This is regarding Massachusetts state tax filing.

In April I couldn't finish my taxes so I paid MA $628 with extension.

Now I finished my taxes and I owe $599, and because I didn't pay estimated tax last year, I also have a penalty of $22.

That totals $622. I've already given them $628 in April. I deserve only $7 back.

The problem...

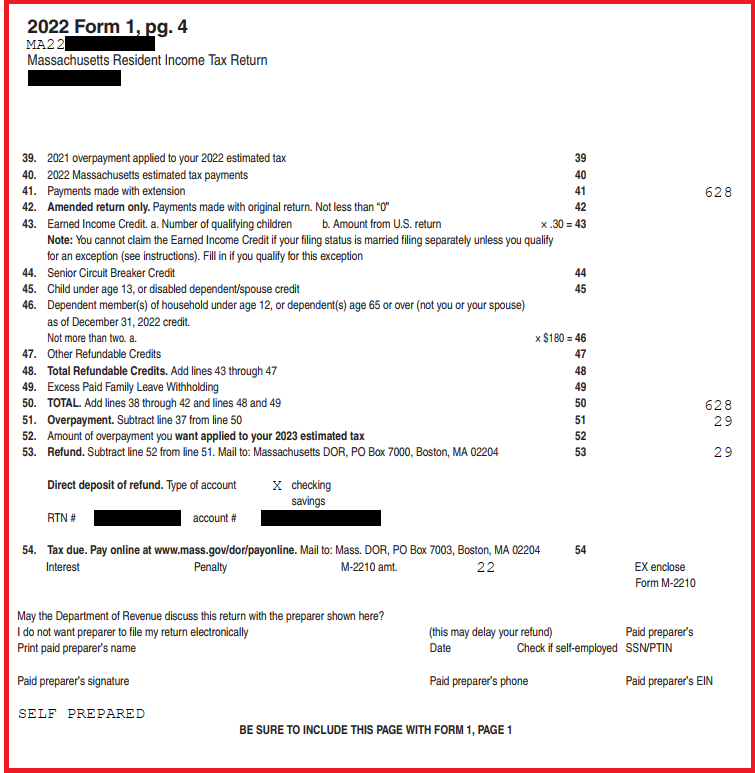

The MA form 1 doesn't let me put $7. It says on line 53 "REFUND... $29" (it's not taking into account the penalty).

Here is a summary of the situation:

Here is the form, the actual point of my question, look at line 53:

At the bottom, next to "M-2210 amt", it does mention the $22 penalty, that's good.

My question is... should REFUND amount be reduced by the penalty on the MA Form 1? Right now it says $29, should it say $7?