- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Capital Gains to two states while livng in the two states

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains to two states while livng in the two states

I sold a property in January of 2022 and need to pay capital gains. I was living in California when I sold the property but the property was in Utah. In August I moved to Utah so I lived in California for 7 months and Utah for 5 months. Does my time spent living in each state affect the capital gains amounts?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains to two states while livng in the two states

Usually, you only claim a credit in the case of a full year resident of one state paying tax in a non resident state.

It's more complicated, in your situation, because you were a part year resident of both states. Rather than claiming a credit, on your CA return, I recommend, you claim it on your UT return, because you were a UT resident at the end of the year. This means you should prepare your CA return first. In both state interviews you will be asked to allocate the capital gain as that state income or not that state income. You will indicate, on the CA return that it is CA source income. You will indicate on the UT return that it is UT source income. In the UT software, you will be asked if there was any income subject to double taxation (this is usually in the credits section) That's where the credit will be initiated.

I am not specifically familiar with either CA or UT software and am describing, generically, how it's usually done.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains to two states while livng in the two states

Yes, since you were a California resident when the property was sold, you must report the capital gain income as nonresident Utah income and resident California income. You will claim a credit for the taxes paid on the Utah return for the sale.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains to two states while livng in the two states

Thank you for the info. I can't figure out how to do that in Turbo Tax. Do I add it to capital gains for my California return or my Utah return? And after I do that where/how do I claim it as a credit on the other?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains to two states while livng in the two states

Usually, you only claim a credit in the case of a full year resident of one state paying tax in a non resident state.

It's more complicated, in your situation, because you were a part year resident of both states. Rather than claiming a credit, on your CA return, I recommend, you claim it on your UT return, because you were a UT resident at the end of the year. This means you should prepare your CA return first. In both state interviews you will be asked to allocate the capital gain as that state income or not that state income. You will indicate, on the CA return that it is CA source income. You will indicate on the UT return that it is UT source income. In the UT software, you will be asked if there was any income subject to double taxation (this is usually in the credits section) That's where the credit will be initiated.

I am not specifically familiar with either CA or UT software and am describing, generically, how it's usually done.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains to two states while livng in the two states

First, go through CA. Allocate all income as CA or not. Enter the rental property income/sale as CA income.

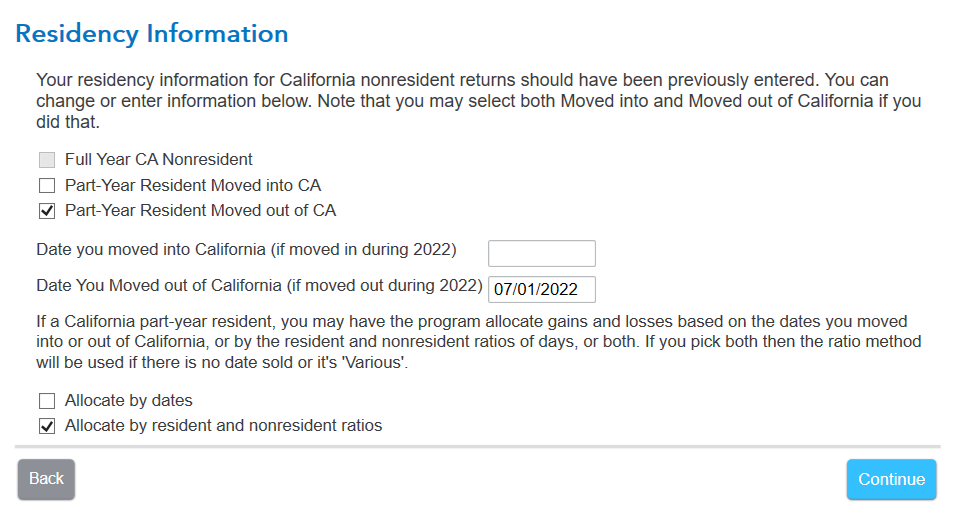

Under Residency Information, you have a choice between dates of residency or residency ratio.

