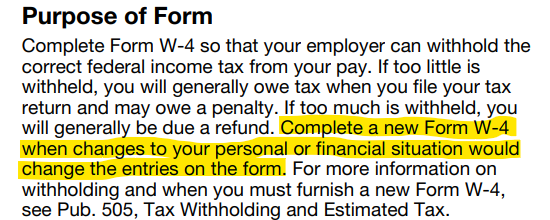

The instructions to Form W-4 state that you should complete it when changes to your personal or financial situation would change the entries on the form. Since your address and name have changed and they are listed on the form, technically you are required to complete a new form. Instructions to Form W-4

From the instructions to form W-4:

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"