- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- R

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

R

R

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

R

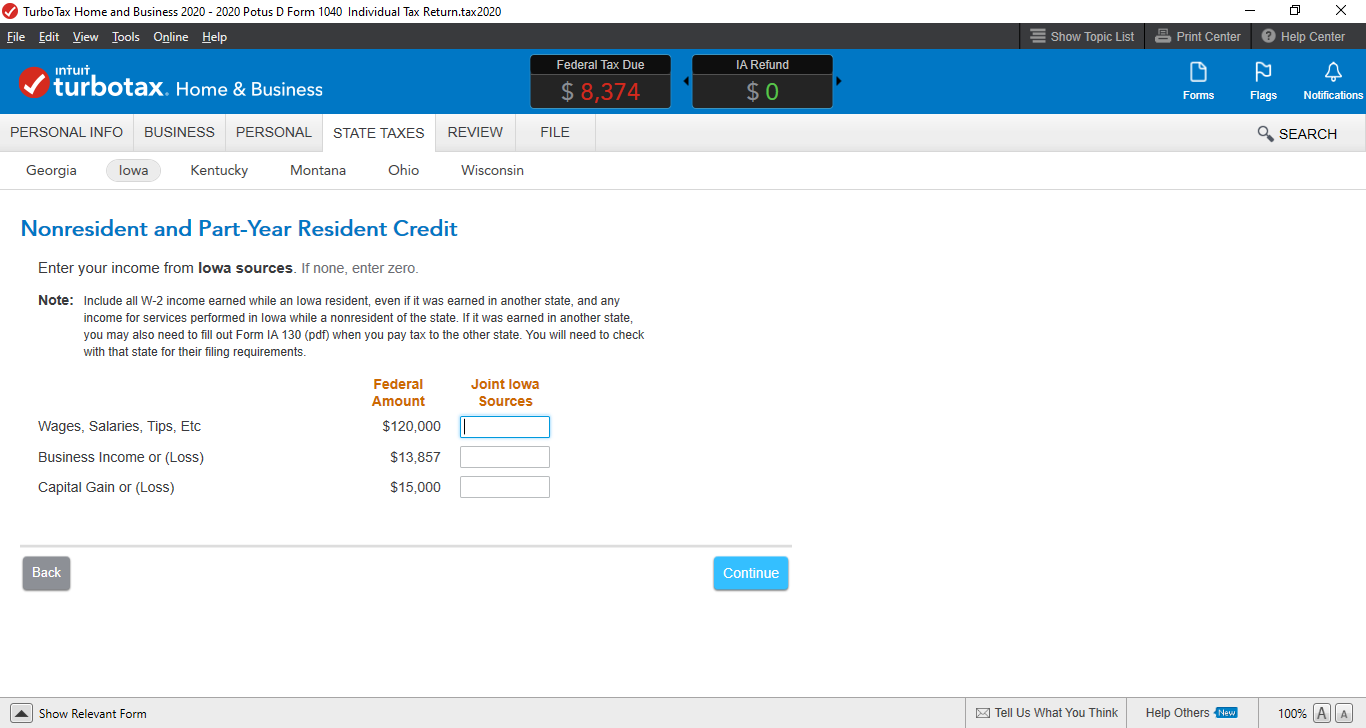

It sounds like you have not allocated the K-1 income to Iowa in the Iowa state return. There is a screen in the Iowa return where you enter income from Iowa sources. See screenshot below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

R

I have reviewed in forms via and see that the amount of rental income from the K-1 is present. We file married separate this year and the IA 1040 tax exemption smart worksheet shows an x for “ income is less or equal to minimum income if checked.” Can this be verified somehow?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

R

It is always better to file separately on same form in Iowa. If you have filed jointly in the past, go back and amended your previous returns. On the Iowa return your tax is calculated on your total income less adjustments and subtractions for Federal taxes paid. Since the Iowa standard deduction amount is so low, if you have mortgage interest, RE taxes, Contributions, etc, you will want to itemize. Your tax is calculated on your total income then a nonresident credit is applied from the IA 126 based on your Iowa income to your Total income.

I would agree with $18K in Iowa based income, you should be paying something just based on the way the Iowa tax is calculated on your total income then a nonresident credit is applied.

Print off your Iowa return and look for form IA126. This is your nonresident credit form and at the bottom should be a percentage of Iowa based income to your total income. Page 1 of your Iowa return should reflect all your total income from all sources, split by taxpayer and spouse. Line 48 you should see the nonresident tax credit. Click here for link to Iowa filing requirements.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17715921677

New Member

schemegreen

New Member

Pedernales

Level 1

berthageo

New Member

litanner

New Member