- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Oregon Return Local Tax OR-A

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Oregon Return Local Tax OR-A

I am using TurboTax Online Premier.

Is there a way for me to enter local tax paid in OR-A? I could not find it. I also did not find a way to override values in OR-A.

Do I have to get the PC desktop version to be able to override the OR-A value?

One problem I have is that I have already filed my Fed taxes online, can I switch to the PC desktop version to complete my state tax return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Oregon Return Local Tax OR-A

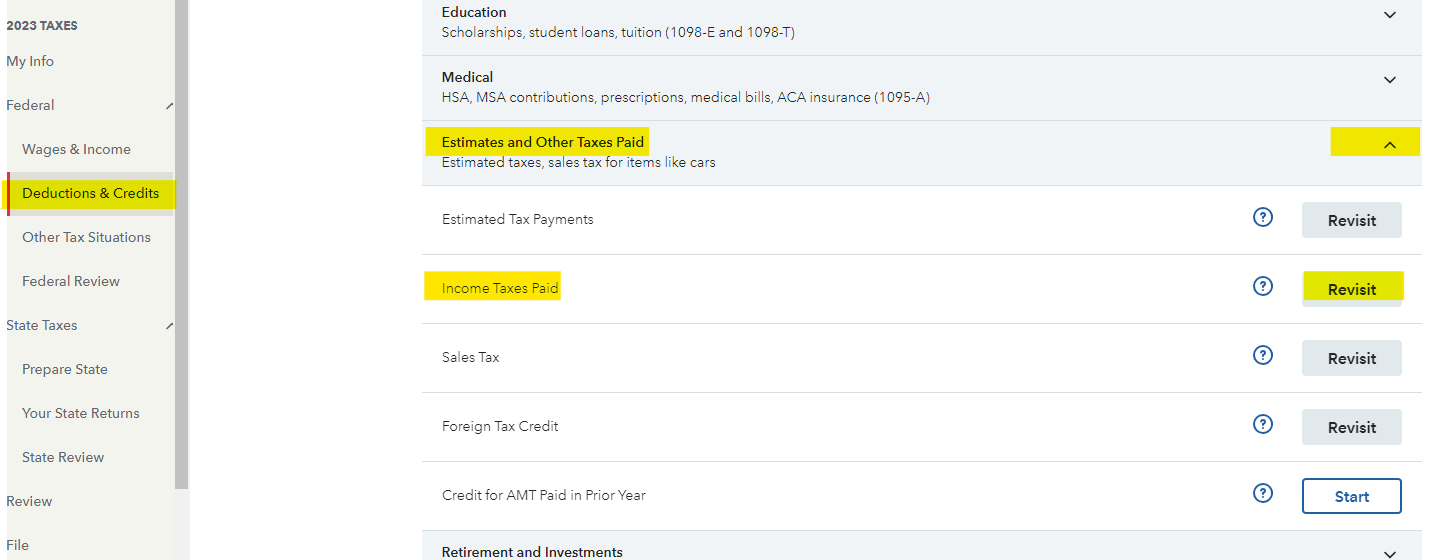

OR taxes paid are entered in the federal section. They will either be estimates paid or on a form, like w2. Return to the correct federal section and correct/enter as needed. You can change the state amounts in the federal section after filing since it should not have an effect. Be sure to save a copy of the federal you filed before making changes. Just in case it does change your itemized state and local tax deduction.

You can switch to the download version if you want -but that is extra work. See How do I switch from TurboTax Online to the TurboTax software?

For online, either revisit your W2 or select taxes paid.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Eric007

Returning Member

user17701539135

Level 1

user17704990963

New Member

user17704478253

Returning Member

mitgrube01

New Member