- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Massachusetts health insurance coverage penalty after company acquisition

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Massachusetts health insurance coverage penalty after company acquisition

Here is my situation:

I live in Massachusetts and had health insurance that met MMC from Jan to July. Afterwards, my employer was acquired by another company and my health insurance changed but I was still paying premiums. I learn now that the new health insurance did not meet the Massachusetts MMC guidelines. As such, it looks like both my spouse and myself will get penalized heavily in our state taxes. We can afford health insurance, buy if we had known that we were undercovered by our new insurance, we would have reacted.

Am I correct that my spouse and I are on the hook for this?

The HC worksheet says there is a way to appeal the penalty. How to I submit an appeal through TurboTax. There is a checkbox in the tax form and the manual instructions say to zero out the penalty if you want to appeal. How do I access this in the application.

Thanks.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Massachusetts health insurance coverage penalty after company acquisition

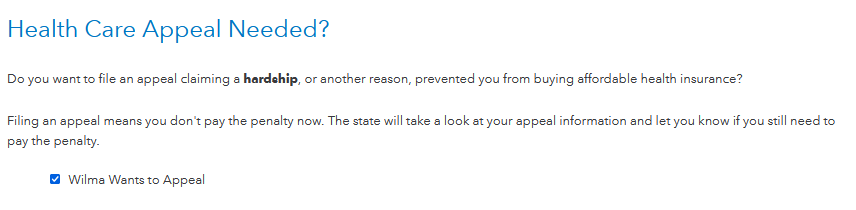

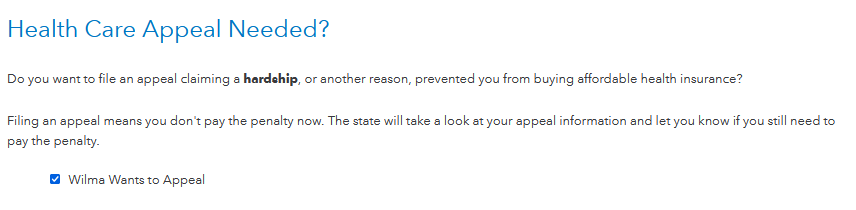

As you go through the health section of the Massachusetts return, look for the screen titled Health Care Appeal Needed? and check the box.

An appeal form will be mailed to you and the penalty will not be included in your Massachusetts tax liability at this time.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Massachusetts health insurance coverage penalty after company acquisition

As you go through the health section of the Massachusetts return, look for the screen titled Health Care Appeal Needed? and check the box.

An appeal form will be mailed to you and the penalty will not be included in your Massachusetts tax liability at this time.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Massachusetts health insurance coverage penalty after company acquisition

Thanks! Not sure how I missed the appeal screen.

JB

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

PCCMCC

New Member

1970 commando

New Member

taylorbuddington

New Member

Joe666

Level 1

massbear

Level 2