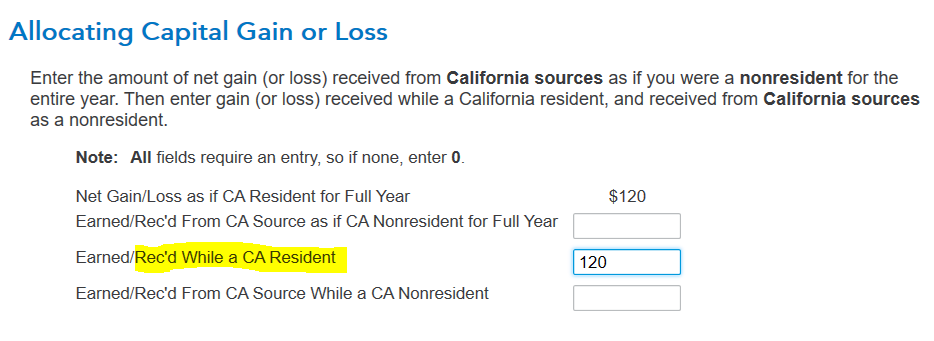

The capital gain was received while a resident of CA so it will go on the CA return. This will be entered in Allocating Capital Gain and Loss.

You need to know the tax liability on this amount.

- I recommend you enter this as zero amount, look at the tax liability.

- Then enter the sale amount and look at the tax liability.

- Subtract to find the tax on just the sale amount.

Second, go through UT. Allocate all income as UT or not.

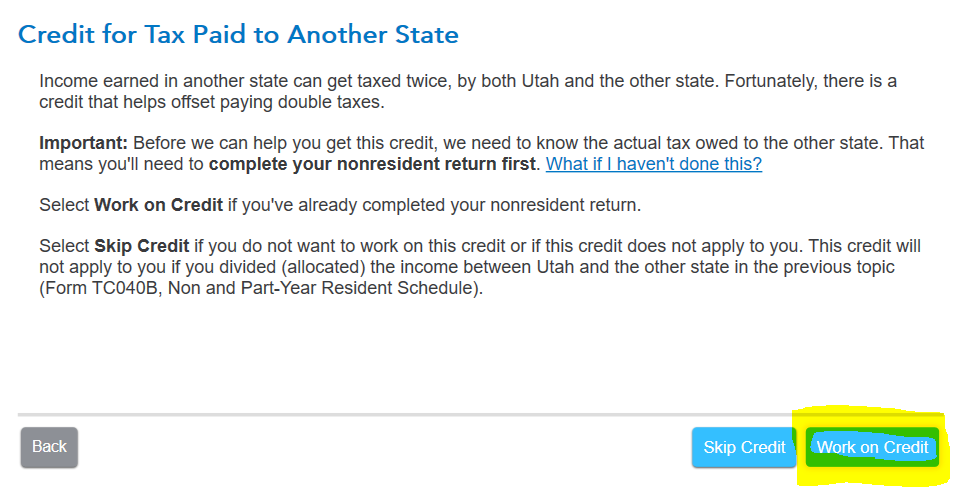

- Continue through until you reach Credit for Tax Paid to Another State.

- Select Work on Credit.

- Select CA, continue

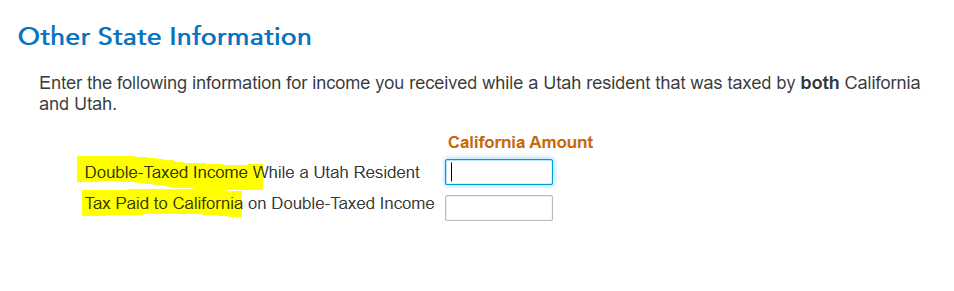

- Enter double taxed income. I do realize it says while a Utah resident. If you had remained a CA resident all year, you would be paying tax to UT with a credit on CA. However, you moved to Utah so CA is getting the tax and UT is giving you the credit, you are now a Utah resident with the tax burden.

- Enter the tax liability on the income that you determined above while in CA.

Here are CA screenshots

Here are Utah screenshots:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jimcross45

New Member

hasalaph

New Member

mjbrown37

New Member

Rprincessy

New Member

4md

New Member