- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Nonresident status Illinois

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Nonresident status Illinois

I go to graduate school in the state of Illinois, and worked a part time job at my school during the school year. My parents live in Michigan, and I return to Michigan in the summers/during holidays. I have a Michigan driver's license.

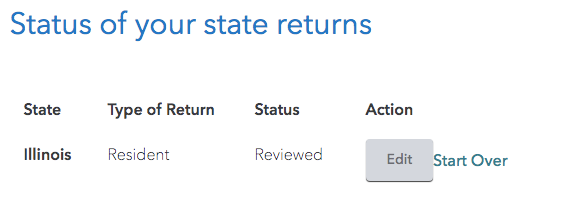

Turbotax says "We can tell you were an Illinois nonresident in 2019 from your federal taxes. We're just making sure." I click "yes," and after everything, when I review "Status of your state returns," under State it says Illinois, and under "Type of Return" it says "resident." Why is this the case?

Also what is an IL-W-5-NR and does that apply to me?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Nonresident status Illinois

If your domicile is in Michigan, then your are a resident of Michigan. Domicile means the place were you have a permanent residence, where you will return to when you finish your sojourn out of state, where your drivers license is, and where you are registered to vote (and a number of other tests).

It is common for college students who study out of state to still maintain their domicile at the parents' home.

"when I review "Status of your state returns," under State it says Illinois, and under "Type of Return" it says "resident."" I am not familiar offhand with this screen. Can you see your Illinois return? Note that everyone (nonresident and resident) uses the same IL-1040 form, but nonresidents have the Nonresident box on line D on this form checked, and you have Schedule NR attached.

IL-W-5-NR is a form that Michigan residents file with their employers in Illinois to instruct them to withhold Michigan taxes instead of Illinois on your employment in Illinois.

If you determine that you are a Michigan resident and you work in Illinois, then yes this form applies to you, but you should have filed it at the beginning of the year with your employer. It is not part of your tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Nonresident status Illinois

Thank you so much for your response! I proceeded with the steps as a non resident, and when I review my State tax return, I see this. Why is it still putting me down as an Illinois Resident? Thanks again 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Nonresident status Illinois

Click start over and make sure you read each question carefully.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Nonresident status Illinois

Illinois & Michigan have tax reciprocity with regard to W-2 wages/salary. Reciprocity means that a MI resident working in IL is not liable for IL taxes on any W-2 income earned in IL. Such income is taxable only by his/her home state of Michigan.

Form IL-W-5-NR is used to advise an Illinois employer that you are a resident of MI, and therefore (due to reciprocity) your wages are not subject to Illinois withholding. Here's a link to the form:

https://www2.illinois.gov/rev/forms/withholding/Documents/currentyear/il-w-5-nr.pdf

If Illinois taxes were mistakenly withheld from your W-2 pay, you should submit a non-resident IL return, showing zero IL income, in order to receive a refund of those taxes. Your income is entirely taxable by your home state of MI.

Note that reciprocity applies only to W-2 wages or salary, not to any other type of income.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

dyarbough11

New Member

swheatl98

Returning Member

flessa

New Member

zhenoushadijafar

New Member

3209i342

New Member