- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- MA 1099-HC family coverage

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MA 1099-HC family coverage

I work in CT and am the subscriber for myself and my spouse insurance. We received one 1099-HC. How do I indicate that my spouse was covered all year under my plan?

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MA 1099-HC family coverage

In the federal section you can mark that your insurance is not through the marketplace. CT followed Federal and there is no penalty for not having health insurance. There are no health questions to answer this year if you have that form.

Tuck the form in with your tax papers and forget it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MA 1099-HC family coverage

Sorry, I apparently wasn't clear in my question: On my MA (we are residents) return, how do I indicate we had family coverage under my plan, when we only received one 1099-HC.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MA 1099-HC family coverage

For each person, you must indicate that each person had health insurance that met MCC all year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MA 1099-HC family coverage

Thanks for your reply Mary,

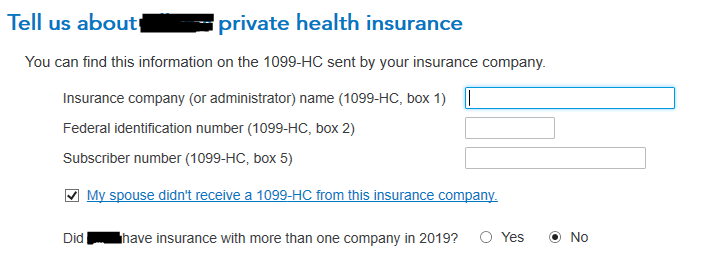

Two screens after the one you posted asks:

One has to answer the three boxes - I can copy the info from the one 1099-HC we received for the Insurance Company and their Fed ID. Its the subscriber number I'm not sure what to do with - do I enter the same subscriber number as on the form even though my name is on the form and not my husbands?

(I don't get any error message from the smart check when I do this)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MA 1099-HC family coverage

Yes, that is correct.

See 2019 Schedule HC instructions for more information. From page 3:

If you received Form(s) MA 1099-HC, be sure to attach to Schedule HC. If you did not receive Form(s) MA 1099-HC, fill in the oval(s) in lines 4f (for you) and/or 4g (your spouse), and enter the name of your insurance carrier or administrator and your subscriber number in line 4f and/or 4g and go to line 5. This information should be on your insurance card. If you do not know this information, contact your insurer or your Human Resources Department if your insurance is through your employer.

Online, see Massachusetts Health Care Reform for Individuals under Form MA 1099-HC to confirm.

Full Resource for 2019 Massachusetts Personal Income Tax Forms and Instructions

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

shalonsorrel1230

New Member

sandeepnagra

Level 2

user17700608622

New Member

user17698131392

New Member

yep-frogs

Level 2