in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Michigan 529 MESP contributions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan 529 MESP contributions

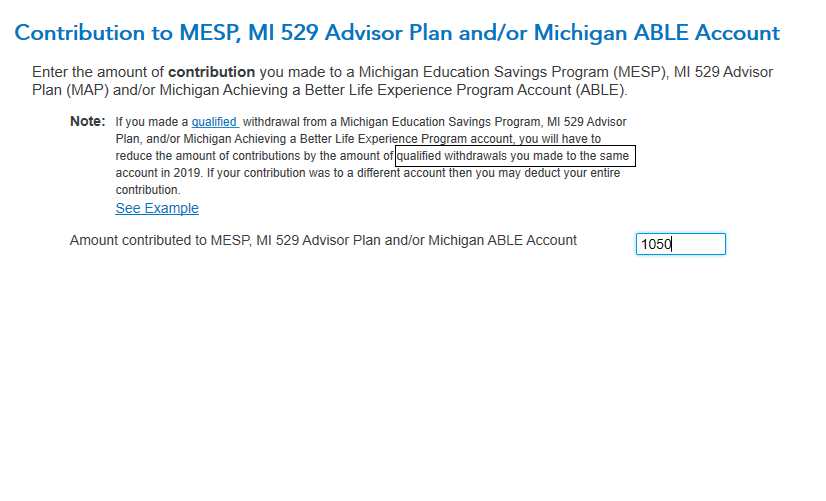

I contributed $650 to my sons plan and $1050 to my daughters plan and oddly enough withdrew $1700 from my sons plan to pay for books. what do I enter for the amount contributed to MESP. By the example provided and by my calculation it should be zero but turbo tax will not allow that. On the next screen it asks how much was withdrawn. why am I being asked to subtract it from my contributions and then on the next screen asks my withdrawal amount. what do I need to enter.

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan 529 MESP contributions

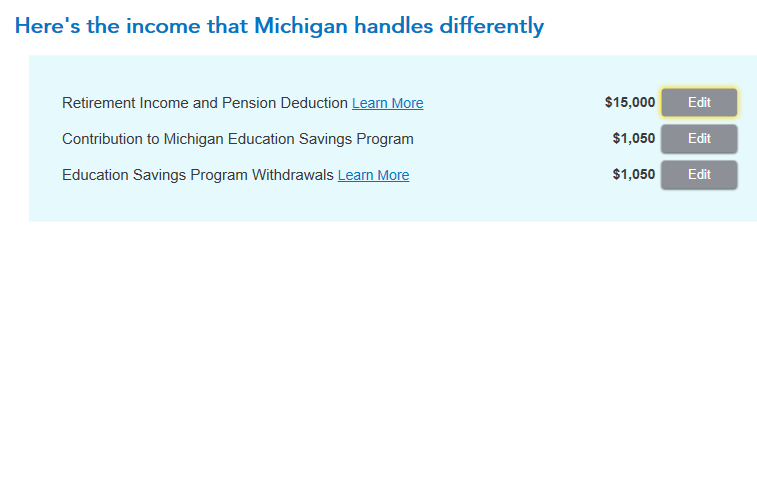

The contributions line is having you add two different accounts. One of them, had a withdrawal greater than the addition. Sons contributed $650 withdrew $1700. Daughter, contributed $1050.

This means: the contribution that counts is only your daughters, $1,050.

For your sons, you had contributions of $650 and withdrawal of $1,700 which included the current year of $650 so it is washed out. So your two entries, will match. $1050 each since they are different accounts.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan 529 MESP contributions

I e-filed my MI return and was tripped by this MESP withdrawal line Line 21. The state reviewed my filing and denied part of my refund. When I reviewed the calculations manually, I learned that Turbo Tax has a calculation error. The instructions to the MI Form 1040 clearly indicated you can't have MESP withdrawals in Line 21.

I have been using Turbo Tax for the last 20 years and this is the first time that I encountered an error. Turbo Tax was unable to catch that error, in fact, asks that question (Step-by-Step) to enter that information, which is misleading. Turbo Tax should compensate for the error.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

aaronvaughn1

New Member

hillite

Level 3

in Education

randy-fall

New Member

tylerboesch28

New Member

in Education

mguoin

New Member