- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Previous state tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Previous state tax

Hi,

For the year 2015, I was a visiting student researcher in the US and received a gross income of a bit less than 10k, I submitted my federal taxes and received a refund. Was I required to file state taxes too? I don't think I was required, but I just want to confirm. The state in question is California, and I was a nonresident alien for federal tax purposes.

Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Previous state tax

Although not authoritative for tax purposes, this San Francisco State University webpage has the following information:

California state law does not mirror the federal law when it comes to taxing non-U.S. citizens; the state of California does not recognize the federal level tax treaty. California income is taxable and subject to withholding for state purposes, irrespective of a federal exemption. California does not distinguish among U.S. citizens, U.S. residents, or nonresident aliens with respect to California state income tax withholding.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Previous state tax

Dear David,

Thanks for your reply! So, my interpretation was correct, and I didn't need to file, right? To give a bit more info, my state income tax (box17 of w2 form was around $440).

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Previous state tax

You are correct.

Box 16 of your W-2 would have been the total California wages.

Box 17 of your W-2 would have been the total California income taxes withheld.

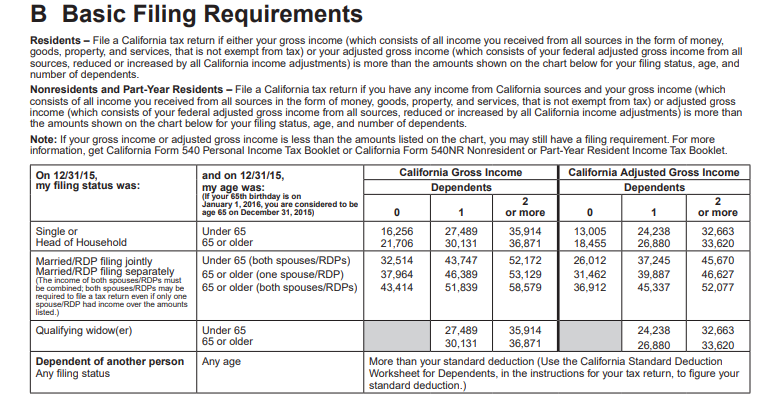

As long as your income is below the amounts listed below for your filing status, you would not have been required to file a California return in 2015.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Previous state tax

Thank you, I appreciate the help!!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

patrickruiz187

New Member

TJet9

Returning Member

ldp91

New Member

r_1

Level 3

gramjue

New Member