returns ? Married filing separate from Maryland.

It is my understanding that for tax year 2020, Maryland will allow you to use itemized deductions even though you you used standard deductions for federal return. Turbo tax does not offer this option to the best of my knowledge.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I itemize deductions on Federal tax returns, is it possible to use standard deduction on my state tax returns ? Married filing separate from Maryland.

Maryland requires taxpayers to use the same method of calculating deductions on their state returns as they do on their federal returns - standard deduction or itemized deductions (see Item 3 on the screen shot below)

TurboTax will allow you to file a federal return (using standard deduction) and a state return (using itemized deductions). It requires a desk version (CD/Download) of the TurboTax program. You have to prepare two returns with the same income information but with different deduction options.

From the Maryland 2020 State and Local Tax Forms and Instructions:

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17544847578

Level 1

margmato

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

Dnmck1

Returning Member

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

juva

Level 2

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

Agwoods11

New Member

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill