- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- NJ State Taxes Worksheet G

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NJ State Taxes Worksheet G

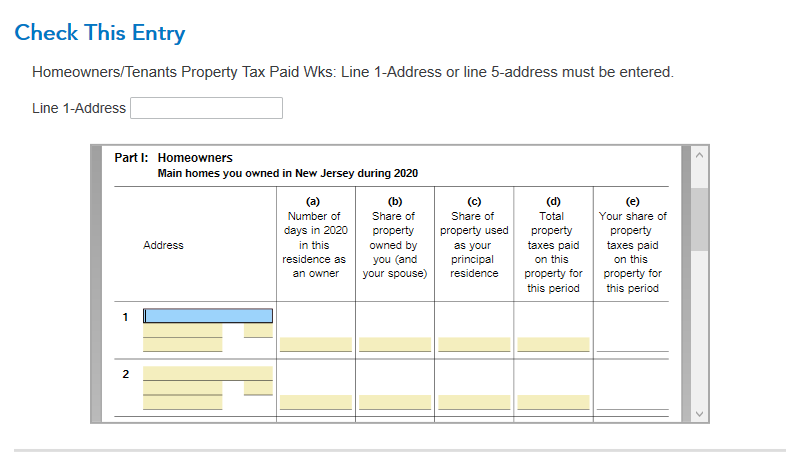

TurboTax's review process said that I was missing info for:

"Homeowners/Tenants Property Tax Paid Wks: Line 1-Address or line 5-address must be entered."

However, I never indicated/completed the Homeowner/Rental section as I lived with my parents for most of the year due to my University sending us home (because of COVID19).

Two questions:

1. Why is TurboTax saying I need to enter this info?

2. Does paying money for University housing/dorms qualify as "renting" in NJ? NJ University.

Thanks in advance.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NJ State Taxes Worksheet G

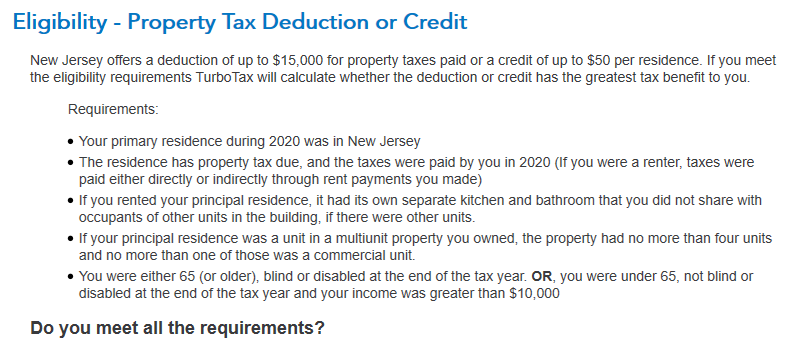

This website shows why the property tax question matters on that section of the New Jersey return: NJ Income Tax Property Tax Deduction/Credit for Homeowners and Tenants. There's a link on the page to see if paying for a dorm is considered rent. The answer is no, because the universities do not have to pay property tax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NJ State Taxes Worksheet G

This website shows why the property tax question matters on that section of the New Jersey return: NJ Income Tax Property Tax Deduction/Credit for Homeowners and Tenants. There's a link on the page to see if paying for a dorm is considered rent. The answer is no, because the universities do not have to pay property tax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NJ State Taxes Worksheet G

Thanks so much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NJ State Taxes Worksheet G

You are most welcome!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NJ State Taxes Worksheet G

Since my parents' home would be my principal home, where do I note this "neither homeowner or renter" status? Do I just not fill in anything for Worksheet G? For some reason, when I click "No" on this screen, it still brings up Worksheet G in the final Review stage?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NJ State Taxes Worksheet G

Exactly. You don't need that form. Go back to the beginning screen of that portion of the interview and click on the option that you do not qualify for the property tax deduction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NJ State Taxes Worksheet G

Ok thanks. It seems to be a glitch, since I said that I didn't qualify but it still brings up the sheet. Oh well.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NJ State Taxes Worksheet G

If you wish, contact customer service. They might be able to assist you with other entries that could be provoking the form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NJ State Taxes Worksheet G

well that glitch that takes you to worksheet G for dorm students is still there and taxes are due tomorrow and I cant get that to go awway - keeps bringing it up in review - i pout in words like none - and that did it but how do i get back th the interview to jsut put in no again this is frutrating - i did taxes in april btu was waiting for more info - and didnt ahve this porblem then

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

marcrosales36

New Member

trinitydefrain7765

New Member

blr0223job

New Member

RNU

New Member

Wulin

New Member