- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Depreciation Allocation Federal K-1 versus Pennsylvania RK-1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation Allocation Federal K-1 versus Pennsylvania RK-1

Hello,

I am an executor filing a "final" return for a decedent's estate. All distributions have been made, which includes taxable income from a rental property. All depreciation has been distributed to the beneficiaries and is properly listed in box 9 of Federal K-1. TurboTax automatically reduced the Estate's portion of depreciation to zero. No issues so far.

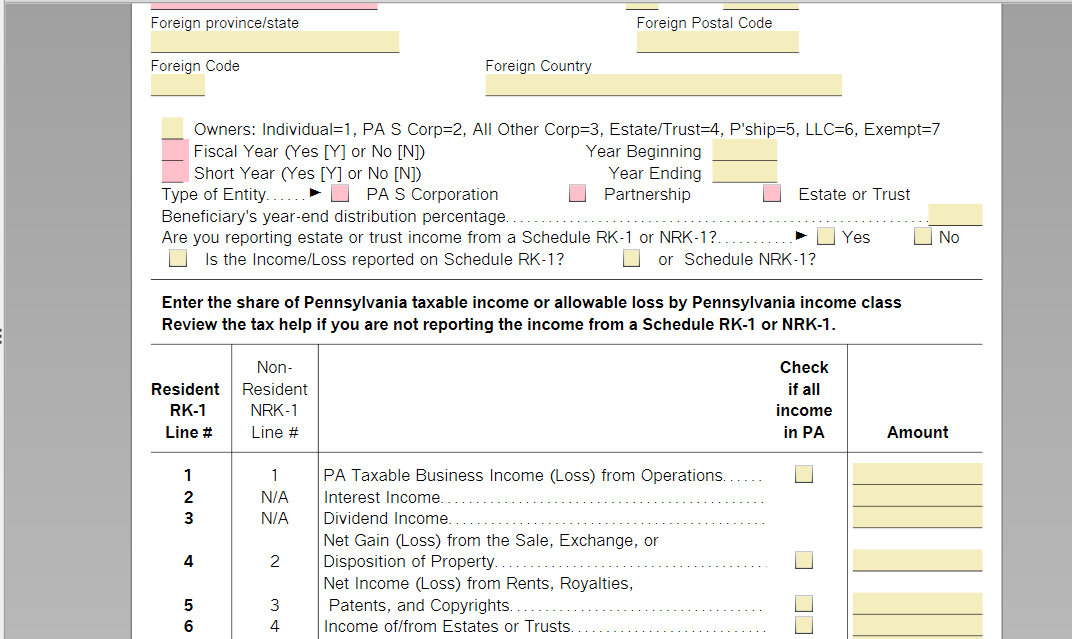

The problem? The Pennsylvania RK-1 transfers rental income values from the Estate (1041) return. How do I get the depreciation deducted off the value in box 6 of the RK-1?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation Allocation Federal K-1 versus Pennsylvania RK-1

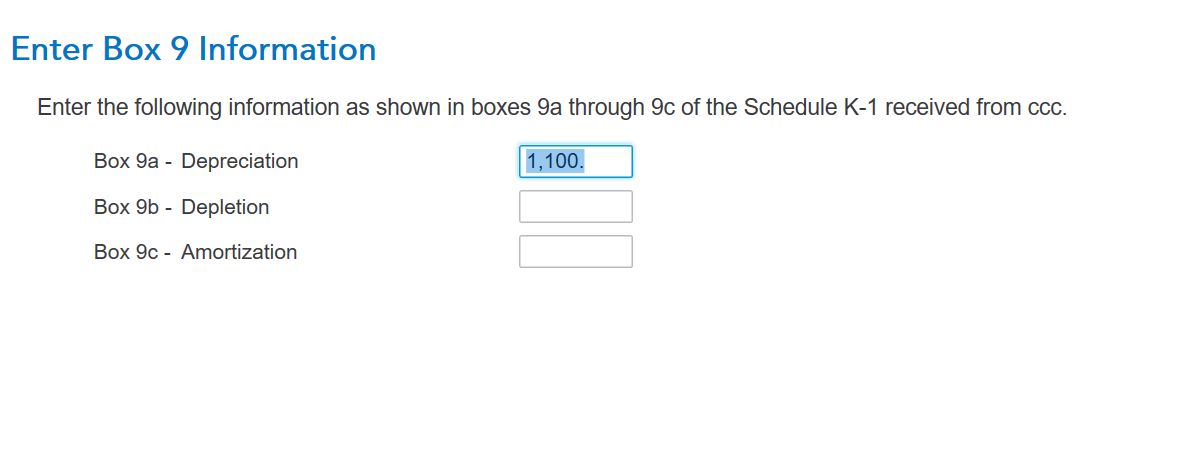

I just did it on my end and it went through. See

but not here Rk-1 line 6

It's off on my end seamlessly.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation Allocation Federal K-1 versus Pennsylvania RK-1

Apologies, I wasn't perfectly clear. I want the depreciation to be taken into account on Pennsylvania RK-1 so it can be deducted. Otherwise, the beneficiary is overpaying for rental income. In your example, suppose the rental income (paid by tenants) was $2000. Deducting $1100 depreciation, I believe box 6 of RK-1 should show $900. In my hypothetical case, box 6 shows $2000. This means the beneficiary is paying taxes on the depreciation (3.07% on $1100) when he shouldn't be.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

wremstedt

Level 1

anatolr

Level 1

calderosa77

Level 2

corinneL

Level 2

jbbuell

New Member