- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- MI Tax Underpayment Situation - Penalty?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MI Tax Underpayment Situation - Penalty?

2023 Michigan Desktop Premier version is telling me I may owe an underpayment penalty for 2022. I saw another reply indicating that this was specific to non-resident filers and social security calculations. I am a MI resident, so that is not the cause for me. Why is it trying to get me to calculate an underpayment penalty?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MI Tax Underpayment Situation - Penalty?

Have you entered all of your income, withholdings, and estimated tax payments? Michigan: Penalty and interest is charged for the following reasons:

- Estimated payments were underpaid in one or more quarters

- Estimated payments were received late

Note: Payments that are not received by the due date will be applied to the following estimated tax quarter - No estimated payments were received

- You received income unevenly during the year and did not annualize your income

The Michigan Department of Treasury follows the Internal Revenue Service (IRS) guidelines for estimated tax requirements. Based on the IRS estimated income tax requirements, to avoid penalty and interest for underpaid estimates, your total tax paid through credits and withholding must be:

- 90% of your current year's tax liability or

- 100% of the previous year's tax liability or

- 110% of your previous year's tax liability if your previous year's adjusted gross income is more than $150,000 ($75,000 for married filing separately)

Penalty is 25% for failing to file estimated payments or 10% of underpaid tax per quarter. Interest is 1% above the prime rate.

To possibly reduce or eliminate your underpayment penalty, open your return in TurboTax and search for annualizing your tax (use this exact phrase). This will take you to the underpayment penalty section, and we'll take you through the steps to possibly reduce what you owe.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MI Tax Underpayment Situation - Penalty?

Yes, I have made all my entries in Federal and was working through all the entries for State using the guide me approach. I did a pre-tax 401k conversion to post tax 401k Roth during December 2023. I made estimated tax payments to Federal and MI State in December 2023. I do not make estimated tax payments typically, i did in this case as most things i read indicated you could get a penalty if you did not make estimated tax payments.

Also, it is saying i owe for underpaying in 2022, it is not saying i owe as part my 2023 taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MI Tax Underpayment Situation - Penalty?

Were you able to get this resolved? Many things have been corrected in the latest updates to TurboTax.

Make sure you have ran all updates.

If using TurboTax Online: Clear your cache and cookies. See this FAQ, for your particular browser.

If using TurboTax Desktop: Please see this FAQ.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MI Tax Underpayment Situation - Penalty?

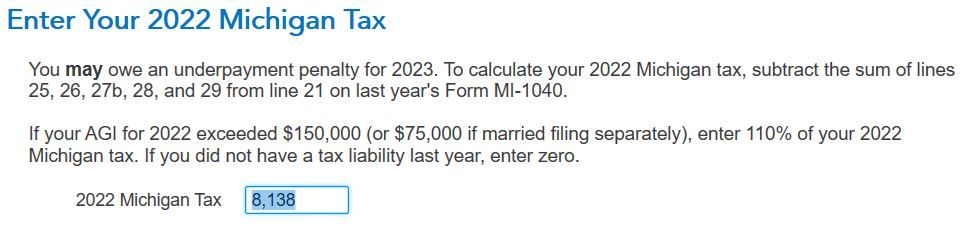

I just opened TT and let it do MI updates (came up automictically). Still shows i owe a penalty for underpaying MI taxes last year. Screen shot

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MI Tax Underpayment Situation - Penalty?

The screenshot you included is for your 2022 tax liability for that year. What does the next screen say when you continue?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MI Tax Underpayment Situation - Penalty?

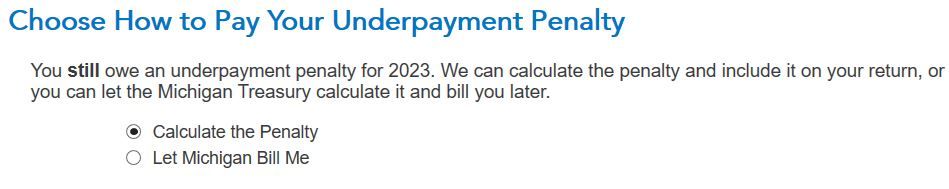

this is the next screen...Then the screen after that asks what day i will file so that it can calculate the amount I owe. Eventually gets to a screen saying that i owe $76.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MI Tax Underpayment Situation - Penalty?

The $76 is your underpayment penalty for 2023.

Underpayment penalties apply if you don't withhold or pay enough tax on income received during each quarter.

If you paid your tax bill in full by the April deadline or are getting a refund, you may still get an underpayment penalty.

To possibly reduce or eliminate your underpayment penalty, open your return in TurboTax and search for annualizing your tax (use this exact phrase). This will take you to the underpayment penalty section and we'll take you through the steps to possibly reduce what you owe.

Click here for Department of Revenue Michigan information on underpayment of estimated tax penalty.

Click here for information about estimated tax underpayment penalties and a tool to figure your estimated taxes.

Click here for additional information on why you are getting an underpayment of estimated tax penalty.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MI Tax Underpayment Situation - Penalty?

ok. just a couple points for clarification. First if this is truly just a 2023 issue on whether or not I paid enough taxes across time within 2023 then why does this section start out with looking at my 2022 tax liability, adding 10%, etc. That is confusing to me if this is just a 2023 issue.

Second, I did make a 401 pretax conversion to post tax Roth within my comapany's plan rules in Q4. The day I did it I paid estimated tax payment to Michigan based on its tax rate. Why would i get assessed a penalty?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MI Tax Underpayment Situation - Penalty?

1. It starts out looking at your 2022 tax liability because the amount that you should have had withheld for 2023 is a percentage of your previous tax year's tax liability. The 10% additional instructions are if your 2022 AGI exceeded $150K threshold for joint filers.

2. The 401k conversion to a Roth tax withheld is only an estimate of the taxes owed on that one event. The conversion, along with all other income items on your return is what is being considered for your tax liability when you complete your tax return. The taxes you pay when you convert a retirement account function like the withholding on a W-2. It may or may not be enough to cover your tax liability.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MI Tax Underpayment Situation - Penalty?

Appreciate the details and patience for all my questions, I plan to do this type of conversion for several years leading up to retirement and would like to avoid paying tax penalties. Regarding item 2 specifically, I made an estimated tax payment the same time i took the conversion. i used the conversion amount times the MI tax rate to get a number. I added $50 to that total as we usually owe a little in MI taxes at the end of the year anyway.

Is this a timing issue? I noticed the 1099-R has no indication of when the transaction actually occurs. So am i having to pay a tax underpayment penalty because they think this happened at the start of 2023 instead of the actual date which was DEC 2023? I made an estimated tax payment right at the same time i did the conversion...so just trying to understand what was done wrong so it does not happen again.

I know information on-line can't be trusted at times, but general indication was you need to make the estimated payment when you make the conversion so you don't get a penalty.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MI Tax Underpayment Situation - Penalty?

When you are going through your MI return, you will get to this screen. Say yes and you will have the opportunity to put how much income you received in certain time frames. Be sure to pay special attention to the dates. Also make sure you have entered your state estimated payments made with the correct date of payment. If you are able to eliminate or reduce your penalty, this will accomplish that.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

freddytax

Level 1

Embers

New Member

Wjm2222

New Member

Mojo-6

New Member

tf35sc

Level 1