- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Colorado K-1 (Share of Income Attributable to Colorado)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Colorado K-1 (Share of Income Attributable to Colorado)

Hello, I'm attempting to file DR 0106K (Colorado K-1), but I do not see a place in TurboTax to enter the "share of income and other items attributable to Colorado". TT does ask about increases and decreases to income. Is this where I would enter those amounts. If so, if I have positive amounts (income rather than losses), would I enter these as increases or decreases?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Colorado K-1 (Share of Income Attributable to Colorado)

You will make the adjustments for the Colorado column in the state interview section of the program.

Proceed through the screens until you see the sections titled Here's the income that Colorado handles differently.

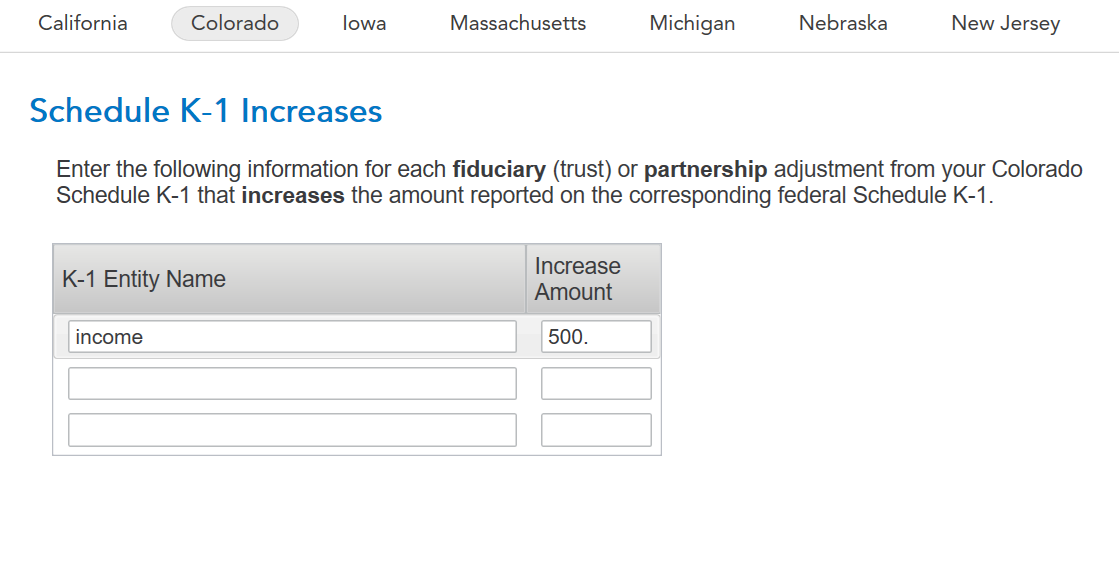

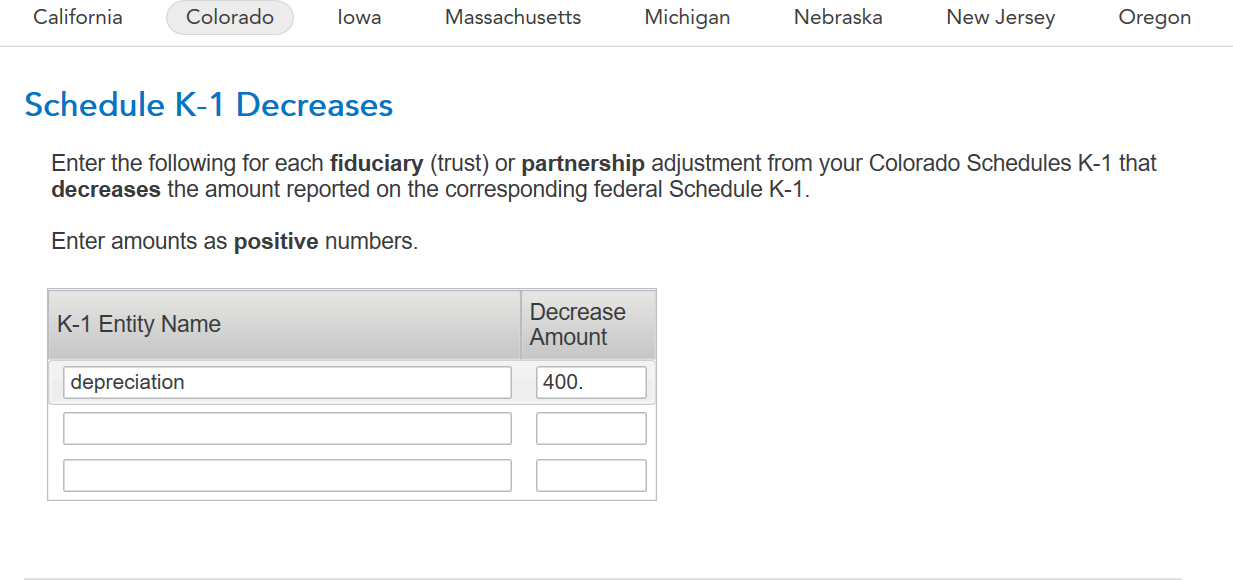

You will make your entries in either Schedule K-1 Increases to Income or Schedule K-1 Decreases to Income.

When you enter the values, enter them as positive numbers in both the Schedule K-1 Increases to Income and Schedule K-1 Decreases to Income. These adjustments will pull into your forms and be adjusted based upon whether they were entered as increases to income or decreases to income.

Once you have made your entries, select the Forms icon on the top right of your program.

Scroll down on the left panel where your forms are listed to the Colorado section and select Other Mod Stmt. You will see your K-1 adjustments reflected here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

smiklakhani

Level 2

Karinalevario

New Member

toddrub46

Level 4

yingmin

Level 1

dan-knifong

New Member